Thank you for attending PNHP’s 2022 Annual Meeting, Leadership Training, and/or SNaHP Summit. Please complete the relevant evaluations below, based on which sessions you attended.

If you have additional feedback, please email organizer@pnhp.org.

Thank you for attending PNHP’s 2022 Annual Meeting, Leadership Training, and/or SNaHP Summit. Please complete the relevant evaluations below, based on which sessions you attended.

If you have additional feedback, please email organizer@pnhp.org.

Click the links below to jump to different sections of the newsletter. To view a PDF version of the shorter print edition of the newsletter, click HERE.

If you wish to support PNHP’s outreach and education efforts with a financial contribution, click HERE.

If you have feedback about the newsletter, email info@pnhp.org.

After two years of meeting virtually, PNHP members and allies will once again gather in-person for our Annual Meeting and Leadership Training. This year’s conference, themed “Brick by Brick: Building the Movement for Medicare for All,” will take place Nov. 4-5 at the Boston Park Plaza.

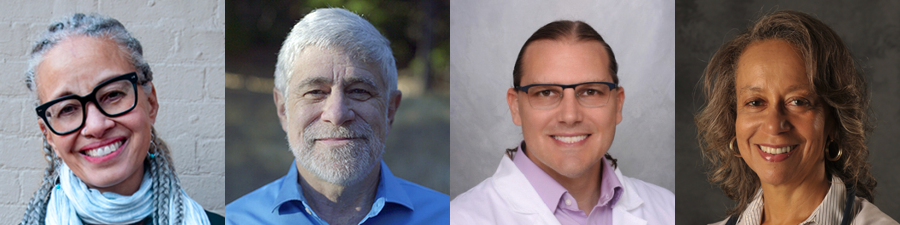

Our keynote speakers for Boston will address some of the most far-reaching and pressing issues facing the Medicare-for-All movement. Linda Villarosa, contributor to The New York Times’ 1619 Project and author of the just-published Under the Skin: The Hidden Toll of Racism on American Lives and the Health of Our Nation will discuss the necessity of confronting systemic racism as part of any effort to achieve health justice, and Donald Cohen, co-author of The Privatization of Everything, will discuss the profiteering that threatens Medicare and Medicaid alongside every other public good in the United States.

PNHP is also thrilled to be hosting the Students for a National Health Program (SNaHP) Summit on Nov. 4, immediately preceding this year’s Leadership Training. Typically held in the spring, the SNaHP Summit is a chance for medical and health professional students to meet like-minded colleagues, strategize for the year ahead, and organize around tangible goals that advance the single-payer movement, both inside and outside of their institutions.

It’s been three long years since PNHP members have been able to gather in-person for an Annual Meeting. In that time, the work of our movement has become more urgent than ever; please join us as we engage in a long overdue weekend of learning, connecting, and strategizing for our shared goal: single-payer Medicare for All.

Online pre-registration is open through Sunday, October 30 at pnhp.org/meeting.

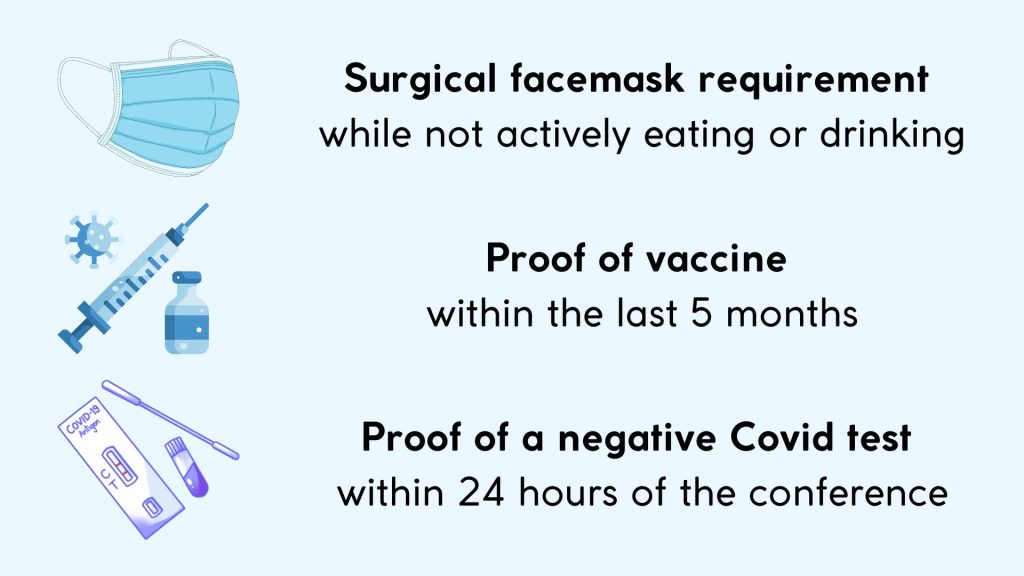

PNHP’s Board of Directors and medical experts have established Covid safety protocols for the Annual Meeting that include a surgical facemask requirement while not actively eating or drinking; proof of vaccine within the last 5 months (physical card, photo, or electronic record is fine); and proof of a negative Covid test (time-stamped photo of a rapid antigen test is fine) taken within 24 hours of the Summit.

In addition, while the conference includes meals, times designated for food service will not contain programming so that participants can eat away from the main conference room should they choose.

By Suzanne Gordon

It’s no surprise to PNHP members that the same vested interests opposed to Medicare for All want to undermine the Veterans Health Administration (VHA), our largest public health care system.

Run by the Department of Veterans Affairs (VA), the VHA is our best working model of socialized medicine. VHA care-givers are not a collection of physician practices or specialty services reimbursed by private insurers, Medicare, or Medicaid on a “fee for service” basis. All VHA doctors, nurses, therapists, and other personnel are salaried, like members of the UK National Health Service.

VHA staff provide high-quality care to nine million patients that is better coordinated and more cost effective than in the private sector. The VHA plays a major “teaching hospital” role in training thousands of new doctors, nurses, and other health care professionals. It doesn’t compete with other hospital chains by spending huge sums on advertising and marketing.

In 2018, corporate Democrats and conservative Republicans took a sledge hammer to the VHA when they passed the VA MISSION Act. As implemented by Donald Trump and now Joe Biden, this legislation has siphoned billions of dollars away from the VHA’s direct care budget and steered that money toward private doctors and for-profit hospitals often less well prepared to treat veterans.

The VHA has been partially converted into a Medicare-style payer of bills submitted by other health care providers. The powerful private interests that have acquired this new $30 billion a year federal revenue stream want to preserve and expand it—just like operators of Medicare Advantage plans and newly minted ACO REACH entities hope to profit from further diversion of seniors from traditional Medicare.

The community-labor campaign to save the VHA from further privatization and the PNHP-led resistance to Medicare profiteering relies on many of the same allies and faces common adversaries. They are parallel struggles in the same fight to build on what’s best in American health care—and we’ll all have a better chance of winning if we work more closely together.

Healthcare journalist Suzanne Gordon is a longtime PNHP supporter and co-founder of the Veterans Healthcare Policy Institute. She will lead a workshop on protecting the VHA from profteers at the PNHP Annual Meeting on Nov. 5. Her new book is called “Our Veterans: Winners, Losers, Friends and Enemies on the New Terrain of Veterans Affairs” from Duke University Press.

When the U.S. Supreme Court issued its ruling in Dobbs v. Jackson Women’s Health Organization earlier this summer, overturning nearly 50 years of federal abortion protections, it prompted a wave of shock, anger, grief and, ultimately, organizing among Americans who care deeply about reproductive justice.

Against this backdrop, PNHP board advisers Drs. Diljeet Singh and Ashley Duhon, along with PNHP national board member Dr. Judith Albert, are planning a workshop for the Nov. 5 Annual Meeting in Boston. Their goal is to brainstorm appropriate responses to this severe curtailing of abortion access, seek ways to support patients and frontline providers, and amplify the work of abortion rights activists both inside and outside of the medical profession. Focusing intently on reproductive justice is both crucial and long overdue.

“We do not always focus on how equity is one of the important principles of single payer,” says Dr. Singh. “Now we have no choice but to talk about it and to rally around it.”

To read PNHP’s statement in response to the Dobbs decision, visit pnhp.org/AbortionStatement. To connect with fellow reproductive justice activists within PNHP, contact Dr. Singh at diljeetksingh@gmail.com.

At last year’s virtual Annual Meeting, PNHP launched a series of Member Interest Groups (MIGs) based on medical specialties, lived experiences, and areas of interest. One of these groups, our Pediatrics MIG, is planning to ramp up their activism with an in-person meeting in Boston on Nov. 5. At the top of their agenda will be organizing within the American Academy of Pediatrics as part of PNHP’s ongoing Medical Society Resolutions campaign.

“There are a lot of pediatricians within PNHP, but the Academy has been resistant to anything on single payer,” says Dr. Eve Shapiro, a PNHP national board member who is active within the MIG. Dr. Shapiro envisions brainstorming with her colleagues in Boston to better understand roadblocks within the Academy, organize a sign-on letter for pediatricians and, ultimately, win passage of a single-payer resolution.

“Seeing large medical organizations saying Medicare for All is a good idea is powerful,” she says. “It can move the issue forward.”

To get involved with the Pediatrics MIG, contact Dr. Shapiro at evecshapiro@gmail.com. For questions about other MIGs, contact Kaytlin Gilbert at kaytlin@pnhp.org. To learn more about organizing within medical societies, contact Lori Clark at lori@pnhp.org.

Previous Experience: At the Jane Addams Senior Caucus, I built a powerful base of leaders who were bonded not by candidates or party, but by a vision for a better future.

Previous Experience: At the Jane Addams Senior Caucus, I built a powerful base of leaders who were bonded not by candidates or party, but by a vision for a better future.

What drew you to PNHP? I wanted to join an organization that was interested in investing in the development of its members, building power, and developing a roadmap to take back control of our health care system from big corporations and the insurance industry.

What are you looking forward to working on over the next 12 months? I am looking forward to working together to create a new organizing model that grows PNHP’s collective power, and helping to develop a strategic roadmap that advances the single-payer movement.

What’s a fun fact about yourself? I lived in an apartment for over a year before I knew that the oven did not work.

Connect with Lori at lori@pnhp.org.

Previous Experience: I previously worked in nuclear and cyber policy research at the Carnegie Endowment for International Peace in Washington, D.C.

Previous Experience: I previously worked in nuclear and cyber policy research at the Carnegie Endowment for International Peace in Washington, D.C.

What drew you to PNHP? As a progressive, I believe that implementing Medicare for All is the best way to fix our country’s deeply flawed health care system. I myself come from a family of doctors, so I’ve always had an appreciation for their leadership and impact in the communities they serve, and I know that if they advocate for single payer, people will listen.

What are you looking forward to working on over the next 12 months? I’m most looking forward to working on our campaign to stop the privatization of Medicare, as well as planning for our annual meeting in November!

What’s a fun fact about yourself? Every year, I go to a documentary film festival in Columbia, Mo. known as True/False.

Connect with Gaurav at gaurav@pnhp.org.

98 million skipped care or cut back on basic needs: Health care costs pushed 38% of American adults to delay or skip health care, cut back on driving, utilities or food, or borrow money to pay for medical bills in the first half of 2022, including 26% who only delayed or avoided care. Lower-income households were hit hardest, with 62% making cutbacks. But high income households were not immune, with 19% of households making at least $180,000 cutting back. “Estimated 98 Million Americans Skipped Treatments, Cut Back on Food, Gas or Utilities to Pay for Healthcare,” West Health-Gallup, 8/4/2022

Americans with serious illness unable to get care: Among households where a member has been seriously ill in the past year, 19% report they delayed care or were unable to get care when they needed it, including 24% of Black households. Lack of health insurance was not the primary factor: more than 80% reported having health insurance. Black respondents reported greater rates of poor treatment, with 15% saying they were disrespected, turned away, unfairly treated, or received poor treatment because of their race or ethnicity, compared with 3% of white respondents. “Personal Experiences of U.S. Racial/Ethnic Minorities in Today’s Difficult Times,” NPR-Robert Wood Johnson Foundation-Harvard T.H. Chan School of Public Health, August 2022

Older adults skip basics to pay for health care: Americans aged 50 and older report forgoing needed treatments because of the cost of care, including 26% of adults age 50 to 64 and 12% of adults 65 and older. Similarly, 18% of people 50 to 64 and 11% of people 65 and older report skipping medication to save money. Large majorities of older adults say health care costs are a major or minor burden, including 72% of people age 50 to 64 (24% major burden, 48% minor burden) and 66% of people 65 and older (15% major burden, 51% minor burden). Willcoxon, “Older Adults Sacrificing Basic Needs Due to Healthcare Costs,” Gallup, 6/15/2022

Insurance is third greatest living expense: Health insurance premiums account for 10.69% of an average U.S. salary, costing $6,487.20. This was the highest living expense after rent and childcare. Health insurance costs relative to salary vary by geography: in four states, insurance costs average at 15% of salary or more, including West Virginia at 20.9%. “Salary vs Health Insurance,” NiceTX, July 2022

Majority of U.S. adults had medical debt in past 5 years: A Kaiser Family Foundation survey finds 41% of adults currently have debt due to medical or dental bills, and an additional 16% have had medical or dental debt in the past five years that has since been paid off. Among subgroups reporting current medical debt are 56% of Black adults, 50% of Hispanic adults, 26% of households earning $90,000 or more, and 22% of adults age 65 and older. Medical debt is less common in states that expanded Medicaid (39%) than in states that did not (47%). Medical debt also forces households to change their behaviors, with 63% of adults with medical debt saying they cut back on spending for food or other basic household items, 40% who took an extra job or worked more hours, and 28% who delayed a home purchase or education for a member of their household. Lopes et al., “Health Care Debt in the U.S.: The Broad Consequences of Medical and Dental Bills,” Kaiser Family Foundation, 6/16/2022

Even the best U.S. states are outpaced by peer countries: A Commonwealth Fund analysis finds that Americans – regardless where they live – have lower life expectancy and greater incidence of avoidable mortality than other middle- and high-income countries. The U.S. ranked 31st among 38 peer countries on life expectancy at birth (78.8 years in 2019) and avoidable deaths before age 75 (272 per 100,000). State level analysis shows that even the states with the best outcomes are below average compared with peer countries, and the states with the lowest life expectancies and highest rates of avoidable deaths have worse outcomes than the worst-ranked peer countries. Radley et al., “Americans, No Matter the State They Live in, Die Younger Than People in Many Other Countries,” To the Point (blog), Commonwealth Fund, 8/11/2022

U.S. spends heavily on cancer care, gets middling outcomes: Among 22 high-income countries, the U.S. has the highest spending on cancer care – over $200 billion in 2020, or $584 per person – yet overall cancer mortality is only slightly better than average. Median per capita spending among the 22 countries was $296. After adjustments for smoking rates, U.S. cancer mortality was higher than nine other countries, and researchers found no association between cancer care expenditures and cancer mortality. Chow et al., “Comparison of Cancer-Related Spending and Mortality Rates in the US vs 21 High-Income Countries,” JAMA Health Forum, 5/27/22

U.S. men report poorer health, more cost-related access problems: A survey of men in 11 high-income countries shows U.S. men have the highest rates of avoidable deaths (337 per 100,000 vs. 156-233), multiple chronic conditions (29% vs. 17-25%), and hypertension (37% vs. 20-28%).The U.S. was tied with Switzerland for having the highest out-of-pocket health spending, with 33% reporting having out-of-pocket costs of $2,000 or more, and 37% reporting cost-related access problems, compared with 7% to 25% in other countries. U.S. men were second behind Australia for having mental health needs, and second behind Sweden for not having a regular doctor or place of care. Only 37% of U.S. men rate their country’s health care system as “good” or “very good” compared with 60% to 88% of men in other countries. Gunja et al., “Are Financial Barriers Affecting the Health Care Habits of American Men?” Commonwealth Fund, 7/14/2022

Diabetics face catastrophic insulin costs: Among the 7 million Americans who use daily insulin, 14.1% spent more than 40% of their post-subsistence income (after food and housing) on insulin, considered a “catastrophic” level. Patients with private insurance or no insurance paid the most out of pocket, while Medicaid beneficiaries were 61% less likely to have catastrophic spending. Bakkila et al., “Catastrophic Spending on Insulin in the United States, 2017-18,” Health Affairs, July 2022

Majority of hepatitis C patients don’t get curative treatment: Despite having a treatment that cures more than 95% of patients with hepatitis C, less than one-third of infected people with insurance get the treatment. The lowest rates of treatment were among adults aged 18-29 and Medicaid recipients. Among Medicaid patients, treatment rates were lower for Black patients and in programs with treatment restrictions. Coverage restrictions can include preauthorization requirements, clinical or social eligibility restrictions, or medical specialist prescribing. Prevalence of treatment within 360 days of a positive test were 23% for patients with Medicaid, 28% with Medicare, and 35% with private insurance. Thompson et al., “Vital Signs: Hepatitis C Treatment Among Insured Adults — United States, 2019-2020,” Centers for Disease Control and Prevention MMWR, 8/12/2022

Childbirth is costly despite insurance: Health care costs for women who give birth average $18,865 more than for women who do not give birth, including $2,854 more in out of pocket expenses. The analysis of women in large group health plans estimated the health costs associated with pregnancy, delivery, and postpartum care. Rae et al., “Health costs associated with pregnancy, childbirth, and postpartum care,” Peterson-Kaiser Family Foundation Health System Tracker, 7/13/2022

Physician face time increases, but disparities grow: Over the past 40 years, the amount of time patients spend annually with outpatient physicians increased to 60.4 minutes in 2018, up from 40 minutes in 1978, mainly due to an increase in average visit duration (15.4 minutes to 22.2 minutes). Time with primary care physicians fell, however, from 33.8 minutes to 30.4 minutes – owing to fewer primary care visits – while time spent with surgeons and medical specialists increased (12.1 to 12.6 minutes with surgeons, 15.4 to 17.4 minutes with medical specialists). While face time increased among all racial and ethnic groups, white patients continue to get more physician time than their Black and Hispanic counterparts. The white-Black gap increased from 13.1 to 22.9 minutes, while the white-Hispanic gap rose from 11.6 to 14.7 minutes. White patients spent significantly less time with specialists than their Black and Hispanic counterparts. Gaffney et al., “Trends and Disparities in the Distribution of Outpatient Physicians’ Annual Face Time with Patients, 1979-2018,” Journal of General Internal Medicine, 6/6/2022

Disparities, barriers persist despite insurance: Black patients enrolled in employer-sponsored commercial insurance are more likely to be burdened by chronic diseases, experience barriers to care, and have unmet social needs according to a study sponsored by Morgan Health, a JP Morgan Chase & Co. initiative. Black enrollees are 15.6 percentage points more likely than white enrollees to have uncontrolled high blood pressure and 5.3 percentage points more likely to have diabetes, after adjusting for age and sex. Black enrollees were 4.9 percentage points more likely to visit an emergency department and were 9.8 percentage points more likely to be food insecure. “Health Disparities in Employer-Sponsored Insurance,” Morgan Health and NORC, July 2022

More Black patients, less reimbursement: An analysis of Medicare data shows hospitals serving a disproportionate share of Black patients receive 21.6% lower payments for patient care per day than other hospitals. Hospitals serving Black patients averaged a loss of $17 per patient day versus an average profit of $126 at other hospitals. After adjusting for patient case mix and hospital characteristics, Black-serving hospitals still received $238 less in revenue per patient day than other hospitals, and $111 less in profits. Researchers estimate $14 billion would have been required to equalize reimbursement levels at Black-serving hospitals in 2018. Himmelstein et al., “Hospitals that Serve Many Black Patients Have Lower Revenues and Profits: Structural Racism in Hospital Financing,” Journal of General Internal Medicine, 8/5/2022

Medicaid utilization lower among Black patients: Medicaid spends an average of $317 less on Black enrollees than their white counterparts after adjusting for demographics, health status, and source of care. Black enrollees had fewer primary care encounters than white enrollees (19.3 fewer per 100 enrollees annually) but more emergency department visits (9.5 more per 100 enrollees). Among children, Black enrollees had 90.1 fewer primary care encounters per 100 enrollees. Wallace et al., “Disparities in Health Care Spending and Utilization Among Black and White Medicaid Enrollees,” JAMA Health Forum, 6/10/2022

Early Covid vaccine rollout plagued by disparities: U.S. health care facilities in counties with a high proportion of Black residents were less likely to receive Covid-19 vaccines in May 2021. Facilities in counties with at least 42.2% Black residents were less likely to administer Covid vaccines than facilities in counties with less than 12.5% Black residents. In urban areas, counties with large Black populations were 32% less likely to provide vaccinations than urban counties with low Black populations. Researchers also found facilities in rural counties and counties in the top quintile of Covid mortality were also less likely to administer Covid vaccines. In rural counties with large Hispanic populations, facilities were 26% less likely to administer vaccines than in rural counties with low Hispanic populations. Hernandez et al., “Disparities in distribution of COVID-19 vaccines across US counties: A geographic information system-based cross-sectional study,” PLOS Medicine, 7/28/2022

Disparities in monkeypox infections, vaccinations: Early data indicates racial disparities in monkeypox infections, unaddressed by vaccination. As of the end of July, 26% of known monkeypox cases were among Blacks and 32% were among Hispanics. Vaccinations have gone to whites, including 55% of vaccine recipients in Chicago and 63.5% in Washington, D.C. Black people are disproportionately diagnosed with monkeypox in North Carolina (70%) but only 22% of vaccine doses have gone to Black men, approximately mirroring the state’s population. In Georgia, 71% of cases have been among Black men, while only 44.5% of people vaccinated were Black. Johnson et al., “White People Get Bigger Share of Monkeypox Shots, Early Data Show,” Bloomberg, 8/11/2022; McFarling et al., “New data from several states show racial disparities in monkeypox infections,” STAT News, 8/11/2022; Pratt, “Racial disparities revealed in monkeypox vaccination data,” Atlanta Journal-Constitution, 8/18/2022

Disparities in drug overdose deaths: Deaths from unintentional or undetermined overdose increased by 44% among Black people compared with 22% for white people in 2020, Black incidence of death rose from 27 deaths per 100,000 people to 38.9 versus an increase from 25.2 to 30.7 for whites. Death rates also increased for American Indian or Alaska Native people by 39% (from 26.2 to 36.4) and 21% among Hispanics (17.3 to 21). Black youths age 15 to 24 saw an 86% increase in overdose deaths, the largest increase of any age or racial group. Black men 65 and older were nearly seven times as likely as white men to die from an overdose. At the same time, Black people were less than half as likely as white people to have received substance use treatment. Kariisa et al., “Vital Signs: Drug Overdose Deaths, by Selected Sociodemographic and Social Determinants of Health Characteristics — 25 States and the District of Columbia, 2019-2020,” Centers for Disease Control and Prevention MMWR, 7/19/2022

Single Payer could have saved thousands of lives: Single-payer health care could have prevented 338,594 Covid-19 deaths in the U.S. from the beginning of the public health emergency to mid-March 2022. Researchers estimate that if everyone in the country was provided with comprehensive care for free at the point of service, 131,438 people who died from Covid-19 could have been spared in 2020 alone, and roughly 80,000 people with other diseases could have been saved that year. More than 207,000 additional Covid-19 deaths could have been averted in 2021 and the first three months of this year. The U.S. also could have saved $105.6 billion in health care costs associated with hospitalizations from the disease—on top of the estimated $438 billion that could be saved in a non-pandemic year. Galvani et al., “Universal healthcare as pandemic preparedness: The lives and costs that could have been saved during the COVID-19 pandemic,” PNAS, 6/13/22

More non-Covid deaths in states with greater uninsurance: The White House Council of Economic Advisors found that states with high uninsurance rates had more non-Covid “excess deaths” during the first two years of the pandemic. They estimate that each 10 percentage point increase in a state’s uninsurance rate was associated with a 4.8 percentage point increase in excess deaths. “Excess Mortality during the Pandemic: The Role of Health Insurance,” White House Council of Economic Advisors, 7/12/2022

Uninsurance associated with late-stage cancer diagnosis, lower survival: A new study shows that people without insurance are significantly more likely to be diagnosed with late-stage cancers and face lower survival rates than their insured peers. The difference was particularly marked for six cancers – prostate, colon, non-Hodgkin lymphoma, oral cavity, liver, and esophagus – where uninsured individuals diagnosed with stage 1 disease fared worse than insured people diagnosed with stage 2 disease. The analysis suggested that people without health insurance were more likely to postpone doctor visits, resulting in a late-stage diagnosis, the researchers said. But people without health insurance coverage were also more likely to have worse short- and long-term survival rates after diagnosis. Uninsured individuals fared worse within each stage for all of the 19 cancers combined. Zhao et al., “Health insurance status and cancer stage at diagnosis and survival in the United States,” CA: A Cancer Journal for Clinicians, 7/13/2022

Suicide deaths rose less in states that expanded Medicaid: Suicide is the 10th leading cause of death in the U.S. and the second leading cause of death in people age 10 to 34. Suicides have been steadily increasing since 1999, with a mean increase of 1% per year from 1999 to 2006 and 2% per year from 2006 to 2018. However, researchers found that death by suicide increased less in states that expanded Medicaid coverage, suggesting the blunting of rising suicide rates among adults age 20 to 64 could be linked to better access to mental health care. Patel et al., “Association of State Medicaid Expansion Status with Rates of Suicide Among US Adults,” JAMA Network Open, 6/15/2022

Paid sick leave tied to fewer ER visits: From 2011 through 2019, in states that put paid sick leave policies in place, ED visits fell 5.6% — or about 23 fewer visits per 1,000 people per year. The biggest drops came from Medicaid patients, with big declines in visits that could have been handled in primary care: for adults, dental problems, mental health issues, and substance use disorder; and for kids, asthma. Ma et al., “State Mandatory Paid Sick Leave Associated with a Decline in Emergency Department Use in the US, 2011-19,” Health Affairs, August 2022

ACA insurers deny nearly one in five claims, but won’t tell patients why: ACA Marketplace insurers denied, on average, nearly one-fifth (18%) of in-network claims. And for 72% of denials, the explanation that insurers offered was “all other reasons.” As a result, for nearly three-quarters of all denied non-group qualified health plan claims, the reason is unclear. Denial rates vary by state: Mississippi and Indiana patients experienced the highest denial rates; insurers there denied 29% of all in-network claims. Only 1% of ACA Marketplace plan enrollees appealed their denied claims, and of those, nearly two-thirds (63%) were still denied coverage at the end of the appeal process. Pollitz et al., “Claims Denials and Appeals in ACA Marketplace Plans in 2020,” Kaiser Family Foundation, 7/05/2022

U.S. administrative costs once again prove high: Billing and insurance-related costs for inpatient bills ranged from $6 in Canada to $215 in the U.S., according to a microlevel accounting study of 5 nations. Australia, which has a mix of public and private payers, was similar to the U.S. The other nations included in the study were Germany, the Netherlands, and Singapore. Richman et al., “Billing and Insurance-Related Administrative Costs: A Cross-National Analysis,” Health Affairs, August 2022

Blues not paying taxes: A dozen Blue Cross Blue Shield (BCBS) insurers have not paid any net federal taxes since 2017 when Congress repealed the alternative minimum tax, while the government has refunded $6.6 billion to those insurers. Meanwhile, a federal judge approved a $2.67 billion antitrust settlement against 34 BCBS plans. Herman, “Many Blue Cross Blue Shield plans aren’t paying taxes — and instead are swimming in refunds,” STAT News, 6/15/2022; Tepper, “Judge approves Blue Cross Blue Shield $2.67B antitrust settlement,” Modern Healthcare, 8/9/2022

Cigna profits up: Cigna’s net income rose 6.2% to $1.5 billion for the second quarter of 2022, driving the company’s medical loss ratio (MLR) to 80.7%, compared with 84.4% for the same period in 2021. Reduced emergency department and surgery utilization drove the decline in spending, while Cigna also repriced its government-sponsored business to lower its MLR. Tepper, “Low medical spending drove Cigna’s quarterly profit,” Modern Healthcare, 8/4/22

Diabetes patients in Medicare Advantage plans have worse health: Type 2 diabetes patients on Medicare Advantage (MA) plans are more likely to have worse health than those in Traditional Medicare (TM), with MA patients having statistically significant higher systolic blood pressure (+0.2 mmHg) and worse blood glucose control (+0.1% A1C). While MA patients were more likely to receive preventive treatment, they were less than likely than TM patients to receive newer, more expensive treatments like SGLT2 inhibitors (5.4% in MA vs. 6.7% in TM) and GLP-1 receptor agonists (6.9% in MA vs. 9.0% in TM). Essein et al., “Diabetes Care Among Older Adults Enrolled in Medicare Advantage Versus Traditional Medicare Fee-For-Service Plans: The Diabetes Collaborative Registry,” Diabetes Care, 7/6/2022

Blues expand their Medicare Advantage market: Health Care Service Corp. (HCSC) plans its largest expansion ever into Medicare Advantage (MA). HCSC – which sells Blue Cross and Blue Shield plans in Illinois, Montana, New Mexico, Oklahoma, and Texas – plans to expand its MA business into 150 new counties for 2023. The previous year, HCSC’s MA plans expanded to 90 new counties, increasing membership by 10,000. Tepper, “HCSC doubles down on Medicare Advantage as market share declines,” Modern Healthcare, 8/3/2022

Phantom docs pervade Medicaid managed care: Only one-third of mental health prescribers listed in Oregon’s Medicaid directories provided care to Medicaid patients in 2018. Nearly six in ten providers (58.2%) in network directory listings were “phantom” providers who did not see Medicaid patients, including 67.4% of mental health prescribers. Zhu et al., “Phantom Networks: Discrepancies Between Reported and Realized Mental Health Care Access in Oregon Medicaid,” Health Affairs, July 2022

NHS outsourcing associated with more deaths: Outsourcing in the U.K.’s National Health Service to private, for-profit providers corresponds with an increase in treatable mortality and a decline in the quality of care, resulting in an additional 557 deaths between 2014 and 2020. From 2013 to 2020, outsourcing grew from 3.9% to 6.4%, with £11.5 billion given to private companies. Each 1% annual increase in outsourcing spending was associated with a 0.38% increase in treatable mortality (0.29 deaths per 100,000). Goodair & Reeves, “Outsourcing health-care services to the private sector and treatable mortality rates in England, 2013-20: An observational study of NHS privatisation,” The Lancet Public Health, July 2022

Health industry profits set to increase: McKinsey & Company estimates health care earnings will rise by 6% each year between 2021 and 2025, resulting in $31 billion in profits for the health industry. Increased profits are expected to come from government programs like Medicare Advantage and Medicaid managed care, and increased demand for non-acute care. Meanwhile, HCA Healthcare told investors they expect to pass along rising costs to commercial insurers through price negotiations, while UnitedHealth Group indicated receptiveness to higher prices. Singhal & Patel, “The future of US healthcare: What’s next for the industry post-COVID-19,” McKinsey & Company, 7/19/2022; Muoio, “Health Systems Confident Payers Will Concede Higher 2023 Rates,” Fierce Healthcare, 7/29/2022

CEOs cash in: The chief executives of approximately 300 health care companies reaped $4.5 billion in 2021, with an average CEO receiving $15.3 million, according to a STAT analysis. The highest paid CEOs usually come from pharmaceutical and medical device companies. Regeneron CEO Leonard Schleifer took in $453 million, or 10% of the total. Salaries make up less than 6% of pay, while realized gains of stock awards compose the greatest portion of pay packages. By comparison, average U.S. household income is $67,000. The $4.5 billion total could provide health insurance to 580,000 individuals for one year. Herman et al., “Health care’s high rollers: As the pandemic raged, CEOs’ earnings surged,” STAT News, 7/18/2022

ED facility fees higher at for-profit hospitals: High-acuity self-pay patients who visited for-profit emergency departments (EDs) were charged an average of $1,218 more than similar patients at non-profit EDs in 2021. Higher facility fees were also charged at hospitals with more than 250 beds (by $826) and system-affiliated EDs (by $311). EDs in high-poverty areas charged $450 less, on average, than EDs in affluent communities. Henderson & Mouslim, “Hospital and Regional Characteristics Associated with Emergency Department Facility Fee Cash Pricing,” Health Affairs, July 2022

Amazon continues foray into health care: Tech giant Amazon will acquire boutique primary care chain One Medical for $3.9 billion. One Medical has 767,000 enrolled patients. Amazon’s health care business includes a virtual and in-home urgent care service and an online pharmacy. Amazon previously acquired PillPack for $753 million in 2018 to jump start its pharmacy business. Lerman & Shaban, “Amazon will see you now: Tech giant buys health-care chain for $3.9 billion,” Washington Post, 7/21/2022

Private Equity draws attention for foray into hospice and autism care: Private Equity (PE) ownership of hospice agencies increased from 106 (3.4% of total hospices) in 2011 to 409 (7.3%) in 2019. Nonprofits represented 72% of hospices acquired by PE in that time. PE is also entering the child autism therapy business, alarming parents, clinicians, and experts. They say PE investments in Applied Behavior Analysis therapy has degraded the quality of service, turning it into “fast food therapy” that could even be harmful for children. Hawryluk, “Hospices Have Become Big Business for Private Equity Firms, Raising Concerns About End-of-Life Care,” Kaiser Health News, 7/29/2022; Bannow, “Parents and clinicians say private equity’s profit fixation is short-changing kids with autism,” STAT News, 8/15/2022

Unions growing among younger physicians: Coinciding with an increase in union organizing nationally, the Committee of Interns and Residents reports its membership has grown by 37.5% since 2019, adding 6,000 new members to bring its current membership to 22,000. Over the past two years, the Union of American Physicians and Dentists has grown by 9.9% and now represents 5,000 professionals. Organizers say the growth is driven by concern over personal protective equipment and worker and patient safety during the Covid-19 pandemic, along with the increasing number of physicians who are directly employed by health systems rather than practicing independently. Christ, “More physicians seek unions amid changing landscape, COVID-19,” Modern Healthcare, 7/20/2022

New drugs, new high prices: The average cost of newly launched drugs increased by 20% per year from 2008 ($2,115) to 2021 ($180,007). Even after adjusting for manufacturer discounts, prices rose by 11% each year. At the same time, a greater proportion of new drugs are high priced, with 47% costing $150,000 or more in 2020 and 2021, compared with 9% of drugs launched from 2008 to 2013. So far this year, the median annual price of 13 new novel drugs for chronic conditions is $257,000. Rome et al., “Trends in Prescription Drug Launch Prices, 2008-2021,” JAMA, 6/7/2022; Beasley, “Newly launched U.S. drugs head toward record-high prices in 2022,” Reuters, 8/16/2022

Bias pervades drug effectiveness studies: Drug, medical device, and biotech industry-sponsored cost effectiveness analyses (CEAs) are twice as likely to report a treatment as cost effective compared with independently conducted CEAs. Incremental cost effectiveness ratios (ICERs) from industry-sponsored CEAs were 33% lower than from non-industry studies. Treatments with lower ICERs are more likely to receive insurance coverage approval. Xie, “Industry sponsorship bias in cost effectiveness analysis: registry based analysis,” BMJ, 6/22/2022

More industry bad behavior: Biogen agreed to pay $900 million to settle a whistleblower case alleging the company paid kickbacks to physicians for its multiple sclerosis drug and disguised marketing programs as educational sessions. Meanwhile, AbbVie was reprimanded by a U.K. pharmaceutical trade group for code of conduct violations. The Prescription Medicines Code of Practice Authority criticized the company’s sales reps for “strategic loitering” and circumventing hospital Covid-19 non-essential visitor restrictions. Silverman, “Biogen agrees to pay $900 million ot settle whistleblower case alleging kickbacks and sham speaking events,” STAT News, 7/20/2022; Silverman, “AbbVie is scolded by a trade group over sales rep ‘strategically loitering’ in a hospital,” STAT News, 7/27/2022

Medicare increases payments to hospitals following key lobbying: Hospitals will receive a 4.3% increase in payments for inpatient services in 2023, the largest rate increase in 25 years. This follows lobbying from hospital groups after the Centers for Medicare and Medicaid Services proposed a 3.2% increase. Medicare will also increase payment rates for hospices (3.8%), inpatient rehabilitation (3.2%), and inpatient psychiatric services (2.5%). Herman, “Hospitals win higher payments from Medicare after lobbying campaign,” STAT News, 8/1/2022; Goldman, “CMS hikes Medicare pay for rehab, psychiatric and hospice providers,” Modern Healthcare, 7/27/2022

“The maternal mortality consequences of losing abortion access,” by Amanda Jean Stevenson, Leslie Root, Jane Menken, SocArVix Papers, 6/29/2022. “After the first year of no abortion occurring, we estimate increased exposure to the risks of pregnancy would cause an increase of 210 maternal deaths per year (24% increase), from 861 to 1071. The increase would be greatest among non-Hispanic Black people, for whom it would be 39%.”

“Universal healthcare coverage and health service delivery before and during the COVID-19 pandemic: A difference-in-difference study of childhood immunization coverage from 195 countries,” by Sooyoung Kim,Tyler Y. Headley,Yesim Tozan, PLOS Medicine, 8/16/2022. “We observed that countries with greater progress toward UHC [Universal Health Coverage] were associated with significantly smaller declines in childhood immunization coverage during the pandemic. This identified association may potentially provide support for the importance of UHC in building health system resilience. Our findings strongly suggest that policymakers should continue to advocate for achieving UHC in coming years.”

“Trends in Out-of-Pocket Costs for Naloxone by Drug Brand and Payer in the US, 2010-2018,” by Evan D. Peet, Ph.D.; David Powell, Ph.D.; Rosalie Liccardo Pacula, Ph.D., JAMA Health Forum, 8/19/2022. “This observational study of 719,612 pharmacy claims data shows that OOP costs of naloxone grew substantially beginning in 2016. However, OOP costs did not increase for all patients and all brands of naloxone but primarily for uninsured patients and for the Evzio brand.”

“Association of Chronic Disease With Patient Financial Outcomes Among Commercially Insured Adults,” by Nora V. Becker, M.D., Ph.D.; John W. Scott, M.D., M.P.H.; Michelle H. Moniz, M.D., M.Sc.; Erin F. Carlton, M.D., M.Sc.; John Z. Ayanian, M.D., M.P.P., JAMA Internal Medicine, 8/22/2022. “This cross-sectional study of commercially insured adults linked to patient credit report outcomes shows an association between increasing burden of chronic disease and adverse financial outcomes.”

“CMS Should terminate the Medicare Advantage Program,” by Physicians for a National Health Program, 8/25/2022. “It would be far more cost-effective for CMS to improve traditional Medicare by capping out-of-pocket costs and adding improved benefits within the Medicare fee-for-service system than to try to indirectly offer these improvements through private plans that require much higher overhead and introduce profiteers and perverse incentives into Medicare, enabling corporate fraud and abuse, raising cost to the Medicare Trust Fund, and worsening disparities in care. These problems are not correctable within the competitive insurance business model, and the Medicare Advantage program should be terminated.”

“Uncovered Medical Bills after Sexual Assault,” by Samuel L. Dickman, M.D.; Gracie Himmelstein, M.D., Ph.D.; David U. Himmelstein, M.D.; Katherine Strandberg, M.P.A.; Alecia McGregor, Ph.D.; Danny McCormick, M.D.; Steffie Woolhandler, M.D., M.P.H., The New England Journal of Medicine, 9/15/2022. “Our findings indicate that an estimated 17,842 persons who sought emergency department care related to sexual assault [out of 112,844 such visits in 2019] were expected to pay the often-substantial costs themselves. Other data indicate that even privately insured sexual assault victims pay, on average, 14% of emergency department costs out-of-pocket.”

“Prevalence and Risk Factors for Medical Debt and Subsequent Changes in Social Determinants of Health in the US,” by David U. Himmelstein, M.D.; Samuel L. Dickman, M.D.; Danny McCormick, M.D., M.P.H.; David H. Bor, M.D.; Adam Gaffney, M.D., M.P.H.; Steffie Woolhandler, M.D., M.P.H., JAMA Network Open, 9/16/2022. “In this cross-sectional and cohort study of survey data from 2017 to 2019, 10.8% of adults carried medical debt, including 10.5% of the privately insured, and 9.6% of residents of Medicaid-expansion states, significantly fewer than in non-expansion states. Over 3 years, decreases in health status and coverage loss were significant risk factors associated with acquiring medical debt, which was, in turn, associated with a significant 1.7-fold to 3.1-fold higher risk of worsening housing and food security.”

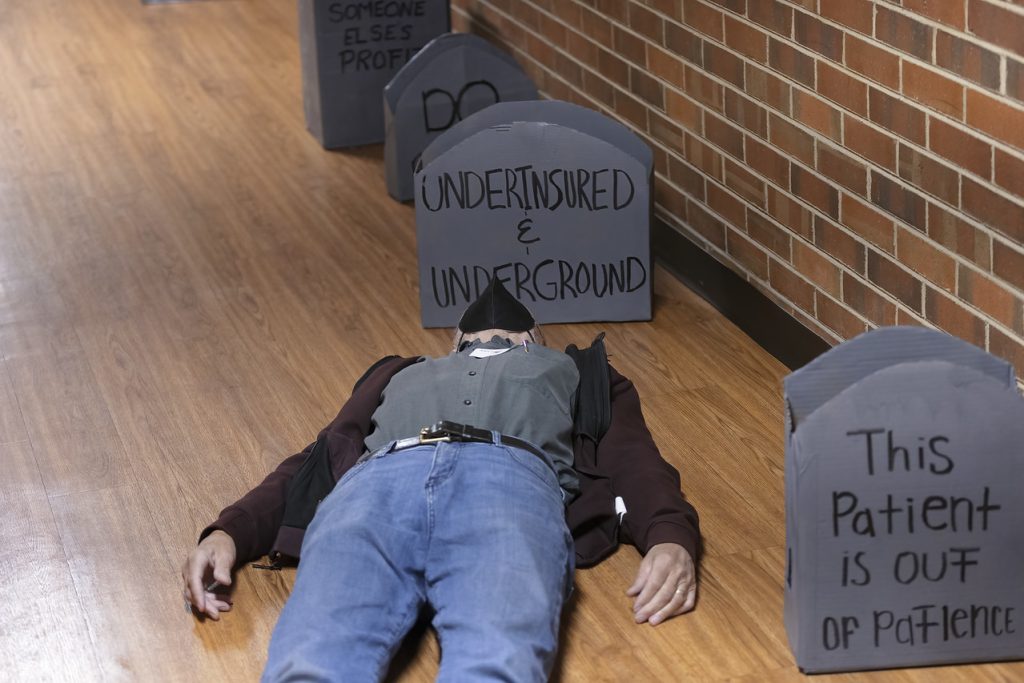

In California, Dr. Ana Malinow organized an action outside the Federal Building in San Francisco to both celebrate the 57th anniversary of Medicare being signed into law and to warn against creeping privatization of the program through schemes like Direct Contracting and REACH. The event, titled “Make it a Birthday, Not a Funeral,” was emceed by Dr. Corinne Frugoni and sponsored by Senior Disability Action, the California Alliance for Retired Americans, and DSA San Francisco, among other organizations. In terms of online activism, the California chapter launched its new website (pnhpca.org), developed in large part by chapter co-chair Dr. Kathleen Healey, and celebrated the release of a health care savings calculator from Healthy California Now (healthyca.org/calculator), which benefited from the contributions of Drs. Hank Abrons and Jim Kahn.

To get involved in California, contact Dr. David Leibowitz at dleibow@gmail.com.

In Georgia, chapter leaders renewed their efforts to engage with members of the Atlanta City Council in support of a municipal Medicare-for-All resolution. Leaders also reached out to Sens. Raphael Warnock and John Ossoff to thank them for supporting a pair of ultimately unsuccessful amendments to the Inflation Reduction Act that would have extended dental, vision, and hearing coverage to Medicare patients and basic health coverage to residents of states that have not expanded Medicaid.

To get involved in Georgia, contact Dr. Liz McCord at pnhpgeorgia@gmail.com.

In Illinois, members of PNHP and the Northwestern University Students for a National Health Program (SNaHP) chapter joined ONE Northside in a spirited demonstration outside Centene’s Chicago office. They demanded that the insurance company stop its fraudulent denial of claims for being “out of network,” highlighting the case of a community member who was wrongfully billed $999 for routine blood work and who had spent countless hours challenging the error. Ultimately, activists demanded that commercial insurance companies be replaced by a health care system that is publicly financed, nonprofit, and fully accountable to the public: improved Medicare for All.

To get involved in Illinois, contact Dr. Monica Maalouf at mmaalouf88@gmail.com.

In Kentucky, chapter members participated in a Continuing Medical Education (CME) program sponsored by the Kentucky Medical Association titled, “The U.S. Healthcare Delivery System: Where it Succeeds, How it Fails to Meet the Needs of Patients and Providers, and Options for Change.” The program was organized by Dr. Susan Bornstein and took place over Zoom on August 17. On July 30, members celebrated Medicare’s 57th birthday by distributing flyers urging an end to Direct Contracting and REACH at Louisville farmers’ markets, and at a Madison County picnic.

To get involved in Kentucky, contact Kay Tillow at nursenpo@aol.com or Dr. Garrett Adams at kyhealthcare@aol.com.

PNHP’s Maine chapter, Maine AllCare, has formed a new 501(c)(4) organization, HealthCare for All Maine, that will engage in lobbying efforts to bolster single-payer legislation. A team of activists within the chapter has also formed a Physician Working Group that is focused on messaging to medical professionals and updating the Maine Medical Association’s position on single payer.

To get involved in Maine, contact Karen Foster at kfoster222@gmail.com.

In Minnesota, a group of 17 rising 2nd-year medical students and graduate students working towards their MPH participated in the chapter’s Summer Education Program. Seven of these students completed individual projects as part of a paid internship, and shared them at the PNHP Minnesota Annual Summer Picnic on August 12. Activists also joined forces with Health Care for All Minnesota to table at the Twin Cities Pride Festival in June and at the Minnesota Farmfest in early August. In late August and early September, more than 50 volunteers tabled at the Minnesota State Fair, spreading the word about single payer to crowds totalling over two million for the week.

To get involved in Minnesota, contact Jen Crawford at pnhpminnesota@gmail.com.

In New Hampshire, chapter leaders worked with state legislators to explore a bill that would form a multi-state single-payer compact, seeking power in numbers and collaboration among activists and legislatures seeking to pursue state-level initiatives. Physician members also made presentations to the SNaHP chapter at the Geisel School of Medicine at Dartmouth.

To get involved in New Hampshire, contact Dr. Donald Kollisch at donald.o.kollisch@dartmouth.edu.

The New Jersey Universal Healthcare Coalition finalized plans to collaborate with Rutgers University on a poll of voters across the state, seeking to gauge their opinion of our current health care “system” and assess their enthusiasm for single-payer reform. Several members are also planning to present resolutions to the Medical Society of New Jersey.

To get involved in New Jersey, contact Dr. Lloyd Alterman at lloydalterman52@gmail.com.

In New York, PNHP’s New York-Metro chapter announced the hiring of a new Executive Director, Morgan Moore, who has been instrumental to the growth of the chapter in recent years. When the Covid-19 pandemic hit, she played a major role in transitioning chapter activities online and continuing the series of high-quality monthly educational forums at PNHP NY Metro. She also launched the chapter’s #MedStoryMonday social media campaign, where health workers are encouraged to share their personal stories of how the for-profit health insurance system has negatively impacted their ability to provide care. Morgan started as Executive Director September 1 and Mandy Strenz, who had been serving as Acting Executive Director, returned to her role as Chapter Coordinator. Earlier in the summer, the NY Metro chapter collaborated with other local advocacy groups to celebrate the anniversary of Medicare and Medicaid. Members presented oversized birthday cards to the offices of Sens. Gillibrand and Schumer, urging them to fight back against profiteering by ending Medicare Direct Contracting and REACH.

To get involved in New York, contact Morgan Moore at morgan@pnhpnymetro.org.

Health Care Justice – North Carolina in Charlotte celebrated Medicare’s birthday by delivering sheet cakes decorated with faux Medicare cards, balloons, and information about Direct Contracting and REACH to local Congressional offices. The chapter also developed a two-page letter containing information about PNHP and Medicare for All (available at healthcarejusticenc.org) which they encouraged members to print and deliver to their health care providers during office visits. On August 21, members continued their annual tradition of marching in the Charlotte Pride Parade.

To get involved in Health Care Justice-NC, contact Dr. George Bohmfalk at gbohmfalk@gmail.com or Dr. Jessica Schorr Saxe at jessica.schorr.saxe@gmail.com.

Members of Healthcare For All – Western North Carolina in Asheville held a public downtown rally to celebrate the 57th anniversary of Medicare. Activists brought banners, gift bags, and sidewalk chalk for visitors to write big, bold messages about what Medicare means to them and why it needs to be protected from profiteers. Chapter leaders also held a well-attended informational meeting at a local retirement community where they screened “FIX IT” and fielded many concerned questions about Direct Contracting and REACH; similar events will be held on a monthly basis going forward.

To get involved in Health Care for All WNC in Asheville, contact Terry Hash at theresamhash@gmail.com.

In Vermont, students who participated in the Northern New England online internship program continued their single-payer activism by giving presentations to a variety of groups, including the League of Women Voters’ National Convention and One Payer States.

To get involved in Vermont, contact Dr. Betty Keller at bjkellermd@gmail.com or Ted Cody tscody@vermontel.net.

The PNHP Washington chapter worked closely with Puget Sound Advocates for Retirement Action, Health Care is a Human Right WA, and other progressive organizations to protest the ongoing privatization of Medicare. On July 29, the day before Medicare’s 57th birthday, members of this coalition joined forces to rally and picket outside the regional office of the Dept. of Health and Human Services in Seattle, demanding an end to Direct Contracting and REACH and eventually securing a meeting with the Regional Director of HHS. In early August, PNHP-WA co-sponsored a “Righteous Mothers” benefit concert to stop the privatization of Medicare, during which Medicare-for-All Act lead sponsor Rep. Pramila Jayapal addressed the crowd.

To get involved in Washington, contact pnhp.washington@gmail.com.

In West Virginia, chapter members collaborated with five local health activist groups to plan and host a “Happy Birthday Medicare and Medicaid” event in Charleston on July 30. The event took place at a Federally Qualified Health Center, and the chapter continued sending letters to similar FQHC providers throughout the state telling them about PNHP and inviting them to join. Chapter leaders also drafted an anti-REACH resolution that was eventually passed by the West Virginia Democratic Party, and sent letters to Gov. Justice and all state legislators opposing any legislation that criminalizes health care providers and patients for providing or receiving abortion services.

To get involved in West Virginia, contact Dr. Dan Doyle at pnhp.wv@gmail.com.

“Prescription for Healthcare: Threats to Medicare,” WFHB Community Radio, 9/05/2022, featuring Dr. Ana Malinow

Click the links below to jump to different sections of the newsletter. To view a PDF version of the shorter print edition of the newsletter, click HERE.

If you wish to support PNHP’s outreach and education efforts with a financial contribution, click HERE.

If you have feedback about the newsletter, email info@pnhp.org.

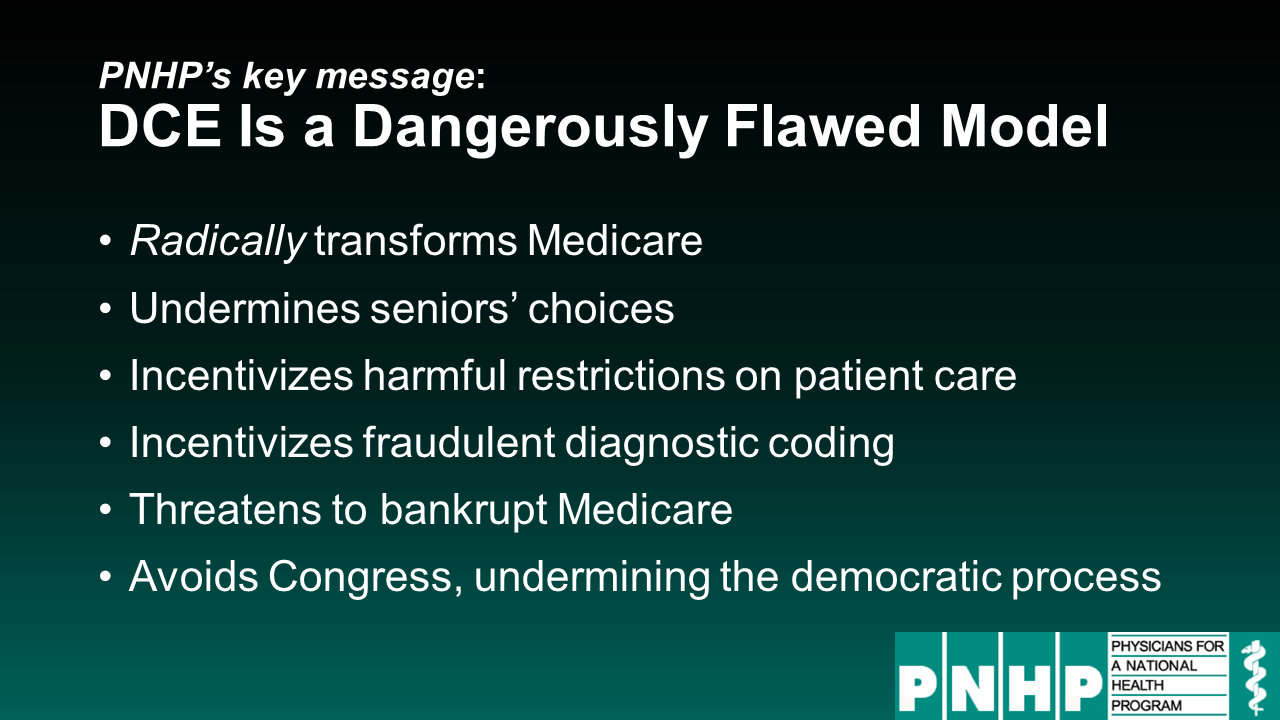

After several months of intense educating and organizing by PNHP and our allies, the Centers for Medicare and Medicaid Services (CMS) announced the termination of the controversial Medicare Direct Contracting model in February, admitting the program “did not align” with the Biden administration’s vision. At the same time, CMS said it planned to replace DC with a nearly identical program called “ACO REACH.”

CMS’ “rebranding” of Direct Contracting to REACH taught PNHP some important lessons. First, we knew that our work made an enormous impact — CMS would have never canceled the program if not for our campaign. But it wasn’t enough. We learned that we could never end Medicare profiteering unless we organize a powerful, national, grassroots movement.

To meet that challenge, PNHP expanded our organizing, working with chapter leaders to give dozens of presentations to community and senior groups. Along with our allies, we helped pass anti-DC/REACH resolutions in the Seattle City Council and the Arizona Medical Association.

The organizing paid off. On May 23, PNHP hosted our biggest event ever: The launch of our “Summer of Action” against Medicare profiteering. More than 3,000 activists participated in this online event, where they learned the nuts-and-bolts of Direct Contacting and REACH, heard powerful testimonials from Medicare beneficiaries, and were inspired to take action by Congresswomen Katie Porter and Pramila Jayapal.

Anyone can get involved in our Summer of Action against Medicare profiteering. Here’s how:

Go to ProtectMedicare.net to find campaign updates, sample scripts, fact sheets, videos and more.

Medicare advocates are celebrating two big victories in the movement to protect Medicare from profiteering and privatization.

In Seattle, seniors from the Puget Sound Advocates for Retirement Action, along with PNHP’s Washington Chapter, proposed a resolution against Medicare Direct Contracting and REACH. The resolution, which demands that the Dept. of Health and Human Services and President Biden immediately end Direct Contracting/REACH and protect Medicare from profiteering, was introduced by Councilmember Teresa Mosqueda and passed unanimously on April 26.

That same week, PNHP members Dr. Eve Shapiro and Dr. Michael Hamant introduced and successfully passed a similar resolution at the annual meeting of the Arizona Medical Association.

Drs. Shapiro and Hamant explained to their colleagues that since most physicians are now employed by large groups or health systems, they may find themselves practicing in Direct Contracting Entities (DCEs) without their knowledge or consent. Among concerns cited by the resolution is that “DCEs are allowed to keep as profit and overhead what they don’t pay for in health services, therefore giving them a dangerous financial incentive to restrict seniors’ care.”

The Seattle and Arizona resolutions are part of PNHP’s strategy to expand the fight against Medicare profiteering into every state and Congressional district in the nation.

After years of education and organizing by PNHP members, the 25,000-member American Public Health Association (APHA) strongly endorsed a Medicare for All policy at its most recent annual meeting, concluding that, “The most equitable and cost-effective health care system is a public, single-payer system.”

The policy statement was crafted by a working group of the APHA’s Medical Section, which included PNHP leaders Drs. Anthony Spadaro, Oli Fein, and Gordy Schiff, working with colleagues in the epidemiology, public health, pharmacy, and social work professions.

The working group published the position paper, “The American Public Health Association Endorses Single-Payer Health System Reform,” in the June 2022 edition of Medical Care, the official journal of the Medical Care Section of the APHA.

“The APHA is our nation’s strongest voice for public health, and I’m thrilled that my colleagues came together to support single payer as the solution to our fragmented and profit-oriented health system,” said Dr. Spadaro, a resident emergency medicine physician at the University of Pennsylvania and former board member of Students for a National Health Program.

The APHA resolution is part of PNHP’s Medical Society Resolutions campaign, which seeks to organize the medical profession by passing Medicare-for-All resolutions in every medical society in the U.S. The MSR campaign has passed resolutions in the American College of Physicians, the Society of General Internal Medicine, and the Hawaii, Vermont, New Hampshire and Washington state medical societies.

For more information on the PNHP Medical Resolutions Campaign, visit MedicalSocietyResolutions.org.

PNHP is known for its independence and unwavering commitment to a gold standard in health policy, in large part because of how we’re funded — by dues and donations of our members, never with corporate money that could compromise our mission.

This spring, longtime PNHP member Dr. Rob Stone discovered a new way to support PNHP’s mission: Through a generous gift of stock.

Dr. Stone, a palliative medicine physician, lives with his wife Karen in Bloomington, Indiana. He’s been a PNHP member since 2000, including roles as a board member and advisor, and usually donates about $1,000 per year to PNHP.

But when he turned 70 earlier this year, Dr. Stone began thinking more about his retirement and his legacy in the health justice movement. He’d been especially excited about PNHP’s campaign to stop Medicare privatization through Direct Contracting, and how important that was for the future of Medicare for All.

As he thought about how he could better support PNHP, Dr. Stone inherited Microsoft stock from his mother, who bought it in the 1980s; the stock had appreciated in value to about $40,000.

“I did the math and realized that if I sold the stock and kept it, I’d have to pay about $5,000 in capital gains taxes,” said Dr. Stone. “But if I donated the stock to PNHP, I would get a $40,000 tax deduction.”

What was more important was the incredible impact that his gift could make to PNHP’s mission.

“I’ve been very excited about the work that PNHP has been doing over the past year and was thrilled that I had an opportunity to help keep that momentum going,” Dr. Stone added. “My mother always encouraged me to give and to lead by example, and I’m hoping that my gift of stock will encourage other PNHP members to do the same.”

Part of Dr. Stone’s stock gift will support the Dorothy W. Stone Scholarship to help medical students attend PNHP’s Annual Meeting in November.

“I strongly encourage other members to think about donating stock to PNHP,” said Dr. Stone. “It’s easy. You get huge tax benefits, and you can make Medicare for All part of your legacy.”

Nominations for PNHP’s Board of Directors will be open from August 1 to 31, with seats up for election in all regions and for at-large representation. Recent bylaws changes expands the number of seats on the Board, so that more members have the opportunity to serve on PNHP’s leadership team. The Board invites nominations and applicants from members interested in contributing to a diverse Board of Directors.

The following seats up for election for 2-year terms:

Questions about qualifications and expectations should be sent to deputy director Matthew Petty at matt@pnhp.org. Nominations (by self or others) are due to matt@pnhp.org by August 31, 2022. Ballots for electronic voting will be circulated in September 2022; please make sure your current email address is on the file with PNHP’s national office.

Americans forego care due to cost: More than half of adults (51%) report that in the past year, they have delayed or gone without medical services due to costs, including 35% who put off dental services, 25% who put off vision care, and 24% who delayed general visits to their health provider. Kirzinger et al., “Health Tracking Poll March 2022: Economic concerns and health policy, the ACA, and views of long-term care facilities,” Kaiser Family Foundation, 3/31/2022

Cancer patients go into debt for care: More than half (51%) of U.S. cancer patients have gone into debt to cover the cost of care. Of those who incurred debt, 53% faced collections and 46% saw their credit scores drop; 62% have since delayed or avoided medical care, while half have sought the least expensive treatment options due to debt. In order to pay for cancer care, more than a quarter (28%) of patients depleted most or all of their savings, 28% have gone into credit card debt, 20% borrowed money from family and friends, and 11% took out another type of loan, like a payday loan or home refinancing. More than a third of cancer patients (36%) cut back on food, clothing, and basic household expenses. “Survivor Views: Cancer & Medical Debt, February 2022 Survey Findings Summary,” American Cancer Society, 3/17/2022

Women in the U.S. face worse health care and outcomes than peer countries: Nearly half (49%) of women of reproductive age in the U.S. skip or delay care because of costs, a rate more than double that of most peer nations. More than half (52%) of women in the U.S. report problems paying medical bills, compared to 10% in the U.K. Over one-quarter (27%) of American women spent $2,000 or more in out-of-pocket medical costs, as compared with less than 5% percent of women in the U.K., France, and Netherlands, and less than 10% in Germany, New Zealand, Canada and Norway. American women have the highest rate of avoidable deaths, and the U.S. maternal mortality rate is three times higher than France and seven times higher than Germany. Gunja et al., “Health and Health Care for Women of Reproductive Age: How the United States Compares with Other High-Income Countries,” Commonwealth Fund, 4/05/2022

Americans lack access to primary care: Compared to a set of 10 other wealthy nations, Americans are the least likely to have a longstanding relationship with a primary care provider, least likely to have access to home visits by a primary care provider, and are the least likely to be able to see a provider after regular office hours. The U.S also has the largest income gap between generalist and specialist physicians ($236,000 vs. $526,000 per year) and the highest medical school tuition. FitzGerald, “Primary Care in High-Income Countries: How the United States Compares,” Commonwealth Fund, 3/15/2022

High costs keep Medicare beneficiaries from critical treatments: Medicare Part D beneficiaries who did not receive subsidies to cap or lower their out-of-pocket costs were nearly twice as likely to not fill prescriptions for serious health conditions, since Part D drug costs can reach $10,000 or more. Among patients without subsidies, 30% did not fill their prescriptions for cancer drugs, 22% did not fill prescriptions for hepatitis C, and more than 50% did not fill therapies for high cholesterol or immune disorders. Dusetzina et al., “Many Medicare Beneficiaries Do Not Fill High-Price Specialty Drug Prescriptions,” Health Affairs, April 2022

Disparities plague drug affordability in Medicare: Among Medicare beneficiaries, 3.5 million seniors (6.6%) and 1.8 million under-65 adults with disabilities (22.7%) had difficulty affording their medications in 2019. Hispanic/Latinx and Black seniors were roughly 1.5 times more likely to have affordability problems compared to white seniors, and two times as likely not to get needed prescriptions due to cost. Among beneficiaries with diabetes, 10% of seniors and 26% of under-65 disabled adults reported medication affordability problems. Tarazi et al., “Prescription Drug Affordability among Medicare Beneficiaries,” U.S. Department of Health and Human Services Assistant Secretary for Planning and Evaluation, Office of Health Policy, 1/19/2022

Major racial disparities among cancer patients with COVID-19: Black cancer patients who were infected with COVID-19 had worse outcomes than similar white patients, with higher rates of hospitalization, intensive care unit admission, and mechanical ventilation. Black patients also experienced higher rates of lung, heart, and vascular complications, acute kidney injuries, and all-cause mortality, and were less likely to be treated with remdesivir and more likely to be treated with hydroxychloroquine. Fu et al., “Racial Disparities in COVID-19 Outcomes Among Black and White Patients with Cancer,” JAMA Network Open, 3/28/2022

Immigrants face major barriers to care: In 2020, more than one in four (42%) undocumented immigrants and 26% of documented immigrants were uninsured, compared to 8% of U.S. citizens. More than a quarter (28%) of undocumented children and 17% of documented children were uninsured, compared to 4% of children with citizen parents. The vast majority of immigrants (83%) were employed or lived with someone who was employed full-time (the same rate as citizens), but undocumented immigrants are not eligible for any kind of financial assistance through Medicaid coverage or tax credits. Income is also a barrier to care, as 44% of undocumented immigrants and 39% of documented immigrants are low-income, compared to 25% of citizens. “Health Coverage of Immigrants,” Kaiser Family Foundation, 04/06/2022

Diabetic amputations higher in states that didn’t expand Medicaid: Among patients of color that were hospitalized for diabetic foot ulcers in the two years after the implementation of the ACA, researchers found a 9% increase in major amputations in states that did not expand Medicaid, but no change in states that did expand. For uninsured adults, the amputation rate decreased 33% in expansion states but did not change in non-expansion states. Tan et al., “Rates of Diabetes-Related Major Amputations Among Racial and Ethnic Minority Adults Following Medicaid Expansion Under the Patient Protection and Affordable Care Act,” JAMA Network Open, 3/24/2022

Commercial insurers delay and deny care: Despite an agreement between the insurance industry and the AMA to streamline the prior authorization (PA) process, 84% of physicians report that the number of PAs required for prescriptions and medical services has increased over the last five years, with 65% saying that it is difficult to determine whether a prescription or medical service requires PA. Physicians report phone calls as the most common method for completing PAs (59%), with 45% of providers always or often using fax machines. An overwhelming majority (88%) of physicians report that PA interferes with continuity of care. “Measuring progress in improving prior authorization: 2021 Update,” American Medical Association, May 2022

High-deductible health plans (HDHPs) a major barrier to mental health care: When employers switched their employees into HDHPs, enrollees with depression were 18% less likely to seek outpatient care, those with ADHD were 15% less likely, and those with anxiety were 14% less likely. Inpatient hospital admissions also dropped significantly for HDHP enrollees with depression (19%), anxiety (16%), and ADHD (6%). After employers switched to HDHPs, overall plan spending for depression, anxiety, and ADHD dropped by $1,137, $984, and $868, respectively, but individual employees’ own spending increased by $326, $321, and $281, respectively. The switch to HDHPs also caused enrollees with anxiety or depression to skip preventative care such as breast, cervical, and prostate cancer screenings, as well as flu and pneumonia vaccinations. Fronstin and Roebuck, “How Do High-Deductible Health Plans Affect Use of Health Care Services and Spending Among Enrollees with Mental Health Disorders?” Employee Benefit Research Institute, 3/10/2022

Commercial insurers won’t pay for catheter supplies: Nearly 80% of catheter users with commercial insurance had to pay out-of-pocket (OOP) for catheters and catheter supplies, including 88% of those on UnitedHealthcare, 79% on BCBS, and 75% on Aetna, compared to 53% of those on public plans. Commercial plan enrollees paid more than three times the amount in OOP catheter expenses ($1,621) than those in public plans ($531). United Healthcare members faced the highest average OOP costs at $2,188 per year. “National Survey Among Catheter Users: A Study to Examine Catheter Usage and Catheter Coverage by Health Plan,” Spina Bifida Association and Duke Health, 3/16/2022

COVID survivors slammed with medical bills: Getting hospitalized for a serious case of COVID-19 left many commercially insured patients with bills averaging $1,600 to $4,000. More than one in ten patients (11%) with commercial insurance and 9.3% of patients with Medicare Advantage had more than $2,000 in bills in the first six months after a COVID-19 hospitalization. For patients hospitalized for pneumonia, OOP spending exceeded $2,000 for 12.1% with commercial insurance and 17.2% with Medicare Advantage plans. Chua, et al., “Out-of-Pocket Spending for Health Care After COVID-19 Hospitalization,” American Journal of Managed Care, 3/16/2022

Insurers celebrate record profits in early 2022: The six largest commercial insurers pocketed a combined $11.2 billion in the first three months of this year. UnitedHealth Group was the most profitable, reporting $5 billion in profit in the first quarter of 2022, followed by CVS Health (Aetna) with $2.3 billion, Anthem at $1.8 billion, Cigna at $1.2 billion, and Humana at $930 million. Minemyer, “UnitedHealth was this quarter’s most profitable payer—again,” Fierce Healthcare News, 5/9/2022

Insurance CEOs pocket millions in compensation: CEOs at the six largest commercial insurers earned nearly $115 million in combined total compensation last year. The late Michael Neidorff, former CEO of Centene, topped the list with $20.6 million in total compensation for 2021; followed by Karen Lynch of CVS Health (Aetna) at $20.4 million; Gail Boudreaux of Anthem with $19.3 million; David Cordani of Cigna with $19.9 million; Andrew Witty of UnitedHealth Group with $18.4 million; and Bruce Broussard of Humana with $16.5 million. Minemyer, “Centene’s Michael Neidorff was the highest-paid payer CEO last year. Take a look at what other execs earned,” Fierce Healthcare News, 4/27/2022

Commercial insurers drive up federal health spending: In 2020, commercial insurers’ overhead totaled $301.4 billion, up from $236.6 billion in 2019. Commercial Medicare Advantage plans accounted for $63.4 billion of that total, up 41.2% from 2019. The overhead of commercial insurers who run Medicaid managed care plans was $55.5 billion, up 64.9% from 2019. Hartman et al., “National Health Care Spending In 2020: Growth Driven By Federal Spending In Response To The COVID-19 Pandemic,” Office of the Actuary, CMS, published in Health Affairs, 12/21/2021

Medicare Advantage (MA) spending drags down Medicare budget in pandemic: Due to the sharp drop in utilization, 2020 spending on Part A and B services for Traditional Medicare (TM) decreased 5.8% from 2019, the first time annual spending has declined in more than 20 years. However, total Medicare spending increased because the federal government increased payments to commercial MA plans by 6.9%, since MA payments were determined in mid-2019 and not adjusted to reflect lower utilization. Biniek et al., “Traditional Medicare Spending Fell Almost 6% in 2020 as Service Use Declined Early in the COVID-19 Pandemic,” Kaiser Family Foundation, 6/1/2022

Medicare watchdog slams inflated Medicare Advantage costs: In 2020, Medicare paid 4% more for beneficiaries enrolled in MA than it would have if those beneficiaries were in Traditional Medicare. Medicare overpaid MA insurers by $12 billion just from upcoding alone. According to MedPAC, “The MA program has been expected to reduce Medicare spending since its inception … but private plans in the aggregate have never produced savings for Medicare, due to policies governing payment rates to MA plans that the Commission has found to be deeply flawed.” The Commission also noted that, “These policy flaws diminish the integrity of the program and generate waste from beneficiary premiums and taxpayer funds.” “Report to the Congress: Medicare Payment Policy,” Medicare Payment Advisory Commission, 3/15/2022

Medicare Advantage plans use prior authorization (PA) to deny needed care: An HHS watchdog found that among commercial MA plans’ PA denials, 13% were for services that met Medicare coverage rules and that the denials likely prevented or delayed necessary care. They also found that 18% of the MA plans’ denied payment requests met Medicare coverage rules and MA billing rules, and were thus improperly denied. “Some Medicare Advantage Organization Denials of Prior Authorization Requests Raise Concerns About Beneficiary Access to Medically Necessary Care,” U.S. Dept. of Health and Human Services Office of the Inspector General, 4/28/2022

Nearly half of seniors don’t understand limitation of MA plans: In a new survey, more than one-third (35%) of Medicare Advantage (MA) enrollees mistakenly believe they don’t have to stay in-network for care, while another 11% weren’t sure, and only half (50%) of MA enrollees said they understood that they don’t have free choice of provider. Grunebaum, “8 in 10 Rate Understanding of Medicare Advantage Good or Very Good: Survey,” MedicareGuide.com, 5/08/2022

Rampant health disparities among Medicare Advantage enrollees: Black, Indigenous and Alaska Native patients experienced the most significant disparities in clinical care among Medicare Advantage enrollees in 2021. American Indian and Alaska Native enrollees ranked lowest among all demographic groups for breast cancer screenings, respiratory conditions, and diabetes care. Compared to all MA enrollees, Black enrollees were less likely to receive follow-up care after emergency department visits for mental and behavioral health events, and also faced the most adverse prescribing practices, with clinicians more likely to dispense medications with significant side effects to Black people. Martino et al., “Disparities in health care in Medicare Advantage by race, ethnicicty and sex,” CMS Office of Minority Health, April 2022

High rate of “ghost” physicians in privatized Medicaid: In a study of four states from 2015 to 2017, researchers found that Medicaid managed care (or MMC, run by commercial insurers) provider network directories overstate how many physicians actually offer care to Medicaid enrollees. They found that 16% of adult primary care physicians listed in MMC networks qualified as “ghost physicians,” meaning they did not file any Medicaid claims in a year, and almost a third of MMC outpatient primary care and specialist physicians saw less than 10 Medicaid patients a year. Psychiatry was the specialty most likely to include ghost physicians, with 35% of MMC-contracted psychiatrists not seeing any Medicaid patients. Among all MMC-contracted providers, 25% of primary care doctors delivered 86% of the care, while 25% of specialists on average provided 75% of the care. Ludomirsky et al., “In Medicaid Managed Care Networks, Care Is Highly Concentrated Among a Small Percentage of Physicians,” Health Affairs, May 2022

Surge in private equity (PE) in health care: Total PE investment in the health care industry has increased 20-fold, from $5 billion annually in 2000 to $100 billion in 2018. Annual PE acquisitions grew from 78 in 2000 to 855 in 2018. Appelbaum and Batt, “Private Equity Buyouts in Healthcare: Who Wins, Who Loses?” Institute for New Economic Thinking Working Paper Series, No. 118, May 2020

Private equity (PE) acquisition of hospitals leads to reduced staffing, higher profits: Between 2005 and 2014, hospitals acquired by PE firms saw a 1.78 percentage point increase in operating margins, along with a 2.79% decrease in bed count (about 4.43 beds). PE acquisition also reduced full-time equivalents (FTEs) staffing by 5.05%, an average loss of 36.97 FTE staff, with total nursing FTEs reduced by 4.38% or 10.52 FTE nurses. The ratio of outpatient to inpatient visits also decreased by 4.58%, indicating an increase in inpatient utilization likely due to more aggressive price negotiation for inpatient care with commercial insurers. Cerullo et al., “Financial Impacts And Operational Implications Of Private Equity Acquisition Of US Hospitals,” Health Affairs, April 2022

Higher nursing staff levels save lives: In a study of over 700,000 Medicare beneficiaries with sepsis, researchers found that an increase in registered nurse hours per patient day was associated with a 3% decrease in 60-day mortality, suggesting that hospitals that provide more RN hours of care could likely decrease sepsis deaths. Cimiotti et al., “Association of Registered Nurse Staffing With Mortality Risk of Medicare Beneficiaries Hospitalized With Sepsis,” JAMA Health Forum, 5/27/2022