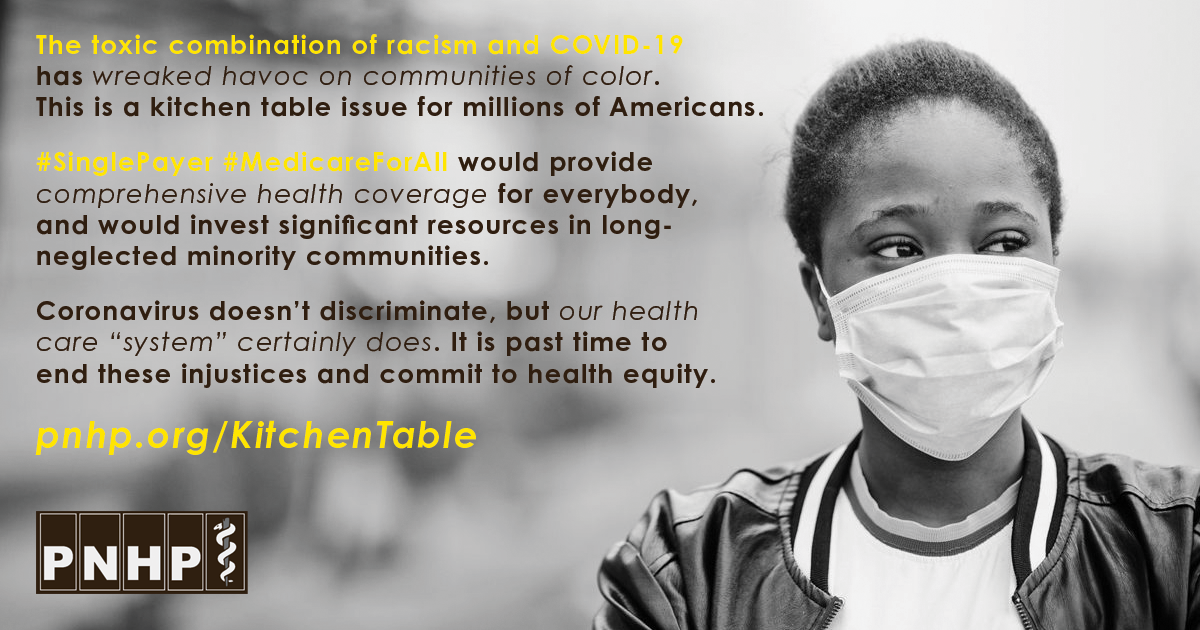

Physicians for a National Health Program is a powerful advocate for the reform that patients, doctors, and taxpayers so desperately need: single-payer Medicare for All. We invite you to join more than 20,000 physicians who are advocating for health care justice in the United States. Please join our fight by making a tax-deductible membership contribution today!

If you prefer to join via check, please mail your membership dues (payable to PNHP) to 29 E. Madison St., Ste. 1412, Chicago, IL 60602. PNHP is a 501(c)(3) nonprofit organization; our tax ID# is 04-2937697.

Annual physician membership: $250

Monthly sustaining membership: $25/mo

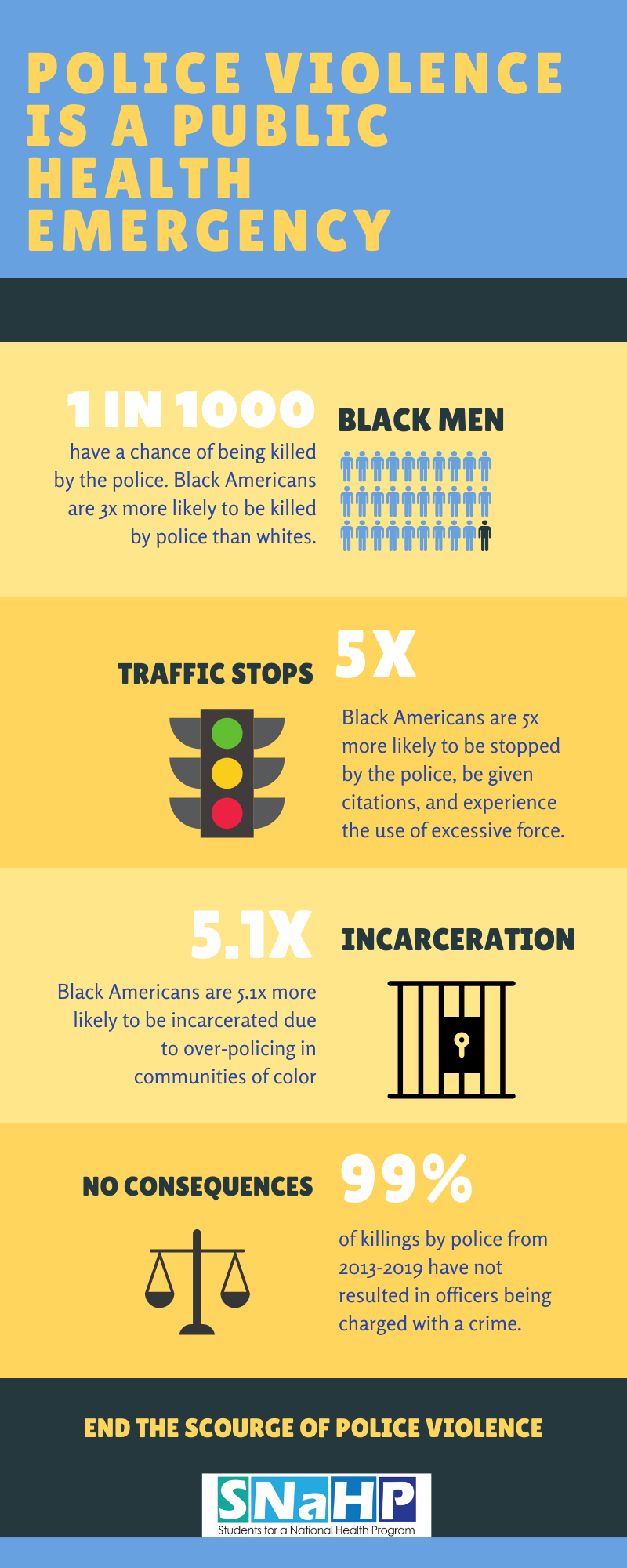

Medical and health professional students are making invaluable contributions to the single-payer movement. Membership in our student arm, Students for a National Health Program, is FREE. Please sign up today, and get connected to one of our many campus-based SNaHP chapters across the country.

Medical or health professional student membership: FREE

PNHP offers additional membership levels for early career physicians (1-3 years post-residency/fellowship), reduced-income physicians, residents and fellows, and health reform advocates inside and outside of the medical profession. Please choose the category that is right for you, and join PNHP with a tax-deductible membership contribution today!

Early career physician membership: $150

Reduced-income physician membership: $50

Resident/Fellow membership: $50

Health professional or ally membership: $50

Finally, please note that our membership levels above renew on an annual basis. If you are interested in joining PNHP or renewing with a monthly sustaining membership, please visit pnhp.org/monthlymembership.