However, just because you’re insured doesn’t mean you can still afford health care, experts say

By Jennifer Gerson Uffalussy

Yahoo Health, September 16, 2015

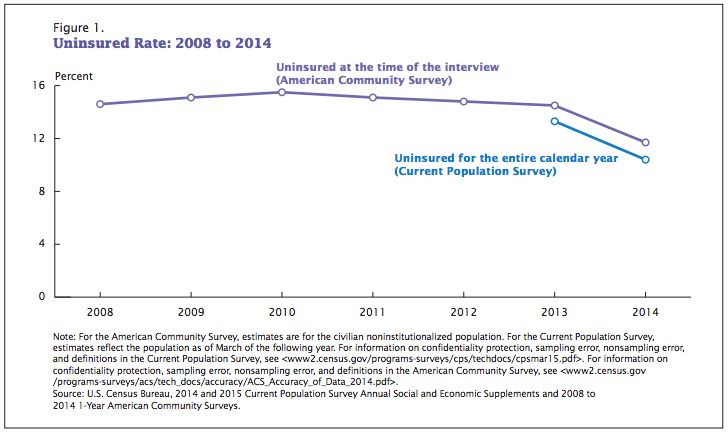

The latest census data released today (Sept. 16) shows that the percentage of people without health insurance was 10.4 percent lower than the number of uninsured in 2013.

While 41.8 million, or 13.3 percent of Americans, were without health insurance in 2013, that number dropped to 33 million — 10.4 percent of Americans — in 2014.

That’s 8.8 million more people who have health insurance coverage year over year.

Between 2008 and 2013, the uninsured rate was relatively stable — despite the passage of the Affordable Care Act in 2010. In 2014, thought, the uninsured rate sharply decreased, with the percentage of people with health insurance coverage in 2014 spiking to 89.6 percent.

(Image: U.S. Census Bureau)

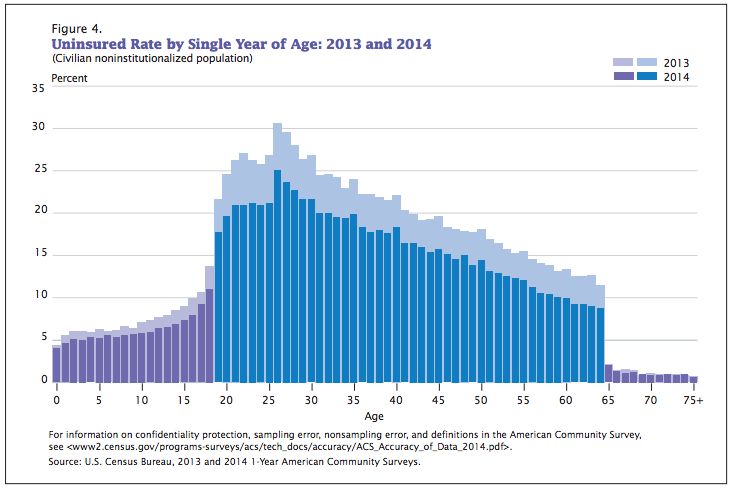

The 2014 numbers show that age is strongly associated with the likelihood that a person has health insurance. In 2014, 98.6 percent of adults aged 65 years or over had some type of health insurance during the year, compared with 93.8 percent of children under age 19 and 85.7 percent of working-age adults aged 19 to 64 years.

(Image: U.S. Census Bureau)

However, the Congressional Budget Office (CBO) predicts that at least 27 million Americans will be uninsured every year for the next 10 years. And the stakes are high: A study in the American Journal of Public Healthshowed in a given year, there are 1,000 deaths for every 1 million people related to the lack of insurance.

What the Census Bureau report neglects to mention is that for some people, just because they have insurance doesn’t mean they can afford to use it due to high deductibles and co-pays, says Robert Zarr, MD, MPH, president of Physicians for a National Health Program.

That’s a problem called underinsurance — when people have skimpy policies with high deductibles and copays that leaves them with high out-of-pocket expenses when paying for their health care.

“A recent study by the Commonwealth Fund shows that about 31 million people who have health insurance – nearly a quarter of all insured non-elderly adults – are underinsured, nearly double the rate in 2003,” Zarr says. “Of these, 44 percent went without a doctor’s visit, medical test, or prescription due to cost, while 51 percent had problems paying off medical bills or were paying off medical debt over time.”

Zarr notes that the average deductible for a family with a silver-level plan— the marketplace standard plan that offers, on average, 70 percent cost coverage for retail medical services — bought through the Healthcare.gov marketplace is estimated to be $6,010. And out-of-pocket costs for copayments and deductibles, after premium payments, for a family of four with an income of about $60,000 per year can be as high as $13,200.

https://www.yahoo.com/health/more-americans-insured-in-2014-data-shows-165337271.html