By Matt Bruenig

People’s Policy Project, December 11, 2020

Yesterday, the Congressional Budget Office (CBO) released an estimate of the cost of implementing a single-payer health insurance program in the United States. The CBO’s report is more exhaustive than any other recent study on the subject and concludes that replacing our current system with a single-payer system would insure every American while reducing overall health spending in the country.

Modeling the cost of a single-payer program is relatively straightforward. You begin with the status quo health care system and then make educated guesses about the following questions:

- How many more units of health care services will be demanded and supplied when price barriers are removed?

- How much more efficient will health insurance administration be after the enrollment and payment systems are radically simplified?

- How much money will be saved by reducing the payments rates for health care providers and drug companies?

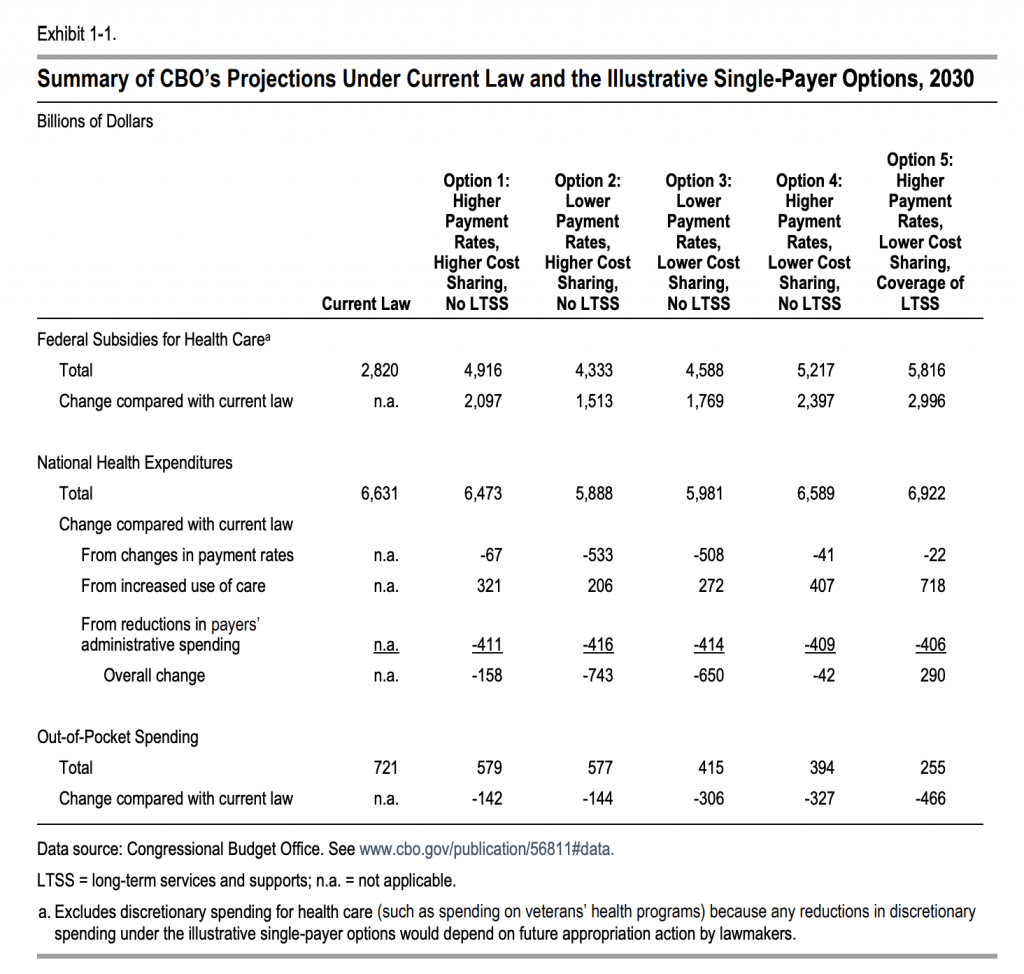

The CBO answered these questions for four different single-payer designs and found that a single-payer system would save $42 billion to $743 billion in 2030 alone.

Separately, the CBO took its most costly single-payer option — a program with high payment rates to providers and drug companies and low cost-sharing for individuals — and added long-term support and services (LTSS) to it to produce a fifth cost estimate. In that estimate, total spending rises by $290 billion.

The CBO option that most closely approximates current Medicare for All proposals is Option 3, which features low payment rates and low cost sharing. That option produces $650 billion of savings in 2030. Adding LTSS to that option, which also approximates what many current Medicare for All proposals does, looks like it would bring the savings down to around $300 billion.

More interesting than the CBO’s headline finding is the extremely detailed inquiry they do into each specific variable and the comparison of the results of their inquiry to the results of other similar studies.

The CBO option that most closely approximates current Medicare for All proposals is Option 3, which features low payment rates and low cost sharing. That option produces $650 billion of savings in 2030. Adding LTSS to that option, which also approximates what many current Medicare for All proposals does, looks like it would bring the savings down to around $300 billion.

More interesting than the CBO’s headline finding is the extremely detailed inquiry they do into each specific variable and the comparison of the results of their inquiry to the results of other similar studies.

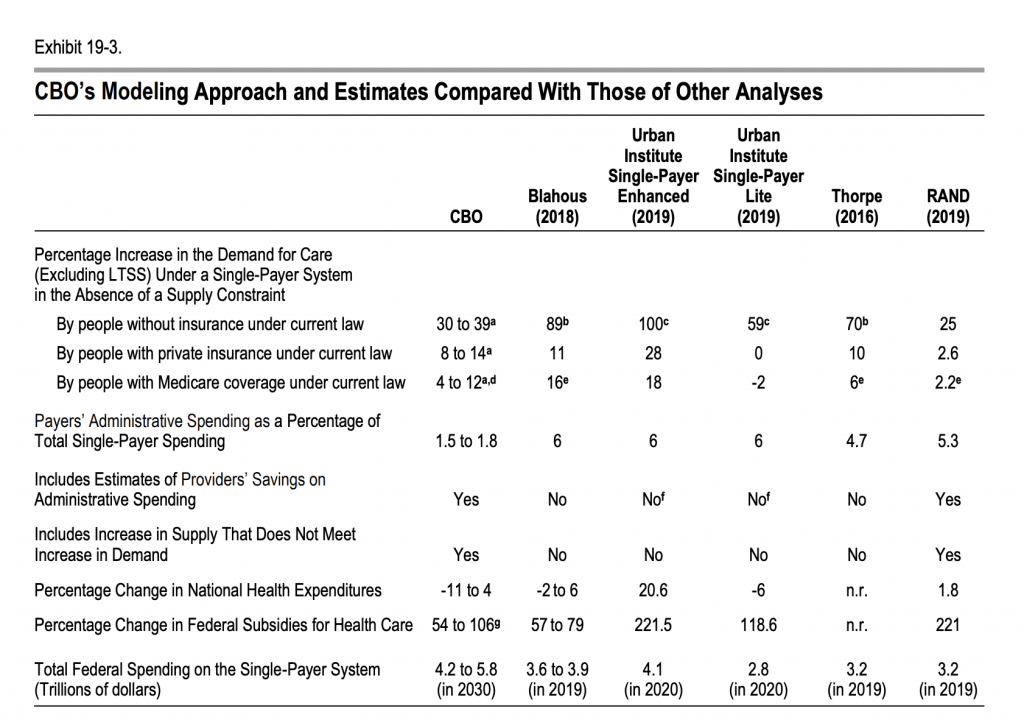

The thing that stands out the most to me in this comparison is CBO’s deep dive into administrative costs. Medicare for All advocates have historically pointed towards the 2 percent administrative costs of traditional Medicare as what we should expect in a Medicare for All system. Critics of this view have typically argued, among other things, that Medicare’s low administrative costs are a mirage driven by the fact that their per-enrollee administrative costs are being divided by disproportionately large per-enrollee health care utilization.

This rebuttal never really made any sense. Private Medicare Advantage plans have a similarly sick and elderly enrollment population, but manage to spend a whopping 13.7 percent of their revenue on administrative expenses. The CBO’s analysis, which starts with the current Medicare administrative costs and then determines how each element of those costs would go up or down in a single-payer system, seems to put this claim to bed once and for all.

Indeed, the CBO finds that the current Medicare administrative costs that are often touted by advocates are actually higher than the administrative costs you would expect in a single-payer system because a large share of those costs are tied up in tasks like eligibility determination and collection of Medicare Part B premiums that would no longer exist in a Medicare for All system.

Thus, the payer administrative costs we could expect under single-payer are not the 6 percent touted by Urban and Mercatus. They are not even the 2 percent of the traditional Medicare program. Rather, they are more like 1.5 to 1.8 percent. These other estimates are therefore missing hundreds of billions of dollars of savings per year on this item alone.

Overall, the study confirms what serious Medicare for All analysts have known for some time now. It is possible to provide high-quality public health insurance to every person in the country while also saving money overall on health spending. The barriers to the policy are not technical deficiencies or costs, but rather political opposition from Republicans and conservative Democrats who would rather spend more money to provide less health care.