S&P Healthcare Claims Index Monthly Report

S&P Dow Jones Indices, April 2016

The “S&P Healthcare Claims Index Monthly Report” provides the latest results for the S&P Healthcare Claims Indices – a comprehensive measure of the change in U.S. healthcare costs based on actual expenses paid by consumers through their commercial health plans – with the goal of providing the public and policymakers with credible, timely and independent data on the cost of healthcare in the U.S.

This Report summarizes data from the October 2015 indices – the latest to be published.

October 2015 In-brief

- National healthcare costs in the commercial market increased by 6.47% year/year

- Medical services costs increased by 4.24%

- Drug costs increased by 16.12%

- Brand-name drug costs increased by 19.31%

- Generic drug costs increased by 7.37%

- Medical services costs increased by 4.24%

- Individual market costs increased by 27.41% year/year

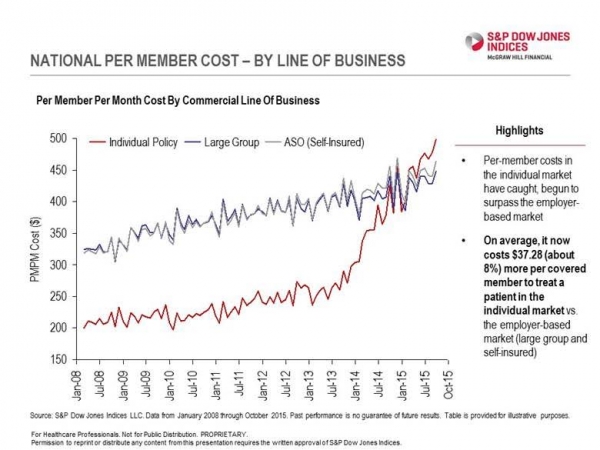

- Monthly costs per covered member (PMPM costs) in the individual market reached an average of $497.55 – about 8.1% more than the employer-provided market (large group and ASO/self-insured)

- Monthly costs per covered member in the individual market reached an average of $497.55 in October 2015 – $37.28 more on average than the $460.27 monthly cost of a covered member within the employer-provided healthcare market (large group and ASO/self-insured).

The graph below charts the PMPM (per member per month) cost by LOB (Lines of Business – individual; large group; and Administrative Services Only/self-insured). This graph demonstrates that PMPM healthcare costs in the individual market appear to have firmly caught up to per member costs in the employer-based market (large group and ASO/self-insured), a result widely anticipated with enactment of the Affordable Care Act (ACA). Whether individual market costs will begin tracking with the employer-based market, or instead continue their rise and diverge to a more costly plateau, is yet to be definitively seen. The next few months of data should be telling.

http://us.spindices.com/resource-center/index-policies/

***

Comment:

By Don McCanne, M.D.

The costs per enrollee in the individual health insurance plans are skyrocketing as a result of the enactment of the Affordable Care Act (ACA). This was expected since the plans could no longer reject individuals with preexisting conditions, and the required benefits are more comprehensive than they were previously.

ACA was designed to protect employer-sponsored plans – primarily large group insurance plans and self-insured (administrative services only) plans – which had been functioning well prior to reform. In order to keep premiums affordable, plans in the individual market frequently had skimpier benefits (excluding maternity benefits, mental health services, etc.), and excluded individuals with preexisting conditions. ACA, in correcting these deficiencies, brought costs in the risk pools for the individual plans up to the costs of the more comprehensive and inclusive employer-sponsored plans.

But look at what has happened. The cost trajectory for those covered in the individual plans shot upward and has now exceeded the cost for those in employer plans by 8 percent. This higher cost could be due to adverse selection – more people enrolling in the individual plans who already have health care needs, or because those declining to enroll are healthier individuals who would otherwise dilute the costs of the risk pools.

But there is one other possibility that may be an important factor why the costs in the individual market are higher. Enrolling individuals and families in plans selected from a marketplace requires greater administrative services than does wholesale enrollment of employees in a group plan (and much more administrative effort than with automatic, one-time, life-long enrollment in a program like Medicare).

Once the risk pools stabilize, it is likely that the curve for individual plans will parallel that of employer plans, but at a higher trajectory. Thus we will be spending more than that part of the market that was supposedly working well – the employer-sponsored plans. When our health care system is infamous for its profound administrative waste, we are adding even more waste through the provisions of ACA.

We can still fix this – with an improved Medicare for all.