Rep. Anthony Weiner on MSNBC

August 18, 2009

Anthony Weiner Leaves Scarborogh “Speechless”

Rep. Anthony Weiner on MSNBC

August 18, 2009

Concerns about reform efforts

NBC News Health Care Survey

Hart/McInturff

August 15-17, 2009

8. Thinking about efforts to reform the health care system, which would concern you more?

41% – Not doing enough to make the health care system better than it is now by lowering costs and covering the uninsured.

54% – Going too far and making the health care system worse than it is now in terms of quality of care and choice of doctor.

5% – Not sure

http://msnbcmedia.msn.com/i/MSNBC/Sections/NEWS/NBC-WSJ_Poll.pdf

A PhD thesis could be written over just what this survey tells us, but we’re certainly not going to do that here.

Give this some thought. Think about what this might mean. Then think about what we should be doing in response. And then do it!

Concerns about reform efforts

NBC News Health Care Survey

Hart/McInturff

August 15-17, 2009

8. Thinking about efforts to reform the health care system, which would concern you more?

41% – Not doing enough to make the health care system better than it is now by lowering costs and covering the uninsured.

54% – Going too far and making the health care system worse than it is now in terms of quality of care and choice of doctor.

5% – Not sure

http://msnbcmedia.msn.com/i/MSNBC/Sections/NEWS/NBC-WSJ_Poll.pdf

Comment:

By Don McCanne, MD

A PhD thesis could be written over just what this survey tells us, but we’re certainly not going to do that here.

Give this some thought. Think about what this might mean. Then think about what we should be doing in response. And then do it!

New Harvard study reveals that taxing job-based health benefits would hit working families hardest

Income and insurance data show that insured, working-poor families would be taxed 140 times more than Wall Street execs

FOR IMMEDIATE RELEASE

August 20, 2009

Contacts:

David Himmelstein, M.D.

Steffie Woolhandler, M.D., M.P.H.

Mark Almberg, Physicians for a National Health Program, (312) 782-6006, mark@pnhp.org

CAMBRIDGE, Mass. – As the debate over health care reform continues to unfold in town hall meetings and on Capitol Hill, a new study by two Harvard researchers has found that taxing job-based health benefits would heavily penalize insured, working families.

The study, titled “The regressivity of taxing employer-paid health insurance,” appears in the August 19 online edition of the New England Journal of Medicine. It was written by Drs. David Himmelstein and Steffie Woolhandler, professors at Harvard Medical School and primary care doctors at Cambridge Hospital in Massachusetts.

The taxation of employer-sponsored health benefits has been advocated by many health economists and lawmakers, including some members of the influential Senate Finance Committee, which is now drafting health care reform legislation. President Obama has said he has not ruled out such a tax to fund his reforms.

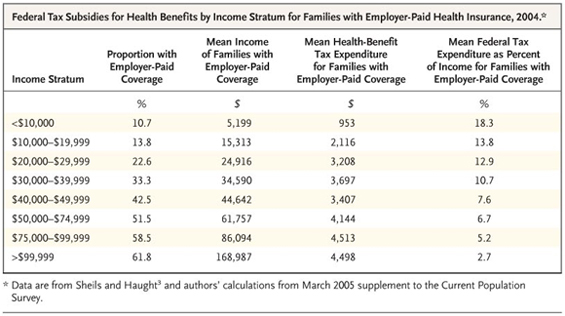

Analyzing income and insurance data from the 2005 Current Population Survey of the U.S. Census Bureau and other sources, the authors reveal that taxing workers’ job-based health insurance would cost those with low-incomes ($0- $10,000 annually) 18.3 percent of their income, but cost high-income (over $100,000) families a mere 2.7 percent. (See the table from the study at http://healthcarereform.nejm.org/?p=1521)

The authors note that the tax rate would drop even lower for the super-rich. “A Goldman Sachs executive who enjoyed the firm’s infamous $40,543 health plan got a federal tax subsidy of about $15,367 last year,” they write. “But that’s only 0.13 percent of the bonuses received by the company’s four top earners. So though taxing health benefits would spare the uninsured, the average poor family with employer-paid coverage would be taxed at a rate 140 times higher than Wall Street titans.”

Dr. David U. Himmelstein, lead author of the study and associate professor of medicine at Harvard, added: “Most economists and many politicians have claimed that taxing health benefits would hit the wealthy hardest, while sparing the poor. But exactly the reverse is true. For a poor, insured family a tax on their health benefits would take almost one-fifth of their total income.”

Dr. Steffie Woolhandler, co-author and professor of medicine at Harvard, said: “Instead of taxing benefits, politicians should embrace the only affordable option for universal coverage: a single-payer, Medicare-for-all program. Single-payer would save $400 billion annually by simplifying administration, enough to assure quality care for everyone. We cannot afford to keep wasteful private health insurers in business, and pay for it off the backs of working families.”

Himmelstein and Woolhandler are co-founders of Physicians for a National Health Program, an organization of 16,000 doctors and medical professionals who advocate for single-payer national health insurance.

*******

A copy of the study is available from the New England Journal website at http://healthcarereform.nejm.org/?p=1521

“The Regressivity of Taxing Employer-Paid Health Insurance,” David U. Himmelstein, M.D; Steffie Woolhandler, M.D., M.P.H. New England Journal of Medicine, August 19, 2009.

Drs. Himmelstein and Woolhandler are available for comment on their new study and on other aspects of the health care reform debate. To contact other physician-spokespersons from Physicians for a National Health Program in your area, visit www.pnhp.org/stateactions or call (312) 782-6006.

"Pre-Existing Condition" by Jim Morin

http://www.miamiherald.com/opinion/jim-morin/

“Pre-Existing Condition” by Jim Morin

http://www.miamiherald.com/opinion/jim-morin/

Policies to address out-of-network charges

Code Blue: Out-of-Network Charges Can Spur Financial Emergency

By Paul Raeburn

Kaiser Health News

August 19, 2009

On the evening of March 1, 2008, Gary Diego was relaxing with his wife, Ellen, when she abruptly lost her hearing, began repeating herself, and seemed to be losing her grip.

Alarmed, Diego rushed her to his insurance company’s in-network hospital, near his home in Truckee, Calif. Unable to handle what was determined to be bleeding in the brain, the hospital quickly transferred her to Renown Regional Medical Center in Reno, Nev., where she spent 17 days in intensive care. While recovering, she caught pneumonia and died.

A few weeks later, a still-grieving Diego learned from his insurer, Health Net, that he owed the Reno hospital $75,462.77. The reason? The hospital was not in his approved network.

(Later Mr. Diego paid a medical billing consultant $7,500 to negotiate a settlement.)

http://www.kaiserhealthnews.org/Stories/2009/August/19/out-of-network.aspx

And…

Tackling the Mystery of How Much It Costs

By Gina Kolata

The New York Times

August 18, 2009

But the health care legislation under discussion does not directly address the out-of-network fee issue. And that is intentional, says Dr. Mark McClellan of the Brookings Institution. Dr. McClellan, a former head of Medicare who works closely with policy makers, says the goal of the House and Senate bills is to encourage people to stay in their networks. He added that the result should be networks that provide better care “so that people don’t have so much need to go outside of them.”

Mark A. Hall, a professor of law and public health at Wake Forest University, for example, advocates restricting out-of-network fees to a fixed amount, perhaps 150 percent of the amount Medicare would pay.

That is how the system works in Germany, says Uwe Reinhardt, a health economist at Princeton University. Professor Reinhardt advocates a national law that caps the maximum doctors can charge when they are out of a patient’s network.

America’s Health Insurance Plans, which represents health insurers, is also trying to draw attention to out-of-network doctors’ fees. Last Tuesday, the group released results of its own survey to show how high such fees can go.

Jonathan Gruber, a health economist at M.I.T., says, however, that it makes more sense to encourage people to stay in networks.

Some may want to pay anyway for an out-of-network doctor, and that is fine, he said. “If you want to go outside your network, God bless you,” he said. “It’s the American way.”

But the only way to fix the system, Dr. Gruber said, is to make the networks better so that people will stay in them and then, most patients, knowing what it will cost them to leave their networks, will decide not to.

http://www.nytimes.com/2009/08/19/health/policy/19fees.html

qotd on AHIP’s report referenced above:

https://pnhp.org/news/2009/august/ahip_explains_why_pr.php

What are private insurers selling us? Their primary product is a network of health care providers that have contracted to accept the insurers’ rates. The benefit of that is that it has helped to slow the rate of increase in health insurance premiums. One major problem with that is individuals frequently obtain care from out-of-network providers – usually not by choice, but by medical circumstances not really under the control of the patient. Under most insurance plans, the individual then becomes responsible for payment of most or all of the out-of-network charges.

With higher premiums, larger deductibles, greater coinsurance, more benefit exclusions, patients are already facing financial hardship without the addition of the out-of-network charges. These unanticipated charges are contributing to our growing epidemic of underinsurance. What to do?

Mark McClellan (think of Medicare privatization) and Jonathan Gruber (think of Massachusetts’ flawed policy of getting more people covered and then pretending that we can figure out later on how to make it work) both believe the answer is to penalize individuals who obtain out-of-network care in an effort to establish incentives for insurers to create perfect networks so that out-of-network care will never have to happen. Of course, “it’s the American way” to choose care outside of your network, and “God bless you” when you can’t pay your bills.

It’s also the American way for Mr. Diego to receive a $75,000 out-of-network bill for his wife’s life-threatening and life-ending care. Haven’t we had enough of our uniquely American system?

There is another way of protecting patients from out-of-network charges. The government can require that out-of-network fees be close to insurer-authorized payments within networks. Yes, that would be the imposition of government fee controls, but fees that are designed to match fees already imposed by the private insurer bureaucracies. That would help, but it does bring up an important question. If the government is going to impose fee controls anyway, then why should we continue to pay the costs of the outrageous administrative waste of the private insurers?

Some might say that they do provide us with the function of pooling risk. But one of the goals of reform is to pool risk across insurers, relieving them of the burden of bearing risk. If we achieve risk equalization then it would be much more efficient and equitable to establish a single universal risk pool administered by the government. Again, the private insurers would be superfluous.

How much risk are the insurers exposed to now under our current system? Half of employer-sponsored benefits are already self-insured. The employer pays the benefits with absolutely no risk exposure to the insurers. So what do the insurers provide the employer? Claims processing for one. But the other service should really give us pause. The private insurers rent their network provider lists to the self-insured employers. How many physicians do you think might be offended if they knew that rent was being paid for use of contracts they signed with the insurers that require the physicians to provide a large discount, and that rent is not going to the physicians but is being kept by the private insurers!?

Tell Congress and the President that we’ve had it with private insurers! Urge them to support the single-payer amendment to the House bill by Rep. Anthony Weiner which Speaker Pelosi has promised will receive an up or down vote on the House floor this year.

Use the following link to access resources on the Weiner amendment:

https://pnhp.org/amendment/

Policies to address out-of-network charges

Code Blue: Out-of-Network Charges Can Spur Financial Emergency

By Paul Raeburn

Kaiser Health News

August 19, 2009

On the evening of March 1, 2008, Gary Diego was relaxing with his wife, Ellen, when she abruptly lost her hearing, began repeating herself, and seemed to be losing her grip.

Alarmed, Diego rushed her to his insurance company’s in-network hospital, near his home in Truckee, Calif. Unable to handle what was determined to be bleeding in the brain, the hospital quickly transferred her to Renown Regional Medical Center in Reno, Nev., where she spent 17 days in intensive care. While recovering, she caught pneumonia and died.

A few weeks later, a still-grieving Diego learned from his insurer, Health Net, that he owed the Reno hospital $75,462.77. The reason? The hospital was not in his approved network.

(Later Mr. Diego paid a medical billing consultant $7,500 to negotiate a settlement.)

http://www.kaiserhealthnews.org/Stories/2009/August/19/out-of-network.aspx

And…

Tackling the Mystery of How Much It Costs

By Gina Kolata

The New York Times

August 18, 2009

But the health care legislation under discussion does not directly address the out-of-network fee issue. And that is intentional, says Dr. Mark McClellan of the Brookings Institution. Dr. McClellan, a former head of Medicare who works closely with policy makers, says the goal of the House and Senate bills is to encourage people to stay in their networks. He added that the result should be networks that provide better care “so that people don’t have so much need to go outside of them.”

Mark A. Hall, a professor of law and public health at Wake Forest University, for example, advocates restricting out-of-network fees to a fixed amount, perhaps 150 percent of the amount Medicare would pay.

That is how the system works in Germany, says Uwe Reinhardt, a health economist at Princeton University. Professor Reinhardt advocates a national law that caps the maximum doctors can charge when they are out of a patient’s network.

America’s Health Insurance Plans, which represents health insurers, is also trying to draw attention to out-of-network doctors’ fees. Last Tuesday, the group released results of its own survey to show how high such fees can go.

Jonathan Gruber, a health economist at M.I.T., says, however, that it makes more sense to encourage people to stay in networks.

Some may want to pay anyway for an out-of-network doctor, and that is fine, he said. “If you want to go outside your network, God bless you,” he said. “It’s the American way.”

But the only way to fix the system, Dr. Gruber said, is to make the networks better so that people will stay in them and then, most patients, knowing what it will cost them to leave their networks, will decide not to.

http://www.nytimes.com/2009/08/19/health/policy/19fees.html

qotd on AHIP’s report referenced above:

https://pnhp.org/news/2009/august/ahip_explains_why_pr.php

Comment:

By Don McCanne, MD

What are private insurers selling us? Their primary product is a network of health care providers that have contracted to accept the insurers’ rates. The benefit of that is that it has helped to slow the rate of increase in health insurance premiums. One major problem with that is individuals frequently obtain care from out-of-network providers – usually not by choice, but by medical circumstances not really under the control of the patient. Under most insurance plans, the individual then becomes responsible for payment of most or all of the out-of-network charges.

With higher premiums, larger deductibles, greater coinsurance, more benefit exclusions, patients are already facing financial hardship without the addition of the out-of-network charges. These unanticipated charges are contributing to our growing epidemic of underinsurance. What to do?

Mark McClellan (think of Medicare privatization) and Jonathan Gruber (think of Massachusetts’ flawed policy of getting more people covered and then pretending that we can figure out later on how to make it work) both believe the answer is to penalize individuals who obtain out-of-network care in an effort to establish incentives for insurers to create perfect networks so that out-of-network care will never have to happen. Of course, “it’s the American way” to choose care outside of your network, and “God bless you” when you can’t pay your bills.

It’s also the American way for Mr. Diego to receive a $75,000 out-of-network bill for his wife’s life-threatening and life-ending care. Haven’t we had enough of our uniquely American system?

There is another way of protecting patients from out-of-network charges. The government can require that out-of-network fees be close to insurer-authorized payments within networks. Yes, that would be the imposition of government fee controls, but fees that are designed to match fees already imposed by the private insurer bureaucracies. That would help, but it does bring up an important question. If the government is going to impose fee controls anyway, then why should we continue to pay the costs of the outrageous administrative waste of the private insurers?

Some might say that they do provide us with the function of pooling risk. But one of the goals of reform is to pool risk across insurers, relieving them of the burden of bearing risk. If we achieve risk equalization then it would be much more efficient and equitable to establish a single universal risk pool administered by the government. Again, the private insurers would be superfluous.

How much risk are the insurers exposed to now under our current system? Half of employer-sponsored benefits are already self-insured. The employer pays the benefits with absolutely no risk exposure to the insurers. So what do the insurers provide the employer? Claims processing for one. But the other service should really give us pause. The private insurers rent their network provider lists to the self-insured employers. How many physicians do you think might be offended if they knew that rent was being paid for use of contracts they signed with the insurers that require the physicians to provide a large discount, and that rent is not going to the physicians but is being kept by the private insurers!?

Tell Congress and the President that we’ve had it with private insurers! Urge them to support the single-payer amendment to the House bill by Rep. Anthony Weiner which Speaker Pelosi has promised will receive an up or down vote on the House floor this year.

Use the following link to access resources on the Weiner amendment:

https://pnhp.org/amendment/

Physician-patient relationship should be sacrosanct

By Syed Quadri

Guest columnist

The News Enterprise (Elizabethtown, Ky.)

I have watched with interest the debate over health care reform unfold in the columns of your newspaper and the rest of media. The airways and the pages of every newspaper in the country are saturated with several buzzwords. “Rationing,” “socialized medicine,” “federal bureaucracy,” and “government takeover of health care” are the names that appear to be driving the discussion and creating the frame of reference for the “debate.”

Allow me to share with your readers my experience with the health care system relative to one concern, of increased federal bureaucratic interference, that has been expounded by the opponents of President Barack Obama’s plan to reform the health care system.

I am a general internist and have been practicing internal medicine in Hardin County for the past 11 years. As an internist I specialize in treating medical conditions of adults and especially the elderly. About 50 percent of my patients are covered by Medicare, and the rest have private insurance, Medicaid or self-pay. I am sure everybody is aware that Medicare is a government program operated by the federal bureaucratic agency of the centers of Medicare and Medicaid services.

I have had approximately 30,000 clinical encounters involving patients with Medicare insurance, and the decisions made during these medical visits were never, not even on a single occasion, questioned or rejected by federal bureaucrats. Never has the shadow of a federal bureaucrat even remotely intruded on the intimate space of the physician-patient engagement. I have the full freedom and Medicare patients have the full freedom and broad choice to avail of all reasonable medical tests and pursue necessary treatment without seeking anybody’s permission.

In contrast, the clinical encounters involving patients with private insurance are different. Many of the clinical decisions that result from that encounter are scrutinized, some are rejected by the insurance company, many are grudgingly accepted but only after considerable effort and time has been expended in explaining and convincing the corporate lackeys the merits of doing a test or prescribing a treatment.

When I decide to order an MRI scan of the knee for a Medicare beneficiary to explore for a cartilage tear, my office staff simply schedules the test. On the the other hand, in that same situation, every private insurance company requires that permission be obtained for the test to be done. A corporate bureaucrat can deny the test a doctor has deemed necessary.

It takes me two minutes to admit a Medicare beneficiary to the hospital from my office and up to two hours to admit a patient with private insurance with that amount of time required to obtain permission from the insurance company’s clerk. Once the patient is admitted to the hospital the continued need for hospitalization will be determined not by the doctor but by corporate bureaucrats.

The core principle of medicine is that the physician-patient relationship is sacrosanct and no other agency or entity should attempt to intrude into this special ground or endeavor to influence, alter or abridge the decision that a patient and physician arrive at after an informed discussion. Among insurances only Medicare, an entity managed by federal bureaucrats, honors and abides by this principle, while the denizens of blue-blooded corporate America in their various insurance incarnations with no regard to medical ethics or any ethics trample upon this ideal every day.

The public should rightly be incensed at any effort by a third party to intrude into the privileged realm of a medical transaction or hinder the ability of the physician to freely exercise his professional judgment, but the outrage would be misdirected if it is aimed at the federal bureaucracy. Contrary to popular belief it is not government bureaucrats who seek to restrict the freedom of the patients and physicians alike but it is their counterparts in the private health insurance sector who relentlessly seek to modify, abbreviate and at times nullify a physician’s considered opinion that was formulated in the best interest of his patient.

Surprisingly the shenanigans of the private health insurance bureaucracy have escaped the public’s attention while the phantoms of federal bureaucratic interference have captured the popular imagination. I hope that public opinion will be infused by the bright light of facts and not be inflamed by the passionate heat of irrational emotions in discussing this important issue of health care reform.

Syed Quadri MD, FACP, has practiced internal medicine in Hardin County for 11 years.

Nonprofit nursing homes provide better care, major study finds

For-profit homes faulted for lower staffing, higher rate of bedsores

FOR IMMEDIATE RELEASE

Aug. 19, 2009

Contact:

Gordon Guyatt, M.D., (905) 525-9140

P.J. Devereaux, M.D., (905) 525-9140

Mark Almberg, Physicians for a National Health Program, (312) 782-6006, mark@pnhp.org

A major new statistical review of 82 individual research studies has revealed that nonprofit nursing homes deliver, on average, higher quality care than for-profit nursing homes. The findings could have a bearing on the present debate about the role of for-profit firms in U.S. health reform.

“The results are unequivocal and completely consistent with other studies comparing for-profit versus nonprofit care,” said Dr. Gordon Guyatt, senior author of the study, professor of medicine at McMaster University in Hamilton, Canada, and a world leader in “evidence-based medicine,” a term he coined. The study was published in the online edition of the British Medical Journal earlier this month.

The authors’ systematic review compared quality-of-care measurements in 82 individual studies that collected data from 1965 to 2003 involving tens of thousands of nursing homes, mostly in the United States.

In 40 of the 82 studies, all statistically significant comparisons favored nonprofit facilities. In three studies, all significant comparisons favored for-profit facilities. The remaining studies had less consistent findings.

The authors’ meta-analysis, i.e. their integration and statistical analysis of the data from the multiple studies, shows that nonprofit facilities delivered higher quality care than for-profit facilities for two of the four most frequently reported quality measures: (1) more or higher quality staffing and (2) less prevalence of pressure ulcers, sometimes called bedsores.

The results also suggest better performance of nonprofit homes in two other quality measures: less frequent use of physical restraints and fewer noted deficiencies (quality violations) in governmental regulatory assessments.

“The reason patients’ quality of care is inferior in for-profit nursing homes is that administrators must spend 10 percent to 15 percent of revenues satisfying shareholders and paying taxes,” said Guyatt. “For-profit providers cut corners to ensure shareholders achieve their expected return on investment.”

About 1.5 million people reside in nearly 16,000 nursing homes in the United States, and more than 3 million Americans will spend at least some time in a nursing home this year, according to the U.S. Centers for Medicare and Medicaid Services. About two-thirds of U.S. nursing home residents live in for-profit facilities.

The findings have significant patient-care implications. For example, the study suggests that of the estimated 80,000 U.S. nursing home residents who presently have bedsores, 7,000 of these cases are attributable to for-profit ownership. Similarly, the results suggest U.S. residents would receive about 500,000 more hours of nursing care per day if nonprofit institutions replaced for-profit nursing homes.

While most of the data in the studies are from U.S. nursing homes, data from Canada and Taiwan were also reviewed. Results were consistent over time.

The authors note that the results are entirely consistent with other studies. Systematic reviews of the evidence have previously shown higher death rates in for-profit versus nonprofit hospitals, and in for-profit versus nonprofit dialysis facilities. Such reviews have also shown higher costs in for-profit hospitals. Studies of outpatient care have shown higher quality of care in not-for-profit settings.

“Our results should raise serious concerns about for-profit care, whether in nursing homes, hospitals, surgi-centers, or other outpatient facilities,” Guyatt said. “It is time to base health care policy on evidence, not ideology.”

“Quality of care in for-profit and not-for-profit nursing homes: systematic review and meta-analysis,” Vikram R Comondore, P J Devereaux, Qi Zhou, Samuel B Stone, Jason W Busse, Nikila C Ravindran, Karen E Burns, Ted Haines, Bernadette Stringer, Deborah J Cook, Stephen D Walter, Terrence Sullivan, Otavio Berwanger, Mohit Bhandari, Sarfaraz Banglawala, John N Lavis, Brad Petrisor, Holger Schünemann, Katie Walsh, Neera Bhatnagar, and Gordon H Guyatt. BMJ 2009;339:b2732, doi: 10.1136/bmj.b2732, Aug. 4, 2009.

A copy of the study can be found here: www.pnhp.org/nursing_home

Physicians for a National Health Program (www.pnhp.org) is an organization of 17,000 physicians and medical professionals who advocate for nonprofit, single-payer national health insurance. For comment on this article and related issues, please contact PNHP by calling (312) 782-6006.

Dr. Paul Song on Larry King

Larry King

CNN

August 18, 2009