This document has been removed from public access for one of the following reasons:

- Privacy concerns

- Outdated content

- Incorrect content

- No longer available

If you require information from this document, please contact us to request access.

This document has been removed from public access for one of the following reasons:

If you require information from this document, please contact us to request access.

PNHP co-founders Drs. Steffie Woolhandler and David Himmelstein developed a pair of slide sets (compact and large) on health policy issues relevant to single-payer reform (dated April 6, 2023).

[ Click HERE for an alternate visual presentation of the large slide set, developed by PNHP board secretary Dr. Ed Weisbart ]

Drs. Himmelstein and Woolhandler published these slides in their roles as Research Associates at Public Citizen’s Health Research Group; PDF and PowerPoint versions are available on the Public Citizen website.

Summary: Yesterday the Supreme Court reversed 50 years of abortion rights established by Roe v. Wade. This attack on reproductive rights and health is an integral part of a broader half-century undermining of our democratic system. The fights to save democracy and provide universal healthcare are linked.

Letters from an American, June 24, 2022, by Heather Cox Richardson

At yesterday’s hearing of the House Select Committee to Investigate the January 6th Attack on the U.S. Capitol, we heard overwhelming proof that former president Trump and his congressional supporters tried to overturn the will of the voters in the 2020 presidential election and steal control of our country to keep a minority in power.

Today, thanks to three justices nominated by Trump, the Supreme Court stripped a constitutional right from the American people, a right we have enjoyed for almost 50 years, a right that is considered a fundamental human right in most liberal democracies, and a right they indicated they would protect because it was settled law. Today’s Dobbs v. Jackson Women’s Health Organization decision overturned the 1973 Roe v. Wade decision that recognized a woman’s right to terminate a pregnancy. For the first time in our history, rather than conveying rights, the court has explicitly taken a constitutional right away from the American people.

These two extraordinary events are related. The current-day Republican Party has abandoned the idea of a democracy in which a majority of the people elect their government. Instead, its members have embraced minority rule.

The Dobbs decision marks the end of an era: the period in American history stretching from 1933 to 1981, the era in which the U.S. government worked to promote democracy. It tried to level the economic playing field between the rich and the poor by regulating business and working conditions. It provided a basic social safety net through programs like Social Security and Medicare …

Now the Republicans are engaged in the process of dismantling that government. …

[The Dobbs decision argued] that the right to determine abortion rights must be returned “to the people’s elected representatives” at the state level, even as states are restricting the right to vote. …

We are still waiting on another potentially explosive decision in West Virginia v. Environmental Protection Agency, in which the court will decide if Congress can delegate authority to government agencies as it has done since the 1930s. If the court says Congress can’t delegate authority, even if it waters that argument down, government regulation could become virtually impossible.

By Jim Kahn, M.D., M.P.H.

Make no mistake about it, yesterday’s Supreme Court decision to reverse Roe v. Wade, clearly an attack on reproductive health and women’s rights, is also integral to a broader attack on democracy. It is latest development in a decades-long concerted effort to deconstruct the federal assertion and protection of rights that started in earnest with FDR 90 years ago, and to exploit our biased electoral system to empower a minority to implement that agenda. The latest twist, we are reminded in the January 6 Congressional hearings, is that the GOP is willing to use big lies and subversion of basic democratic processes to complete their slow coup. Heather Cox Richardson, as usual, sees all the connections. I encourage you to read her full post.

Single payer is profoundly pro-democratic, as I’ve repeatedly written in HJM. It is universal, equitable, economically leveling, and guided by representatives of the people not of corporate shareholders. Thus, the fight for universal healthcare and for real democracy have linked core values. I believe that mending our health care financing will help mend our fractured democracy. But are these two goals linked strategically? Does the fight for single payer bolster efforts to preserve democracy? Does preserving democracy tactically advance the single payer cause? My intuition says yes, but I don’t yet understand the integrated battle plan. I’ll revert on that.

I’ll close with a reminder that this is not just about governance and human rights, it’s also about life and death. Ample research demonstrates that restricting access to abortion raises maternal and even infant mortality. The new decision and subsequent state actions to restrict or ban abortion will cause many hundreds of added deaths per year. The evidence can be seen here, here, here, here, and here.

http://healthjusticemonitor.org…

Stay informed! Subscribe to the McCanne Health Justice Monitor to receive regular policy updates via email, and be sure to follow them on Twitter @HealthJustMon.

Summary: CMS promised that the Medicare REACH ACO program, which supplants Direct Contracting Entities as a capitated replacement of fee-for-service Medicare, would prevent using diagnostic upcoding to drive up payment rates as seen with Medicare Advantage. However, scrutiny of recent guidance to contractors, combined with past CMS regulatory failures, suggest extreme skepticism.

CMS REACH ACO Financial FAQs, Dated April 2022; Downloaded June 2022

Q: What is the purpose of the Coding Intensity Factor (CIF) and the ACO-level symmetric 3% cap in risk adjustment?

By Jim Kahn, M.D., M.P.H.

What does this technical mumbo-jumbo mean? Well, CMS and MedPAC acknowledge that the Medicare Advantage program has been plagued by rampant diagnostic upcoding, as compared with traditional Medicare, and inadequate corrective action is leading to hundreds of billions in overpayments to private MA insurers.

So, for the REACH ACO program (rebranded DCEs) CMS promised to hold the diagnostic risk score to a reference year, presumably at the start of the program. No upcoding, they said.

Then come the details. The devil is always in the details.

The first bullet is tricky. What’s key to understand is that “normalized” means counting only the coding growth that exceeds traditional Medicare coding growth. So, it’s not zero coding growth, it’s zero compared with some reference growth rate. But how will that growth rate be calculated? When assessing Medicare Advantage over-coding, the reference comparison was clear – traditional Medicare. Yet REACH ACOs are displacing traditional Medicare. So is the reference the remaining un-REACHed corners of traditional Medicare? Or all of traditional Medicare, including the REACH parts, which leads to a self-referential paradox?

The second bullet says that each ACO will be permitted an annual growth of 3% in risk score, compared with the prior year. That’s huge. Is it 3% absolute, or 3% above “normalized” growth? Critically, the promised static “reference year” kicks in only in 2024, just two years before the program ends. And, if the program changes before 2026, it won’t even happen. Oops, the actual implementation drops the reference year promise. Just like that, poof, gone!

If you’re confused, you’re not alone. I certainly am. The language used obscures as much as it clarifies.

What we’ve seen with Medicare Advantage is that even with crystal clear rules, the insurers influence Congress and CMS to inadequately adjust for known MA over-coding. This failure shifts billions from the government and beneficiaries to insurance stockholders.

Two additional issues:

Note that there’s a separate “demographic” adjuster – another opportunity to increase payments and profits.

And, as we’ve noted before, with the tempting prospect of keeping 100% of the first 25% in savings, REACH ACOs will work hard to suppress utilization, via care denials, “lemon dropping”, and other techniques.

Gilfillin and Berwick recently re-iterated concerns that the corporate nature of REACH ACOs will exacerbate profiteering gaming. These worrisome risk adjustment details compound that fear.

I predict that if REACH continues, within 3-5 years we will see in technicolor how these complex and squishy rules provided the opportunity for ACO contractors to increase payment rates, decrease outlays, and generally fleece the government and Medicare beneficiaries of hundreds of billions of dollars. One could call it, I suppose, my “Exploitation Expectation”.

It’s imperative that REACH is stopped; inserting corporations into traditional Medicare is a travesty.

http://healthjusticemonitor.org…

Stay informed! Subscribe to the McCanne Health Justice Monitor to receive regular policy updates via email, and be sure to follow them on Twitter @HealthJustMon.

Summary: Health savings accounts (HSAs) paired with deductibles are regressive: they yield financial gains mostly for healthy individuals with high income. They are justified as reducing health care costs, but these benefits are minimal. Now that large deductibles are widespread, any pretense of HSA cost-control is gone. When will we end this tax break for the rich?

Health Savings Accounts No Longer Promote Consumer Cost-Consciousness, Health Affairs, June 2022, by Sherry A. Glied, Dahlia K. Remler, and Mikaela Springsteen

Two decades ago Congress enabled Americans to open tax-favored health savings accounts (HSAs) in conjunction with qualifying high-deductible health plans (HDHPs). This HSA tax break is regressive: Higher-income Americans are more likely to have HSAs and fund them at higher levels. Proponents, however, have argued that this regressivity is offset by reductions in wasteful health care spending because consumers with HDHPs are more cost-conscious in their use of care. Using published sources and our own analysis of National Health Interview Survey data, we argue that HSAs no longer appreciably achieve this cost-consciousness aim because cost sharing has increased so much in non-HSA-qualified plans. Indeed, people who have HDHPs with HSAs are becoming less likely than others with private insurance to report financial barriers to care. In sum, promised gains in efficiency from HSAs have not borne out, so it is difficult to justify maintaining this regressive tax break.

By Don McCanne, M.D.

After two decades, conservatives are still promoting health savings accounts, in spite of their pronounced regressivity. We have long needed policies that assist lower income individuals, yet health savings accounts and their associated high deductible health plans have failed to protect those with more modest incomes. Only a well-designed single payer Medicare for All system would. So why on earth does support for this unsuccessful policy persist when it works to the detriment of the poor but not the wealthy?

http://healthjusticemonitor.org…

Stay informed! Subscribe to the McCanne Health Justice Monitor to receive regular policy updates via email, and be sure to follow them on Twitter @HealthJustMon.

Summary: Juneteenth commemorates an 1865 US army order to end slavery in Texas. Emancipation was the first essential step to offer Black Americans the opportunity to live a free and healthy life. But even today, 157 years later, the well-being of people of color is compromised by numerous post-emancipation policies that disadvantage them. We offer a framework to understand these issues and advocate for change.

By Jim Kahn, M.D., M.P.H. and Susan Rogers, M.D.

Systemic racism in health is the constellation of policy decisions taken within health care as well as in other policy domains that affect health, regardless of the purported mindset of decision-makers and practitioners. Overt racist intent (e.g., denying Black individuals the same rights as White individuals) is unacceptable and deeply harmful, but is not required for racist consequences. Indeed, many broadly harmful policies derive from racist perspectives dressed up to appear beneficent (e.g., providing inferior public services when the likely users are people of color). What makes racism “systemic” is that structural features foster unequal treatment and outcomes.

Our framework for understanding systemic racism in health starts with health care, including insurance and delivery of care. It then proceeds to broader domains that less obviously, but indeed powerfully, influence health. Our effort in this post is broad, with a few citations. It should not be taken as a definitive academic review on the topic. Instead, we hope it helps clarify the challenges we face in order to reduce and end systemic racism in health.

A note on terminology. Observed differences are often described as “disparities,” which has a neutral tone. We prefer “inequities,” which highlights that these differences are unjust and unfair.

Health insurance: Black and Latino Americans are less likely to be privately insured, and more likely to be uninsured or Medicaid-insured. This is the insurance structure that predisposes them to health care access problems. Our public policy tolerance of low payment rates and poor access under Medicaid differentially harms people of color, and in so doing reveals a fundamental and unacceptable disregard for their welfare.

The Affordable Care Act reduced uninsurance inequities, via the Medicaid expansion. However, the 13 non-expansion states have high Black and Hispanic Medicaid participation, including five of the ten highest states by this metric. Thus state refusals of federal money to expand Medicaid disproportionally hurt people of color.

Inequities in coverage worsened during COVID.

Historical Origins: 20th century health insurance expansions, including the lack of universal coverage, were shaped substantially by the linked issues of states’ rights and racism. Medicaid design and implementation compromises were similarly influenced.

Access to care: Blacks and Latinos are more likely to experience financial barriers to care. This derives from higher rates of uninsurance and Medicaid. In the Medicare program, lower income and race interact to create higher rates of skipped or delayed care. In addition, there are geographic barriers: often no hospitals, clinics, or pharmacies in poor and rural neighborhoods.

Health workforce: People of color are under-represented in the most prestigious professional group in medicine – physicians. Even worse, they remain under-represented among medical students, so the physician mix is not evolving. The American Medical Association excluded blacks until the 1965 passage of Medicare, which desegregated hospitals. A wide variety of racist attitudes and behaviors continue in clinical practice.

Pain management: One often-mentioned issue is different attitudes and use of narcotic pain relief for Black patients, with an example here. This problem is especially difficult to read about for sickle cell anemia, with its excruciating sickle crises.

Quality of care: The literature on race and quality of care is massive. A PubMed search turned up 1,700 systematic reviews, and 200,000 articles. The issue pervades medicine.

Now we discuss issues apparently outside the health realm. Yet they influence health care and health in profound ways.

Law enforcement & incarceration: Our criminal justice system is biased against people of color at all steps: stops, arrests, convictions, and severity of punishment. Blacks and Latinos are vastly over-represented in prisons. The high rate of incarceration creates a “prison penalty” which impairs employment. This, in turn, reduces access to private insurance, among other harms.

Living in areas with concentrated poverty: Blacks are more likely to be poor than are whites. However, the elevated risk of living in areas of concentrated poverty – with scarce resources like supermarkets, well-funded schools, and health care, and greater environmental toxicity – is even greater. Blacks are five times more likely than whites to live in concentrated poverty, 10 times in some cities, and even non-poor Black families are 1.5 times as likely as poor White families to live in concentrated poverty.[1]

Public funding to get ahead: The GI bill after World War II paid for higher education for returning soldiers – if white; black soldiers were mainly excluded. Federal mortgage guarantees were “red-lined”: excluding high risk (read: mainly black) neighborhoods. As a result, Black families were denied the leg up needed to establish family financial stability. Wealth differences are massive by race. This contributes to a greater medical debt burden.

Health effects: Life expectancy is >3 years greater for White than Black babies. At age 60, the difference is 1 year. Both differences increased with COVID, which had much higher death rates among Black than White individuals.

We’ve said it before, and we’ll keep saying it: single payer universal health care will help end inequity in health insurance and thus largely in access. The phrase “health insurance program for the poor” will no longer have meaning. Being Black or Hispanic will no longer feed an “algorithm” to rank health insurance attention to underserved populations. Instead, it will mean that person deserves excellent universal health insurance, just like everyone else.

We should rejoice that the federal government has designated Juneteenth as an official holiday. We have a lot more work to do.

Dr. Susan Rogers is president of Physicians for a National Health Program.

http://healthjusticemonitor.org…

Stay informed! Subscribe to the McCanne Health Justice Monitor to receive regular policy updates via email, and be sure to follow them on Twitter @HealthJustMon.

By Lunna Lopes, Audrey Kearney, Alex Montero, Liz Hamel, and Mollyann Brodie

Kaiser Family Foundation, June 16, 2022

The KFF Health Care Debt Survey is part of a broader investigative project on health care debt conducted by our colleagues at KHN in partnership with NPR. The survey was designed and analyzed by public opinion researchers at KFF in collaboration with KHN journalists and editors. This Report contains findings from the survey as well as the topline and methodology. The KFF Health Care Debt Survey provides a broad measure of health care debt, including medical and dental bills people are unable to pay as well as different forms of debt accruing from health care bills such as payment plans, credit cards, bank loans, and borrowing from family and friends. It also explores the effects of health care debt on individuals and the financial and personal sacrifices they make due to their debt.

Diagnosis: Debt is a multimedia investigative journalism series by KHN and NPR that explores the scale, impact, and causes of health care debt in America. It represents a fusion of the investigative power of KHN and NPR, the public opinion survey expertise of the KFF polling team, and original data analysis.

full survey findings:

https://www.kff.org…

Kaiser Health News / NPR story, “Diagnosis Debt”:

https://khn.org…

By Alison P. Galvani, Abhishek Pandey, Pratha Sah, Kenneth Colón, Gerald Friedman, Travis Campbell, James G. Kahn, Burton H. Singer, and Meagan C. Fitzpatrick

PNAS (Proceedings of the National Academy of Sciences), June 13, 2022

The fragmented and inefficient healthcare system in the United States leads to many preventable deaths and unnecessary costs every year. Universal healthcare could have alleviated the mortality caused by a confluence of negative COVID-related factors. Incorporating the demography of the uninsured with age-specific COVID-19 and nonpandemic mortality, we estimated that a single-payer universal healthcare system would have saved 212,000 lives in 2020 alone. We also calculated that US$105.6 billion of medical expenses associated with COVID-19 hospitalization could have been averted by a Medicare for All system.

The fragmented and inefficient healthcare system in the United States leads to many preventable deaths and unnecessary costs every year. During a pandemic, the lives saved and economic benefits of a single-payer universal healthcare system relative to the status quo would be even greater. For Americans who are uninsured and underinsured, financial barriers to COVID-19 care delayed diagnosis and exacerbated transmission. Concurrently, deaths beyond COVID-19 accrued from the background rate of uninsurance. Universal healthcare would alleviate the mortality caused by the confluence of these factors. To evaluate the repercussions of incomplete insurance coverage in 2020, we calculated the elevated mortality attributable to the loss of employer-sponsored insurance and to background rates of uninsurance, summing with the increased COVID-19 mortality due to low insurance coverage. Incorporating the demography of the uninsured with age-specific COVID-19 and nonpandemic mortality, we estimated that a single-payer universal healthcare system would have saved about 212,000 lives in 2020 alone. We also calculated that US$105.6 billion of medical expenses associated with COVID-19 hospitalization could have been averted by a single-payer universal healthcare system over the course of the pandemic. These economic benefits are in addition to US$438 billion expected to be saved by single-payer universal healthcare during a nonpandemic year.

full study:

https://www.pnas.org…

“How are you going to pay for it?” Single-payer skeptics often ask this question in a bad-faith attempt to discredit Medicare for All. But the answer is simple: We’re already spending enough on health care. We’re just not getting our money’s worth.

Interested in how single payer would affect your personal finances? Check out the Medicare for All household savings calculator, which was developed by a team of health policy experts including PNHP leaders Drs. James G. Kahn, Henry L. Abrons, and Rachel Madley.

PNHP-MN interns and medical students Conor Nath and Preethiya Sekar reviewed the evidence for overall health spending by analyzing a decade’s worth of post-ACA single-payer financing studies (John A. Nyman, Ph.D.; Gordon Mosser, M.D.; and Kenneth Englehart, M.D. served as advisors). The team developed detailed infographics for each study (see below) as well as a primer and a PowerPoint presentation that offer an overview of their project.

PNHP will add new financing studies to this page as they are published (most recent study appearing first). For archival links to pre-ACA analyses, state-based studies, and a succinct statement from former American Public Health Association president Dr. Linda Rae Murray, click here.

It’s also worth noting that several high-profile Medicare-for-All financing plans have been released by elected officials: one from Sen. Elizabeth Warren and one from Sen. Bernie Sanders. PNHP offered comment on these proposals, here.

Of course, the status quo is unsustainable. National health spending continues to grow at a rapid clip, year after year, with the latest figures from 2022 showing a 4.1% increase from 2021, to $4.5 trillion. That’s more than enough to finance all medically necessary care for every U.S. resident while totally eliminating out-of-pocket spending.

Bottom line: a single-payer national health program is not only affordable, it’s the only affordable option.

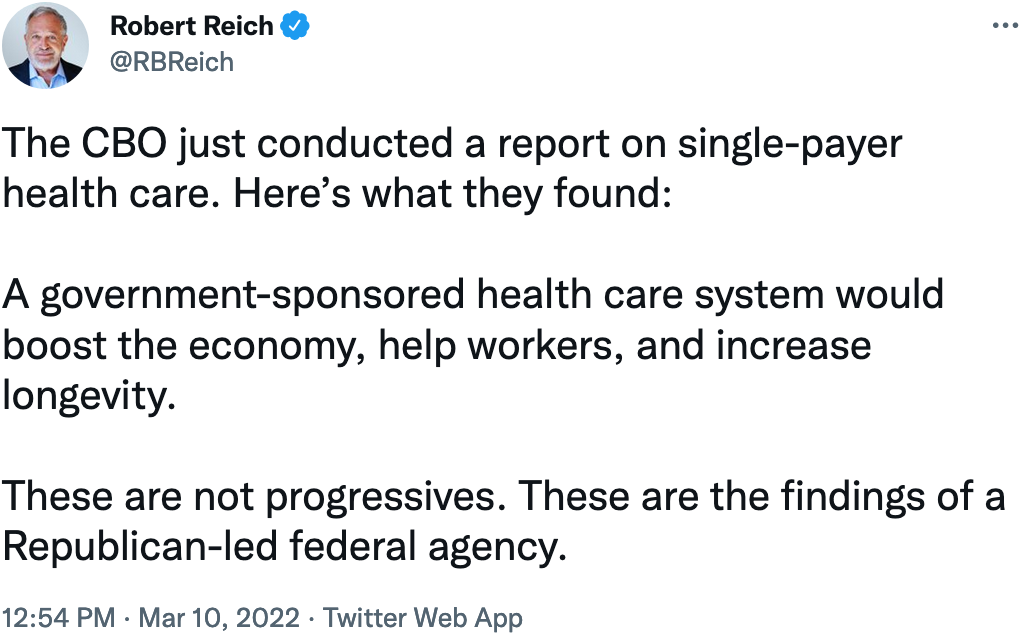

Congressional Budget Office 2022

learn moreCongressional Budget Office 2020

learn moreYale School of Public Health 2020

learn morePLOS Medicine 2020

learn moreThe Urban Institute 2019

learn moreHopbrook Institute 2019

learn moreRAND 2019

learn morePolitical Economy Research Institute (PERI) 2018

learn moreMercatus Center 2018

learn moreThe Urban Institute 2016

learn moreEmory University 2016

learn moreRAND 2016

learn moreUniversity of Massachusetts at Amherst 2013

learn moreCongressional Budget Office 2022

Title: Economic Effects of Five Illustrative Single-Payer Health Care Systems

Year: 2022

Authors: Jaeger Nelson

Institution: Congressional Budget Office

Plan Analyzed: “Five illustrative options” for a single-payer national health program, not strictly based on existing legislation

Percent Change in National Health Expenditure under M4A: Ranging from a decrease of $743 billion to an increase of $290 billion in 2030

Economic Effects of Five Illustrative Single-Payer Health Care Systems, Working Paper

This paper builds on previous studies published by the Congressional Budget Office about single-payer health care systems. It uses a general-equilibrium, overlapping-generations model to analyze the economic and distributional implications of five illustrative single-payer health care systems. The systems vary by their payment rates to providers, degree of cost sharing, and inclusion of benefits for long-term services and supports (LTSS). The economic effects of financing a single-payer system are beyond the scope of this paper. However, the results can be paired with some of CBO’s previously published estimates of the economic effects of financing a large and permanent increase in government spending.

We analyze six channels through which a single-payer system would affect the economy:

In this analysis, we found that economic output would be between 0.3 percent lower and 1.8 percent higher than the benchmark economy 10 years after the single-payer system was implemented, without incorporating the effects of financing the system. Under a single-payer system, workers would choose to work fewer hours, on average, despite higher wages because the reduction in health insurance premiums and OOP expenses would generate a positive wealth effect that allowed households to spend their time on activities other than paid work and maintain the same standard of living. If the system was financed with an income or payroll tax, gross domestic product (GDP) would be between approximately 1.0 percent and 10 percent lower by 2030, depending on the specification of the single-payer system and the details of the financing policy.

Moreover, that wealth effect would boosts households’ disposable income, which they could then split between increased saving and nonhealth consumption. Although hours worked per capita would decline, the effect on GDP would be offset under most policy specifications by an increase in economywide productivity, an increase in the size of the labor force, an increase in the average worker’s labor productivity, and a rise in the capital stock. Additionally, we found that average private nonhealth consumption per capita would rise by about 11.5 percent by 2030. The average rise in nonhealth consumption is larger than it would be if the effects of financing the system were included in the analysis. The effects of a single-payer health care system on nonhealth consumption would be felt differently by people of different ages and incomes. The percentage increase in lifetime nonhealth consumption would be largest among younger and lower-income households after the system was implemented. If the system was financed with an income or payroll tax, nonhealth consumption per capita would be between approximately 3 percent higher and 7 percent lower by 2030, depending on the specification of the single-payer system and the details of the financing policy.

Congressional Budget Office 2020

Title: How CBO Analyzes the Costs of Proposals for Single-Payer Health Care Systems That Are Based on Medicare’s Fee-for-Service Program

Year: 2020

Authors: CBO’s Single-Payer Health Care Systems Team

Institution: Congressional Budget Office

Plan Analyzed: “Five illustrative options” for a single-payer national health program, not based on H.R. 1384 or S.1129

Percent Change in National Health Expenditure under M4A (10-year): Ranging from a decrease of $0.7 trillion to an increase of $0.3 trillion in 2030

In this paper, CBO describes the methods it has developed to analyze the federal budgetary costs of proposals for single-payer health care systems that are based on the Medicare fee-for-service program. Five illustrative options show how differences in payment rates, cost sharing, and coverage of long-term services and supports under a single-payer system would affect the federal budget in 2030 and other outcomes. CBO’s projections of national health expenditures under current law are a key basis for the estimates.

CBO projects that federal subsidies for health care in 2030 would increase by amounts ranging from$1.5 trillion to $3.0 trillion under the illustrative single-payer options—compared with federal subsidies in 2030 projected under current law—raising the share of spending on health care financed by the federal government. National health expenditures in 2030 would change by amounts ranging from a decrease of $0.7 trillion to an increase of $0.3 trillion. Lower payment rates for providers and reductions in payers’ administrative spending are the largest factors contributing to the decrease. Increased use of care is the largest factor contributing to the increase.

Health insurance coverage would be nearly universal and out-of-pocket spending on healthcare would be lower—resulting in increased demand for health care—under the design specifications that CBO analyzed. The supply of health care would increase because of fewer restrictions on patients’ use of health care and on billing, less money and time spent by providers on administrative activities, and providers’ responses to increased demand. The amount of care used would rise, and in that sense, overall access to care would be greater. The increase in demand would exceed the increase in supply, resulting in greater unmet demand than the amount under current law, CBO projects. Those effects on overall access to care and unmet demand would occur simultaneously because people would use more care and would have used even more if it were supplied. The increase in unmet demand would correspond to increased congestion in the health care system—including delays and forgone care—particularly under scenarios with lower cost sharing and lower payment rates.

Yale School of Public Health 2020

Title: Improving the prognosis of health care in the USA

Year: 2020

Authors: Alison P. Galvani, Alyssa S. Parpia, Eric M. Foster, Burton H. Singer, Meagan C. Fitzpatrick

Institution: Yale School of Public Health

Funding Source: N/A

Plan Analyzed: S. 1804 Medicare for All Act of 2017

Percent Change in National Health Expenditure under M4A (1-year): -13.1% (2017)

Percent Change in National Health Expenditure under M4A (10-year): NS

Increase in Federal health expenditures: $773 billion (2017)

Improving the prognosis of health care in the USA

Although health care expenditure per capita is higher in the USA than in any other country, more than 37 million Americans do not have health insurance, and 41 million more have inadequate access to care. Efforts are ongoing to repeal the Affordable Care Act which would exacerbate health care inequities. By contrast, a universal system, such as that proposed in the Medicare for All Act, has the potential to transform the availability and efficiency of American health care services. Taking into account both the costs of coverage expansion, and the savings that would be achieved through the Medicare for All Act, we calculate that a single-payer, universal health care system is likely to lead to a 13% savings in national health-care expenditure, equivalent to more than US$450 billion annually (based on the value of the US$ in 2017). The entire system could be funded with less financial outlay than is incurred by employers and households paying for health care premiums combined with existing government allocations. This shift to single-payer health care would provide the greatest relief to lower-income households. Furthermore, we estimate that ensuring health care access for all Americans would save more than 68,000 lives and 1.73 million life-years every year compared with the status quo.

SHIFT Tool allowing users to modify inputs and assumptions

back to topPLOS Medicine 2020

Title: Projected costs of single-payer healthcare financing in the United States: A systematic review of economic analyses

Year: 2020

Author: Christopher Cai, Jackson Runte, Isabel Ostrer, Kacey Berry, Ninez Ponce, Michael Rodriguez, Stefano Bertozzi, Justin S. White, James G. Kahn

Institution: University of California, San Francisco

Plan Analyzed: Economic analyses of 22 single-payer plans published over the past 30 years

Percent Change in National Health Expenditure under M4A: -3.46% (median savings for the 19 of 22 analyses that predicted net savings)

Background: The United States is the only high-income nation without universal, government-funded or -mandated health insurance employing a unified payment system. The US multi-payer system leaves residents uninsured or underinsured, despite overall healthcare costs far above other nations. Single-payer (often referred to as Medicare for All), a proposed policy solution since 1990, is receiving renewed press attention and popular support. Our review seeks to assess the projected cost impact of a single-payer approach.

Methods and findings: We conducted our literature search between June 1 and December 31, 2018, without start date restriction for included studies. We surveyed an expert panel and searched PubMed, Google, Google Scholar, and preexisting lists for formal economic studies of the projected costs of single-payer plans for the US or for individual states. Reviewer pairs extracted data on methods and findings using a template. We quantified changes in total costs standardized to percentage of contemporaneous healthcare spending. Additionally, we quantified cost changes by subtype, such as costs due to increased healthcare utilization and savings due to simplified payment administration, lower drug costs, and other factors. We further examined how modeling assumptions affected results. Our search yielded economic analyses of the cost of 22 single-payer plans over the past 30 years. Exclusions were due to inadequate technical data or assuming a substantial ongoing role for private insurers. We found that 19 (86%) of the analyses predicted net savings (median net result was a savings of 3.46% of total costs) in the first year of program operation and 20 (91%) predicted savings over several years; anticipated growth rates would result in long-term net savings for all plans. The largest source of savings was simplified payment administration (median 8.8%), and the best predictors of net savings were the magnitude of utilization increase, and savings on administration and drug costs (R2 of 0.035, 0.43, and 0.62, respectively). Only drug cost savings remained significant in multivariate analysis. Included studies were heterogeneous in methods, which precluded us from conducting a formal meta-analysis.

Conclusions: In this systematic review, we found a high degree of analytic consensus for the fiscal feasibility of a single-payer approach in the US. Actual costs will depend on plan features and implementation. Future research should refine estimates of the effects of coverage expansion on utilization, evaluate provider administrative costs in varied existing single-payer systems, analyze implementation options, and evaluate US-based single-payer programs, as available.

The Urban Institute 2019

Title: From Incremental to Comprehensive Health Insurance Reform: How Various Reform Options Compare on Coverage and Costs

Year: 2019

Author: Linda J. Blumberg, John Holahan, Matthew Buettgens, Anuj Gangopadhyaya, Bowen Garrett, Adele Shartzer, Michael Simpson, Robin Wang, Melissa M. Favreault, and Diane Arnos

Institution: Urban Institute

Funding Source: The Commonwealth Fund

Plan Analyzed: “Reform 8”

Percent Change in National Health Expenditure under M4A (1-year): 20.6% (2020)

Percent Change in National Health Expenditure under M4A (10-year): NS

Increases in federal health expenditures: $33.988 trillion (2020-29)

Policymakers, including candidates in the 2020 presidential campaign and members of Congress, have proposed a variety of options to address the shortcomings of the current health care system. These range from improvements to the Affordable Care Act to robust single-payer reform.

There are numerous challenging trade-offs when choosing an approach to health care reform, including covering the uninsured, improving the affordability of health care, and raising the government funding required to implement them. The public and policymakers alike need more information about the potential effects of various health reform proposals.

This study, funded by the Commonwealth Fund, analyzes eight health care reforms and their potential effects on health insurance coverage and spending. Each of the analyzed reform proposals makes health insurance considerably more affordable by reducing people’s premiums and cost sharing. Some reforms also reduce US health care costs, and all require additional federal dollars.

PNHP co-founders Drs. David Himmelstein and Steffie Woolhandler found that “the Urban Institute analysis grossly underestimates the administrative savings under single payer, and projects increases in the number of doctor visits and hospitalizations that far exceed the capacity of doctors and hospitals to provide this added care.” Their full critique here, and a QOTD response from Dr. Don McCanne, including comments from PNHP president Dr. Adam Gaffney, here.

Comparing Health Insurance Reform Options: From “Building on the ACA” to Single Payer

back to topHopbrook Institute 2019

Title: Yes, We Can Have Improved Medicare for All

Year: 2019

Author: Gerald Friedman

Institution: University of Massachusetts at Amherst

Funding Source: Hopbrook Institute

Plan Analyzed: H.R. 676

Percent Change in National Health Expenditure under M4A (1-year): -20.0% (2019)

Percent Change in National Health Expenditure under M4A (10-year): -20.6% (2019-28)

Yes, We Can Have Improved Medicare for All

Growing public support for universal health coverage through a public program has provoked increasing attention to the question of how to finance such a program. There should not be any controversy about our ability to pay for universal health care. Given the nearly universal agreement that the current health-care system involves administrative waste and monopoly pricing, a system that would be more efficient and would reduce both should certainly be affordable. Studies finding higher costs for universal coverage programs have reached their conclusions by acknowledging efficiency savings but dismissing them by emphasizing, even exaggerating, the higher costs of providing better access to health care. Such studies provide a poor guide to the possibilities for an overhaul of our health-care finance system. In this paper, I discuss the financing of a universal health-care program, beginning with a discussion of current projected spending and the savings to be achieved through administrative efficiency and reducing monopoly pricing. Next, I outline increased spending associated with universal coverage through covering the uninsured and reducing barriers to access. I consider the net cost of universal coverage, after taking account of savings and the cost of extending and improving coverage, under various scenarios with alternative immediate savings and savings over time. Finally, I discuss sources of funding for such a program, beginning with public funds already committed and including possible additional sources of revenue. I develop funding plans under a variety of assumptions regarding the course of the single-payer system, and under alternative assumptions regarding revenue sources. This work shows that compared with the current system of health-care finance, a program of Improved Medicare for All could save Americans over $1 trillion in the first year, and savings could increase over time. Because some of the savings would be returned to health care through programs of universal coverage and improved access, net savings could be over $700 billion in the first year, rising over the next decade. Depending on the assumptions made and the program details, total financial savings, after taking account of program improvements, would come to $10 trillion or more over the next decade, on top of gains in quality of life and reduced mortality through universal access. A variety of models are compared, with varying assumptions of the magnitude of administrative savings and savings through reduced monopoly rents, as well as savings from bending the cost curve and maintaining some cost-sharing. Overall, the ten-year national savings on health-care expenditures range from a low of over $6 trillion to a high of over $13 trillion. In every model tested, Improved Medicare for All is cheaper than the current system even while providing improved health care.

Comprehensive cost analysis conducted by Gerald Friedman updating his previous work on the subject with similar considerations for financing options.

RAND 2019

Title: National Health Spending Estimates Under Medicare for All

Year: 2019

Authors: Jodi L. Liu and Christine Eibner

Institution: RAND

Funding Source: Modeled after H.R. 1384

Plan Analyzed: S. 1782 / H.R. 1200

Percent Change in National Health Expenditure under M4A (1-year): +1.75% (2019)

Percent Change in National Health Expenditure under M4A (10-year): NS

Increases in federal health expenditures: $2.4 trillion (2019)

National Health Spending Estimates Under Medicare for All

We estimate that total health expenditures under a Medicare-for-All plan that provides comprehensive coverage and long-term care benefits would be $3.89 trillion in 2019 (assuming such a plan was in place for all of the year), or a 1.8 percent increase relative to expenditures under current law. This estimate accounts for a variety of factors including increased demand for health services, changes in payment and prices, and lower administrative costs. We also include a supply constraint that results in unmet demand equal to 50 percent of the new demand. If there were no supply constraint, we estimate that total health expenditures would increase by 9.8 percent to $4.20 trillion.

While the 1.8 percent increase is a relatively small change in national spending, the federal government’s health care spending would increase substantially, rising from $1.09 trillion to $3.50 trillion, an increase of 221 percent.

Regarding increased utilization, we would highlight three studies from 2019 that found large-scale coverage expansions in the United States (Medicare/Medicaid in the late 1960s and the ACA in the early 2010s) did not lead to a society-wide increase in hospitalizations or doctor visits, and that large-scale expansions in other nations also did not cause a spike in utilization. (See “Utilization of health care services after large coverage expansions.”)

back to topPolitical Economy Research Institute (PERI) 2018

Title: Economic Analysis of Medicare for All

Year: 2018

Author: Robert Pollin, James Heintz, Peter Arno, Jeannette Wicks-Lim, and Michael Ash

Institution: Political Economy Research Institute (PERI) U-Mass Amherst

Funding Source: California Nurses Association/National Nurses United

Plan Analyzed: S. 1804 Medicare for All Act of 2017

Percent Change in National Health Expenditure under M4A (1-year): -9.6% (2017)

Percent Change in National Health Expenditure under M4A (10-year): -11.9% (2017-26)

Increase in Federal health expenditures: $1.35 trillion (2017-26)

PERI – Economic Analysis of Medicare for All

This study by PERI researchers Robert Pollin, James Heintz, Peter Arno, Jeannette Wicks-Lim and Michael Ash presents a comprehensive analysis of the prospects for a Medicare-for-All health care system in the United States. The most fundamental goals of Medicare for All are to significantly improve health care outcomes for everyone living in the United States while also establishing effective cost controls throughout the health care system. These two purposes are both achievable. As of 2017, the U.S. was spending about $3.24 trillion on personal health care—about 17 percent of total U.S. GDP. Meanwhile, 9 percent of U.S. residents had no insurance and 26 percent were underinsured—they were unable to access needed care because of prohibitively high costs. Other high-income countries spend an average of about 40 percent less per person and produce better health outcomes. Medicare for All could reduce total health care spending in the U.S. by nearly 10 percent, to $2.93 trillion, while creating stable access to good care for all U.S. residents.

PNHP co-founders Drs. Steffie Woolhandler and David Himmelstein, and PNHP president Dr. Adam Gaffney, submitted a reviewer assessment of the PERI study. They note that the PERI analysis may understate administrative savings, but overall find it to be a “highly credible economic analysis.”

Facing job loss with Just Transition (KHN)

back to topMercatus Center 2018

Title: The Costs of a National Single-Payer Healthcare System

Year: 2018

Authors: Charles Blahaus

Institution: Mercatus Center

Funding Source: Koch

Plan Analyzed: S. 1804 Medicare for All Act of 2017

Percent Change in National Health Expenditure under M4A (1-year): -2.03% (2022)

Percent Change in National Health Expenditure under M4A (10-year): -3.44% (2022-31)

Increase in Federal health expenditures: $5.838 trillion (2017-26)

The Costs of a National Single-Payer Healthcare System

The leading current bill to establish single-payer health insurance, the Medicare for All Act (M4A), would, under conservative estimates, increase federal budget commitments by approximately $32.6 trillion during its first 10 years of full implementation (2022–2031), assuming enactment in 2018. This projected increase in federal health care commitments would equal approximately 10.7 percent of GDP in 2022, rising to nearly 12.7 percent of GDP in 2031 and further thereafter. Doubling all currently projected federal individual and corporate income tax collections would be insufficient to finance the added federal costs of the plan. It is likely that the actual cost of M4A would be substantially greater than these estimates, which assume significant administrative and drug cost savings under the plan, and also assume that health care providers operating under M4A will be reimbursed at rates more than 40 percent lower than those currently paid by private health insurance.

PNHP co-founders Drs. David Himmelstein and Steffie Woolhandler critique the Mercatus reports as “ideology masquerading as health economics.”

The Urban Institute 2016

Title: The Sanders Single-Payer Health Care Plan: The Effect on National Health Expenditures and Federal and Private Spending

Year: 2016

Author: John Holahan, Lisa Clemans-Cope, Matthew Buettgens, Melissa Favreault, Linda J. Blumberg, and Siyabonga Ndwandwe

Institution: Urban Institute

Funding Source: N/A

Plan Analyzed: Bernie Sanders’ 2016 campaign proposal (eventually became S. 1804 Medicare for All Act of 2017)

Percent Change in National Health Expenditure under M4A (1-year): 16.9% (2017)

Percent Change in National Health Expenditure under M4A (10-year): 16.6% (2017-26)

Increases in federal health expenditures: $456.9 billion (2017)

The Sanders Single-Payer Health Care Plan

Presidential candidate Bernie Sanders proposed a single-payer system to replace all current health coverage. His system would cover all medically necessary care, including long-term care, without cost-sharing. We estimate that the approach would decrease the uninsured by 28.3 million people in 2017. National health expenditures would increase by $6.6 trillion between 2017 and 2026, while federal expenditures would increase by $32.0 trillion over that period. Sanders’s revenue proposals, intended to finance all health and nonhealth spending he proposed, would raise $15.3 trillion from 2017 to 2026—thus, the proposed taxes are much too low to fully finance his health plan.

Emory University 2016

Title: An Analysis of Senator Sanders Single Payer Plan

Year: 2019

Author: Kenneth Thorpe

Institution: Emory University

Plan Analyzed: S. 1129

Increases in federal health expenditures: $1.9 trillion (2017) and $24.6 trillion (2017-26)

An Analysis of Senator Sanders’s Single Payer Plan

Senator Sanders has proposed eliminating private health insurance and the exchanges created through the Affordable Care Act and replacing it with a universal Medicare program with no cost sharing. The plan would shift virtually all health care spending from private and public sources today onto the federal budget. The campaign estimates his plan would cost an average of $1.38 trillion per year over the next decade. They outline a variety of payroll and income tax increases, higher taxes for capital gains and dividends, taxes on estates of high income households and eliminate tax breaks that subsidize health insurance. Collectively he claims these taxes fully pay for the costs of the single payer plan. The analysis presented below however estimates that the average annual cost of the plan would be approximately $2.5 trillion per year creating an average of over a $1 trillion per year financing shortfall. To fund the program, payroll and income taxes would have to increase from a combined 8.4 percent in the Sanders plan to 20 percent while also retaining all remaining tax increases on capital gains, increased marginal tax rates, the estate tax and eliminating tax expenditures. The plan would create enormous winners and losers even with the more generous benefits with respect to what households and businesses pay today compared to what they would pay under a single payer plan. Overall, over 70 percent of working privately insured households would pay more under a fully funded single payer plan than they do for health insurance today.

This study is unique because it primarily focuses on the increase in federal health care spending and how this increase might be financed.

This study considers:

Gordon Mosser Critical Review and comment by Dr. Don McCanne

back to topRAND 2016

Title: Exploring Single-Payer Alternatives for Health Care Reform

Year: 2016

Authors: Jodi L. Liu

Institution: Pardee RAND graduate school

Funding Source: N/A

Plan Analyzed: S. 1782 / H.R. 1200

Percent Change in National Health Expenditure under M4A (1-year): -5% (2017)

Percent Change in National Health Expenditure under M4A (10-year): NS

Increase in Federal health expenditures: $446 billion (2017)

Exploring Single-Payer Alternatives for Health Care Reform

The Affordable Care Act (ACA) has reduced the number of uninsured and established new cost containment initiatives. However, interest in more comprehensive health care reform such as a single-payer system has persisted. Definitions of single-payer systems are heterogeneous, and estimates of the effects on spending vary. The objectives of this dissertation were to understand single-payer proposals and to estimate health care spending under single-payer alternatives in the United States. Single-payer proposals are wide-ranging reform efforts spanning financing and delivery, but vary in the provisions. I modeled two sets of national scenarios – one labeled comprehensive and the other catastrophic – and compared insurance coverage and spending relative to the ACA in 2017. First, I estimated the effects of utilization and financing changes, and then I added the effects of “other savings and costs” relating to administration, drug and provider prices, and implementation. Due to coverage of all legal residents and low cost sharing, and prior to adjusting for other savings and costs, the comprehensive scenario increased national health care expenditures by $435 billion and federal expenditures by $1 trillion relative to the ACA. The range of the net effect of the other savings and costs in the literature was $1.5 trillion in savings to $140 billion in costs, with a mean estimate of $556 billion in savings. If this mean estimate was applied to the comprehensive scenario, national expenditures would be $121 billion lower but federal expenditures would still be $446 billion higher relative to the ACA. The catastrophic scenario also covered all legal residents but increased overall cost sharing, resulting in a reduction in national expenditures by $211 billion and federal expenditures by $40 billion even before adjusting for other savings and costs. Average household spending on health care in both sets of scenarios could be more progressive by income than spending under the ACA. I also developed an interactive, web-based cost tool that allows the savings and cost assumptions to be adjusted by any user. As the debate on how to finance health care for all Americans continues, this study provides increased transparency about economic evaluations of health care reform.

University of Massachusetts at Amherst 2013

Title: Funding HR 676: The Expanded and Improved Medicare for All Act

Year: 2013

Author: Gerald Friedman

Institution: University of Massachusetts at Amherst

Plan Analyzed: H.R. 676

Percent Change in National Health Expenditure under M4A (1-year): -6.2% (2014)

Funding HR 676: The Expanded and Improved Medicare for All Act

The Expanded and Improved Medicare for All Act, HR 676, introduced into the 113th Congress by Rep. John Conyers Jr. and 37 initial co-sponsors, would establish a single authority responsible for paying for medically necessary health care for all residents of the United States. Under the single-payer system created by HR 676, the U.S. could save an estimated $592 billion annually by slashing the administrative waste associated with the private insurance industry ($476 billion) and reducing pharmaceutical prices to European levels ($116 billion). In 2014, the savings would be enough to cover all 44 million uninsured and upgrade benefits for everyone else. No other plan can achieve this magnitude of savings on health care. Specifically, the savings from a single-payer plan would be more than enough to fund $343 billion in improvements to the health system such as expanded coverage, improved benefits, enhanced reimbursement of providers serving indigent patients, and the elimination of co-payments and deductibles in 2014. The savings would also fund $51 billion in transition costs such as retraining displaced workers and phasing out investor owned, for-profit delivery systems. Health care financing in the U.S. is regressive, weighing heaviest on the poor, the working class, and the sick. With the progressive financing plan outlined for HR 676 (below), 95% of all U.S. households would save money. HR 676 would also establish a system for future cost control using proven-effective methods such as negotiated fees, global budgets, and capital planning. Over time, reduced health cost inflation over the next decade (“bending the cost curve”) would save $1.8 trillion, making comprehensive health benefits sustainable for future generations.

Dr. Friedman conducts an easy-to-follow cost analysis of H.R. 676 using a projection model. Dr. Friedman also discusses financing this program through both existing funding sources and “progressive taxation.”

Gordon Mosser Critical Review and comment by Dr. Don McCanne

back to top