Title: Funding HR 676: The Expanded and Improved Medicare for All Act

Year: 2013

Author: Gerald Friedman

Institution: University of Massachusetts at Amherst

Plan Analyzed: H.R. 676

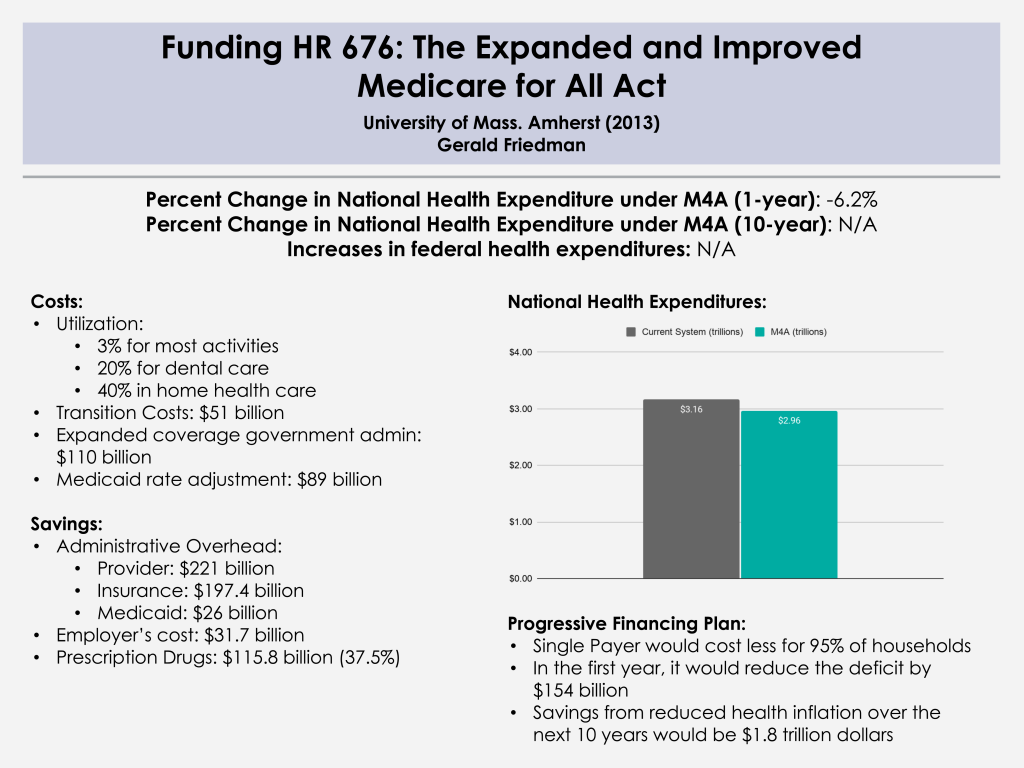

Percent Change in National Health Expenditure under M4A (1-year): -6.2% (2014)

Read Study:

Funding HR 676: The Expanded and Improved Medicare for All Act

Abstract:

The Expanded and Improved Medicare for All Act, HR 676, introduced into the 113th Congress by Rep. John Conyers Jr. and 37 initial co-sponsors, would establish a single authority responsible for paying for medically necessary health care for all residents of the United States. Under the single-payer system created by HR 676, the U.S. could save an estimated $592 billion annually by slashing the administrative waste associated with the private insurance industry ($476 billion) and reducing pharmaceutical prices to European levels ($116 billion). In 2014, the savings would be enough to cover all 44 million uninsured and upgrade benefits for everyone else. No other plan can achieve this magnitude of savings on health care. Specifically, the savings from a single-payer plan would be more than enough to fund $343 billion in improvements to the health system such as expanded coverage, improved benefits, enhanced reimbursement of providers serving indigent patients, and the elimination of co-payments and deductibles in 2014. The savings would also fund $51 billion in transition costs such as retraining displaced workers and phasing out investor owned, for-profit delivery systems. Health care financing in the U.S. is regressive, weighing heaviest on the poor, the working class, and the sick. With the progressive financing plan outlined for HR 676 (below), 95% of all U.S. households would save money. HR 676 would also establish a system for future cost control using proven-effective methods such as negotiated fees, global budgets, and capital planning. Over time, reduced health cost inflation over the next decade (“bending the cost curve”) would save $1.8 trillion, making comprehensive health benefits sustainable for future generations.

Overview:

Dr. Friedman conducts an easy-to-follow cost analysis of H.R. 676 using a projection model. Dr. Friedman also discusses financing this program through both existing funding sources and “progressive taxation.”

- Section I: Financing needs for single payer

- Current regressive and obsolete funding sources to be replaced by progressive taxation

- Estimated costs of system improvements and transition costs

- Section II: Single-payer system savings as a source of financing

- Savings on provider administrative overhead and drug prices

- Savings on the administrative overhead of private insurers, Medicaid, and employers

- Section III: A progressive financing plan for HR 676 for 2014

- Conclusion: Single payer covers more, costs less for 95 percent of Americans

Further Reading:

Gordon Mosser Critical Review and comment by Dr. Don McCanne