Table of contents

Click the links below to jump to different sections of the newsletter. To view a PDF version of the shorter print edition of the newsletter, click HERE.

If you wish to support PNHP’s outreach and education efforts with a financial contribution, click HERE.

If you have feedback about the newsletter, email info@pnhp.org.

PNHP News and Tools for Advocates

- PNHP celebrates new Medicare for All legislation, H.R. 1976

- Kitchen Table Campaign

- 2021 Virtual Leadership Training

- 2021 Annual Meeting: Oct. 22-24

- Medicare for All Financing: How will we pay for it?

- Welcome to PNHP’s new executive director

- Chapter Event Calendar

- Board nominations

Research Roundup

- Data Update: Health care crisis by the numbers

- Featured Report: The Lancet Commission on public policy and health in the Trump era

- Studies and analysis of interest to single-payer advocates

PNHP Chapter Reports

- California

- Colorado

- Illinois

- Kentucky

- Maine

- Minnesota

- Missouri

- New Hampshire

- New York

- North Carolina

- Oregon

- Pennsylvania

- Vermont

- Washington State

PNHP in the News

- News Articles Quoting PNHP Members

- TV and Video

- Radio and Podcasts

- Opinion: Op-eds and Guest Columns

- Opinion: Letters to the Editor

PNHP News and Tools for Advocates

PNHP celebrates new Medicare for All bill in the House

On March 17, Reps. Pramila Jayapal (D-Wa.), Debbie Dingell (D-Mich.), and 110 original co-sponsors introduced the Medicare for All Act of 2021 (H.R. 1976). Like previous versions of the Medicare for All Act, H.R. 1976 closely mirrors PNHP’s Physicians’ Proposal for Single-Payer Health Care Reform. It would establish a national health program to cover everybody living in the U.S. for all medically necessary care, including hospitalization and doctor visits; dental, vision, hearing, mental health, and reproductive care, including abortion; long-term care services and supports; ambulatory services; and prescription drugs. Patients could visit the doctor or hospital of their choice, without copays or deductibles. The program would pay independent and small group practice providers on a fee-for-service basis, and fund hospitals and other large facilities with yearly global operating budgets; separate funds would be used for capital improvements. By eliminating the profiteering and waste of commercial insurance, Medicare for All would save $600 billion per year while expanding coverage to all.

What’s new in the 2021 bill?

After months of dialogue with health justice advocates, Rep. Jayapal made some significant new improvements to this year’s bill. H.R. 1976 would:

- Protect the national health program by preventing any future administration from reducing or eliminating existing benefits;

- Establish an Office of Health Equity to monitor and eliminate health disparities, and promote primary care;

- Increase access to mental health care by including Licensed Marriage and Family Therapists and Licensed Mental Health Counselors in the list of covered providers;

- Improve health services for indigenous peoples by providing additional funding for the Indian Health Service;

- Expand support for disabled Americans by expanding eligibility for long-term care supports and services;

- Respond to future public health crises by automatically increasing hospitals’ global budgets during pandemics or other public health emergencies.

What’s next for the Medicare for All bill?

H.R. 1976 has gained three more co-sponsors since its introduction in March, but needs much more support in Congress to move forward. PNHP members can help by educating themselves and their colleagues about the bill, and then urging lawmakers to sign on. The following resources can help advocates get started.

Learn more about H.R. 1976:

- One-page summary covering major features of the bill;

- Comparison chart contrasting Medicare for All with commercial insurance;

- PowerPoint slides from Dr. Ed Weisbart offering a primer on the bill;

- Full text of H.R. 1976

Take action:

- Send an email to your representative or call them at (202) 224-3121 and ask them to co-sponsor the bill. If your representative is already a co-sponsor, thank them for their support and ask them to push for hearings in Congress. Click HERE for a list of current co-sponsors;

- Schedule an in-person meeting with your representative or a health policy staffer at their district office. These meetings are a crucial part of building a relationship with lawmakers.

- Get active with the PNHP chapter in your city or state. If you don’t live near a PNHP chapter, use THIS LIST of more than 300 groups that endorsed H.R. 1976 to find an allied organization in your area.

2021 Kitchen Table Campaign

PNHP’s Kitchen Table Campaign (KTC) was launched in January of 2020, just as the presidential candidates were fiercely debating their health care proposals. With so many different plans in the mix — from the public option to “Medicare Advantage for All” — PNHP wanted to show voters how single-payer Medicare for All would address the urgent problems that families discussed around the kitchen table. Each KTC toolkit was designed for a general audience, and included handouts, slide shows, webinars, podcasts, videos, social media posts, and sample letters-to-the-editor.

The first phase of KTC focused on surprise billing, racial health inequities, and rural health. During Covid-19, the campaign pivoted to the topics of Medicare for All and public health emergencies, and the pandemic’s impact on health care workers and racial health inequities. Ahead of the 2020 elections in November, the KTC issued a Health Care Voters Guide, with a checklist for evaluating candidates’ health plans.

PNHP re-launched the KTC in 2021 with a focus on America’s mental health crisis. The campaign explained the ways that commercial insurers discriminate against mental health care, by underpaying mental health professionals, limiting patients’ choice of provider, and denying coverage for treatments like medication, therapy, and hospitalization. By contrast, Medicare for All would provide comprehensive mental health coverage with free choice of provider.

This summer, the KTC will explore reproductive health, highlighting the barriers that patients face in our fractured health system, and how Medicare for All could remove them. PNHP members who wish to get involved in the Kitchen Table Campaign should contact clare@pnhp.org.

Spring 2021 Virtual Leadership Training

PNHP hosted its first-ever virtual Leadership Training in late April. While there’s no substitute for gathering in person, the program provided activists with a combination of skill-building, strategy, and networking opportunities. All programs were recorded and are available to view online:

- “Physician Advocacy & Local Organizing” presented by PNHP-IL Co-President Dr. Monica Maalouf

- “Organizing a Summit” presented by SNaHP leader Robertha Barnes

- “Talking about Health Insurance 101” presented by PNHP Board Adviser Dr. Diljeet Singh

- “Organizing a Webinar” presented by Healthcare-NOW! Director of Communications Stephanie Nakajima (with additional reference materials HERE)

- “Building Relationships with Elected Officials” presented by PNHP National Coordinator Dr. Claudia Fegan

- “Building Bridges across Generations, from Medical Students to Retired Physicians” panel discussion featuring SNaHP leaders Alankrita Siddula and Ashley Lewis in conversation with PNHP leaders Dr. Richard Bruno and Dr. Daniel Lugassy

The Leadership Training keynote address was made by legendary public health advocate Dr. Linda Rae Murray, who reminded activists that the core skills needed to practice medicine are also the skills needed to be effective advocates for health justice. Dr. Murray explained that advocates must always listen, seek new information, and “connect the dots” between different forms of injustice. Physicians in particular must truly understand the medical system and all its dysfunction before they can work to change it. PNHP members can view and share Dr. Murray’s presentation HERE.

Save the date for our 2021 Annual Meeting

New toolkit on Medicare for All financing: How will we pay for it?

When advocating for Medicare for All, PNHP members are often asked how the country could afford universal coverage. The short answer is, “We’re already spending enough to provide comprehensive coverage to all — we’re just not getting our money’s worth.”

But to provide the “long” answer, PNHP-Minnesota interns Conor Nath and Preethiya Sekar, along with advisors John A. Nyman, Ph.D., Gordon Mosser, M.D., and Kenneth Englehart, M.D., analyzed a decade’s worth of post-ACA financing studies. They determined that Medicare for All could provide universal coverage without an increase in national health spending by controlling health costs in the long term.

The team’s findings can be found on PNHP’s dedicated single-payer financing page, pnhp.org/PayingForIt. The page includes detailed infographics, a PowerPoint presentation, and a policy primer on the data, as well as links to the original studies, older (pre-ACA) studies, and studies of state single-payer plans. PNHP will continue to update the page as new studies become available.

PNHP welcomes new executive director

On May 1, PNHP welcomed Ken Snyder as executive director. In this role, Ken will work closely with PNHP leaders to grow our membership, increase fundraising, and expand our organizing and communications capacity. Ken brings more than 20 years of experience working for social change within a variety of organizations, including grassroots community groups, labor unions, and legislative campaigns. His organizing expertise will be invaluable as PNHP redoubles its efforts to organize physicians in support of single payer and to strengthen the capacity of PNHP and SNaHP chapters at the local level — all while advancing PNHP’s role as a leader in developing evidence-based health policy.

On May 1, PNHP welcomed Ken Snyder as executive director. In this role, Ken will work closely with PNHP leaders to grow our membership, increase fundraising, and expand our organizing and communications capacity. Ken brings more than 20 years of experience working for social change within a variety of organizations, including grassroots community groups, labor unions, and legislative campaigns. His organizing expertise will be invaluable as PNHP redoubles its efforts to organize physicians in support of single payer and to strengthen the capacity of PNHP and SNaHP chapters at the local level — all while advancing PNHP’s role as a leader in developing evidence-based health policy.

PNHP members can reach Ken at ken@pnhp.org. PNHP’s previous executive director Matthew Petty will assume the role of deputy director and continue to oversee many of our administrative, management, and fundraising functions (matt@pnhp.org). The rest of the PNHP staff team includes national organizer Kaytlin Gilbert (kaytlin@pnhp.org) and communications specialists Dixon Galvez-Searle (dixon@pnhp.org) and Clare Fauke (clare@pnhp.org).

New Chapter Events National Calendar

Many PNHP and SNaHP chapters have found creative ways to continue their outreach and education efforts during the pandemic, including webinars and online public forums. Because these online events are open to anyone regardless of location, they provide an opportunity to reach advocates across the nation. In order to facilitate broader participation, PNHP created a Chapter Events National Calendar, a tool that allows chapters and coalition partners to share their online events with other members. Chapter leaders are encouraged to submit their virtual events to the PNHP organizing team at: organizer@pnhp.org.

PNHP Board Nominations Open

Nominations for PNHP’s Board of Directors are now open, with seats up for election in all regions and for at-large representation. In order to promote an open and transparent process, the Board has not slated candidates in advance, and invites nominations and applicants from members interested in contributing to a diverse Board of Directors.

The following seats are up for election for 2-year terms:

- At-large (2 seats)

- North East region (1 seat)

- South region (1 seat)

- North Central region (1 seat)

- West region (2 seats)

Nominations and inquiries can be sent to Matt Petty at matt@pnhp.org by July 15, 2021. Ballots for electronic voting will be circulated in Summer 2021; be sure your current email address is on file with PNHP’s office.

Research Roundup

Data Update Spring 2021

Costs of Care

Nearly one-fifth (18%) of U.S. adults and 35% of low-income earners say they did not seek treatment for a health problem in the last year due to cost. An equal number say that if they needed some form of health care today they would not be able to afford it. This current measure of health care unaffordability runs considerably higher among Black adults (29%) and somewhat higher for Hispanic adults (21%) than for white adults (16%). In order to pay for health care in the past year, 12% of Americans have cut back on spending on food; 11% cut back on over-the-counter drugs; and 35% reduced spending on recreational activities, including 21% of those in households earning at least $180,000 per year. Witters, “In U.S., an estimated 46 million cannot afford needed care,” Gallup, 3/31/2021

Total costs for ACA marketplace plans were 83% higher compared to Medicaid. For patients, out-of-pocket spending was 10 times higher in marketplace plans vs. Medicaid: $20.29 vs. $2.80 for office visits, $106.21 vs. $7.27 for emergency visits, and $6.82 vs. $2.40 for prescriptions — even after accounting for federal cost-sharing reductions. Allen et al., “Comparison of utilization, costs, and quality of Medicaid vs. subsidized private health insurance for low-income adults,” JAMA Network Open, 1/5/2021

Cancer care is increasingly unaffordable due to rising out-of-pocket expenses imposed by commercial insurers. In 2018, patients paid a combined $5.6 billion in out-of-pocket cancer costs. These costs vary substantially based on a patient’s insurance plan: When premiums, deductibles, copays and coinsurance were calculated, cancer patients with ACA-compliant plans paid between $5,000 and $12,000 out-of-pocket. Those in short-term limited duration plans spent a staggering $52,000 out-of-pocket, mostly due to high deductibles and poor coverage of prescription drugs. Cancer-caused financial hardship falls hardest on young people, people of color, and those who have lower incomes and education levels. “The Costs of Cancer: 2020 Edition,” The American Cancer Society Cancer Action Network, October 2020

A study of income inequality and health care affordability among wealthy nations reveals stark disparities in the U.S. In the past year, 38% of U.S. adults skipped needed doctor visits, tests, treatments, follow-up, or prescription medicines because of cost; 36% skipped dental care; 22% were unable to pay medical bills. Among low-income U.S. adults, 50% skipped doctor visits, tests, treatments, follow-up, or prescription medicines because of cost; 51% skipped dental care; and 36% were unable to pay medical bills; 28% worried about being able to afford basic necessities such as food or housing. Doty et al., “Income-related inequalities in affordability and access to primary care in eleven high-income countries,” Health Affairs, 12/9/2020

Even before the pandemic, millions of Americans traveled to other countries for savings of up to 80% percent on medical treatments. In 2019, more than 1% of Americans traveling internationally did so for health treatments, although that figure only accounts for those who traveled by air and does not include the thousands who crossed the U.S.-Mexico border using ground transportation. Mexico and Costa Rica are the most popular destinations for dental care, cosmetic surgery, and prescription drugs; Thailand, India, and South Korea attract patients for more complex procedures such as orthopedics, cardiovascular, cancer, and fertility treatments. Yeginsu, “Why medical tourism is drawing patients, even in a pandemic,” New York Times, 1/19/2021

Sixty percent of Americans have been in debt due to medical bills. According to a new survey, 37% of adults currently owe medical debt and 23% have had medical debt in the past, with the average debt between $5,000 and $10,000. The top drivers of medical debt are emergency room visits (39%), doctor or specialist visits (28%), surgery (26%), childbirth (22%), and dental care (20%). Medical debt affects people’s financial and mental health, as 19% of those with medical debt said it’s preventing them from buying a home and 68% say they have lost sleep worrying about it. Giovanetti, “60% of Americans have been in debt due to medical bills,” LendingTree/Qualtrics survey, 3/21/21

The number of health-related fundraisers on GoFundMe has skyrocketed. Medical fundraisers increased from 42 campaigns in 2010 to nearly 120,000 in 2018, and now account for more than a quarter of all campaigns on the site. In that time, patients requested $10.2 billion in donations for health care costs, and received more than $3.6 billion. The most common campaign was for cancer treatment, followed by care for trauma/injury and care for neurological conditions. Angraal et al., “Evaluation of internet-based crowdsourced fundraising to cover health care costs in the United States,” JAMA Network Open, 1/11/2021

Drug Prices

A recent survey found a large number of Americans face financial hardship due to the price of medications. 36% of patients say they have forgone their medications to pay for essential items and bills; 43% have forgone paying for essential items and bills to afford their medications; and 41% skipped or reduced doses to stretch out their prescription. “2021 Medication Access Report,” CoverMyMeds, 1/26/2021

Even a modest increase in out-of-pocket costs has shown to significantly lower medication adherence and increase mortality among patients. Using data from Medicare’s prescription drug program, researchers discovered that raising patients’ out-of-pocket costs by just $10 per prescription led to a 23% drop in overall drug consumption, and to a 33% increase in mortality. Researchers found that when faced with higher costs, seniors did not drop “low-value” drugs, but instead cut back life-saving, high-value drugs such as those to lower cholesterol (statins), blood pressure (ACE inhibitors, beta blockers), and blood sugar (oral hypoglycemics); and drugs that treat acute exacerbations of emphysema and asthma (inhalers). Chandra et al., “The health costs of cost-sharing,” National Bureau of Economic Research Working Paper 28439, February 2021

U.S. prescription drug list prices have more than doubled in recent years. Between 2010 and 2016, the median drug wholesale list price increased by 129% and median insurance payments after rebates and discounts increased by 64%, while median patient out-of-pocket costs increased by 85% for specialty medicines and by 42% for non-specialty drugs. Yang et al., “Changes in drug list prices and amounts paid by patients and insurers,” JAMA Network, 12/9/2020

Prescription drug prices in the U.S. are 256% higher than prices in 32 comparable countries. Among the 33 countries studied, the U.S. accounted for 58% of revenues, but just 24% of volume. Most of the discrepancy was caused by prices for brand name drugs, which in the U.S. averaged 3.44 times higher than the prices in other nations. Some of the highest-priced brands treat life-threatening illnesses, Hepatitis C, or cancers. Drug spending in the U.S. jumped by 76% between 2000 and 2017. Mulcahy et al., “International prescription drug price comparisons: Current empirical estimates and comparisons with previous studies,” RAND Corporation, 1/28/2021

Medicare Part D spent more than twice as much on hundreds of prescription drugs compared to the Dept. of Veterans Affairs. In a sample of 399 brand-name and generic prescription drugs, the VA paid an average of 54% less per unit than Medicare, even after accounting for rebates and discounts; 233 drugs were at least 50% cheaper and 106 were at least 75% cheaper. Specifically, VA’s prices were 68% lower than Medicare’s for the 203 generic drugs (an average difference of $0.19 per unit) and 49% lower for the 196 brand-name drugs (an average difference of $4.11 per unit). The price difference is almost entirely due to the VA’s ability to negotiate drug prices. “Prescription drugs: Department of Veterans Affairs paid about half as much as Medicare Part D for selected drugs in 2017,” U.S. Government Accountability Office, 1/14/2021

Pharmaceutical companies hike their list prices substantially each year, and 2021 is no exception. More than 100 drug firms raised list prices on 636 drugs in the first week of January, with a median price hike of 5% — more than four times the rate of inflation. For the 19th year in a row, AbbVie raised the price of the world’s best-selling drug, Humira, which is used to treat autoimmune diseases such as rheumatoid arthritis, by 7.4%. The price for two pens — enough for up to one month of treatment — is now $5,968. Contrary to what drug manufacturers argue, two-thirds of Americans pay for some or all of the cost of their medication based on the list price, including 9% of Americans who are uninsured, 40% with high-deductible plans, and 18% with Medicare. “Pharma raises prices on over 600 drugs to start the new year,” Patients for Affordable Drugs, 1/14/2021

Coverage Saves Lives and Money

Medicare eligibility means better access to care. Medicare eligibility at age 65 is associated with a 50.9% reduction in reports of being unable to get necessary care compared with the percentage at age 64, and a 45.3% reduction in not being able to get needed care because of the cost. Jacobs, “The impact of Medicare on access to and affordability of health care,” Health Affairs, February 2021

Medicare eligibility at age 65 is associated with a rise in early-stage cancer diagnoses and a resulting survival benefit. Researchers discovered a greater jump in diagnoses for the four most common cancers — lung, breast, colon, and prostate — at the transition from 64 to 65 than at all other age transitions, suggesting that older adults are delaying care for financial reasons until they enroll in Medicare. For example, colon cancer diagnoses showed a consistent increase of just 1-2% each year from 61 to 64, then at 65 jumped to nearly 15%. Diagnosis rates then declined for all cancers in the years following age 65. Compared to uninsured older adults under 65, Medicare-enrolled cancer patients had lower five-year cancer-specific mortality rates. Patel et al., “Cancer diagnoses and survival rise as 65‐year‐olds become Medicare‐eligible,” Cancer, 3/29/2021

Survival after cancer diagnosis is considerably lower in younger uninsured patients than in older Medicare patients. Uninsured patients ages 60–64 were nearly twice as likely to present with late-stage cancer and were significantly less likely to receive surgery, chemotherapy, or radiotherapy compared to Medicare beneficiaries ages 66–69, despite lower comorbidity among younger patients. Compared with older Medicare patients, younger uninsured patients had significantly lower five-year survival across cancer types: Five-year survival in younger uninsured patients with late-stage breast or prostate cancer was 5–17% lower than among older Medicare patients. Silvestri et al., “Cancer outcomes among Medicare beneficiaries and their younger uninsured counterparts,” Health Affairs, May 2021

Medicaid expansion is correlated with fewer deaths. Researchers identified 4,800 fewer deaths per year out of a sample of 3.7 million people living in Medicaid expansion states, or roughly 19,200 fewer deaths over the first four years of Medicaid expansion, compared to the mortality rate pre-expansion. Conversely, in a sample of 3 million people in non-expansion states, researchers identified 15,600 additional deaths over this four year period that could have been avoided if the states had expanded coverage. Miller et al., “Medicaid and mortality: New evidence from linked survey and administrative data,” National Bureau of Economic Research Working Paper 26081, January 2021

Medicaid expansion is correlated with improved treatment for colon cancer. Compared to non-expansion states, patients who lived in Medicaid expansion states had an increase in Stage I diagnoses and were more likely to receive treatment within 30 days. Among surgical patients, Medicaid expansion correlated with fewer urgent cases and more minimally invasive surgery; Stage IV patients were more likely to receive palliative care. Hoehn et al., “Association between Medicaid expansion and diagnosis and management of colon cancer,” Journal of the American College of Surgeons, 11/23/2020

Children who gained health coverage during the rollout of Medicaid in the late 1960s enjoyed lifelong health and financial benefits. The first Medicaid covered cohort (born between 1955 and 1975) were less likely to die young or to have a disability as an adult, and were more likely to be employed, compared to peers who were not enrolled; the improvements in longevity and disability added 10 million quality-adjusted life years to this cohort. Medicaid enrollment also saved taxpayers money as the covered individuals had less later need for disability, unemployment, or similar safety-net benefits, saving governments $200 billion (in 2017 dollars) — more than twice the cost of coverage. Goodman-Bacon, “The long-run effects of childhood insurance coverage: Medicaid implementation, adult health, and labor market outcomes,” Opportunity and Inclusive Growth Institute, Federal Reserve Bank of Minneapolis, October 2020

Medicaid expansion has been good for hospitals’ financial health. In 2017, hospitals in states that expanded Medicaid saw an average decrease of $6.4 million on uncompensated care — a 53.3% drop — compared to the pre-expansion period. Uncompensated care comprised 6% of total expenses for hospitals in non-expansion states, which is double the amount for hospitals in expansion states. Medicaid expansion had the most impact on operating margins for safety-net hospitals and small (fewer than 100 beds) hospitals. Blavin and Ramos, “Medicaid expansion: Effects on hospital finances and implications for hospitals facing Covid-19 challenges,” Health Affairs, January 2021

Excess mortality in the U.S. is higher than peer nations — except for the oldest adults. Compared to 18 European countries, the U.S. ranked among the worst for excess mortality in working-age adults, resulting in more than 400,000 excess deaths and 13 million years of life lost in 2017, a 64.9% increase since 2000. Excess mortality is most severe for Americans aged 30 to 34, who were three times more likely to die than their European counterparts. However, the U.S. had lower death rates in people aged 85 and older – 97,788 fewer deaths than the European standard; this advantage in older adults (who are covered by Medicare in the U.S.) has only increased since 2000. Preston and Vierboom, “Excess mortality in the U.S. in the 21st century,” Proceedings of the National Academy of Sciences, 4/20/2021

Health Inequities

Black mortality remains far higher than white mortality in America’s 30 largest cities. From 2016 to 2018, the national all-cause mortality rate among Black Americans was 24% higher than among whites (960 v. 777 per 100,000), resulting in 74,402 excess Black deaths annually. The mortality rates among Black populations were significantly higher in 29 of America’s 30 biggest cities. Washington, D.C. had the biggest disparity, with a death rate for Black residents that was more than twice as high as the white mortality rate. In both Chicago and New York, more than 3,500 Black people died annually because of this health inequity. Benjamins et al., “Comparison of all-cause mortality rates and inequities between Black and white populations across the 30 most populous U.S. cities,” JAMA Network, 1/20/2021

The pandemic has exacerbated disparities in life expectancy between white and Black Americans. Overall life expectancy in the U.S. dropped one full year during the first half of 2020 (from 78.8 years in 2019 to 77.8 years in mid-2020), but with major racial disparities. For white people, life expectancy decreased by 0.8 years (78.8 to 78); but for Black people, life expectancy decreased by 2.7 years (74.7 to 72). White Americans now live an average of six years longer than Black Americans, up from a four-year difference in 2019. Arias et al., “Provisional life expectancy estimates for January through June, 2020,” National Center for Health Statistics, February 2021

A new survey shines a light on discrimination within U.S. health care. 21% of adults say they have experienced discrimination in the health care system, and 72% of those experienced discrimination more than once. Among those reporting discrimination, racial/ethnic discrimination was the most common type (17.3%), followed by discrimination based on educational or income level (12.9%), weight (11.6%), sex (11.4%), and age (9.6%). Of the patients who reported discrimination, 63% were women and 60% had household incomes of less than $50,000 a year. Nong et al., “Patient-reported experiences of discrimination in the U.S. health care system,” JAMA Network Open, 12/15/2020

Contrary to the claims of former President Trump and other elected officials, undocumented immigrants are not an economic burden on safety net facilities such as hospital emergency departments. Undocumented immigrants used far fewer health services and incurred lower health costs than U.S. citizens. Annual health expenditures were $1,629 for unauthorized immigrants, compared to $3,795 for authorized immigrants and $6,088 for U.S.-born individuals. Unfortunately, undocumented immigrants were also more likely to be uninsured: Nearly half of unauthorized immigrants (47.1%) were uninsured compared with 15.9% of authorized immigrants and 6.0% of U.S.-born individuals. Wilson et al., “Comparison of use of health care services and spending for unauthorized immigrants vs. authorized immigrants or U.S. citizens using a machine learning model,” JAMA Network, 12/11/2020

The poverty rate jumped to 11.7% in November 2020, up from 9.3% in June, the biggest increase since the government began tracking poverty 60 years ago. Poverty — officially an income of $26,200 or less for a family of four — has risen most for Black Americans (up 3.1 percentage points, or 1.4 million people) and for Americans with high school degrees or less (up 5.1 percentage points, or 5.2 million people). These populations have experienced the largest job losses during the pandemic. Households with children have also seen a larger-than-average increase in poverty: About 2.3 million children under 17 have fallen into poverty since June. Han et al., “Real-time poverty estimates during the Covid-19 pandemic through November 2020,” 12/15/2020

More than 110 rural hospitals have closed from 2013 to 2020, resulting in longer distances for care, fewer providers, and less services for residents of the closed hospitals’ service areas. The share of hospitals that offered general medical and surgical care in rural communities dropped from 81% in 2012 to 39.7% in 2017. After rural hospitals closed, the average distance traveled for inpatient care increased by 20.5 miles; for emergency care, travel increased 20.9 miles; for coronary care, 31.6 miles; and for substance use disorder treatment, nearly 40 miles. Counties with hospital closures also lost significant numbers of health providers. From 2012 to 2017, the availability of physicians in closure counties dropped from a median of 71.2 to 59.7 doctors per 100,000 residents. “Rural hospital closures: Affected residents had reduced access to health care services,” U.S. Government Accountability Office (GAO), December 2020

Veteran’s Health

Veterans who get their care at Veteran’s Affairs (VA) facilities live longer after a medical emergency compared to those receiving non-VA care. In a study of veterans age 65 and older who were dual eligible for VA and Medicare benefits, those who were treated inside the VA system for a medical emergency had a 46% reduction in 28-day mortality compared to those treated outside the VA; survival gains persist for at least a year after the initial ambulance ride. Notably, this “VA advantage” was as large for Black and Hispanic veterans as for white ones. The VA also reduced per-patient cumulative spending at 28 days by $2,548, approximately 21% less than private providers. Evidence suggests that the “VA advantage” comes from two factors: more effective care coordination, and information retrieval through a common electronic medical record system. Chan et al., “Is there a VA advantage?: Evidence from dually eligible veterans,” National Bureau of Economic Research, November 2020

Health Care for Profit

Hospital relief funds from the 2020 CARES Act helped wealthy hospitals most, while safety-net hospitals were hemorrhaging. Funding distribution was based on hospitals’ past revenue and did not account for existing assets or investments, favoring institutions with wealthier, commercially-insured patients over those whose patients were uninsured or covered by Medicaid or Medicare. In May of 2020, Baylor Scott & White Health, the largest nonprofit hospital system in Texas, accepted $454 million in relief funds and laid off 1,200 employees, but reported an $815 million surplus in 2020 — $20 million more than in 2019 — resulting in a 7.5% operating (aka profit) margin. UPMC in Pittsburgh accepted a $460 million bailout and then reported $2.5 billion more in revenue in 2020 than in 2019, along with an $836 million operating surplus, partly due to the growth of the health insurance plan the system owns. Mayo Clinic received $338 million in federal funds, then ended 2020 with a $728 million surplus and $202 million more in revenue than in 2019. Rau and Spolar, “Despite Covid, many wealthy hospitals had a banner year with federal bailout,” Kaiser Health News, 4/5/2021

U.S. hospitals charge an average of $417 for every $100 of their actual costs. The “markups” — which have more than doubled over the past 20 years — have resulted in hospital profits skyrocketing by 411% from 1999 to 2017. The markups are led by for-profit hospitals: 95 of the 100 hospitals with the highest charges relative to costs are investor-owned; all 100 are owned by hospital systems, as opposed to being independently operated community hospitals. For-profit HCA Healthcare owns 53 of the top 100 markup hospitals, including the hospital with the highest charge-to-cost ratio in the U.S., Poinciana Medical Center in Kissimmee, Florida, whose charge-to-cost ratio is a staggering 1,808%. “Fleecing Patients: Hospitals charge patients more than four times the cost of care,” National Nurses United, November 2020

HCA Healthcare was also found to have netted $1.6 billion from excessive emergency department admissions. A new analysis found the investor-owned hospital chain admits far more Medicare patients who visit its emergency departments compared to the national average. This practice of unnecessary admissions may have netted HCA excess Medicare payments of $1.6 billion since 2009. Banow, “Shareholder group calls out HCA for alleged excessive emergency department admissions,” Modern Healthcare, 3/2/2021

Hospitals have been invoking a century-old liens law to bypass insurance — especially Medicaid — and sue patients for the full cost of their care. Since Medicaid typically pays less than commercial insurance, hospitals realized that in the case of car accidents (where an insurance settlement was expected), it was more lucrative to bypass Medicaid and place a lien on patients’ accident settlements. For one patient, the hospital should have billed Medicaid for $2,500, but instead placed a lien for $12,856 — the “sticker price” charged to uninsured patients. These liens can ruin patients’ credit scores and leave them unable to pay for future care. The practice is so lucrative that some hospitals hire investigators to scan police accident reports in search of patients who might have been in a crash. Kliff and Silver-Greenberg, “How rich hospitals profit from patients in car crashes,” New York Times, 2/1/2021

High staff turnover in for-profit nursing homes likely contributed to high patient deaths during the pandemic. Nursing homes accounted for more than one-third of all Covid-19 deaths in the U.S., and high staff turnover rates made it harder for facilities to implement strong infection controls during the pandemic. Researchers found the average annual turnover rate was 128%, with some facilities experiencing turnover that exceeded 300%. Turnover rates were much higher at for-profit institutions and those owned by chains. Gandhi et al., “High nursing staff turnover in nursing homes offers important quality information,” Health Affairs, March 2021

When private equity (PE) firms acquire nursing homes, patients die more often. PE investment in nursing homes has exploded in recent years, from $5 billion in 2000 to more than $100 billion in 2018. Going to a PE-owned nursing home increased mortality for patients by 10% against the average. Researchers estimate that 20,150 lives of Medicare enrollees — about 1,000 deaths per year on average — were lost due to PE ownership of nursing homes from 2000 to 2017. PE-owned facilities tend to reduce staffing by 1.4%, as well as reduce the number of hours that front-line nurses spend providing basic but critically important patient services such as bed turning and infection prevention. Researchers also found a 50% increase in the use of antipsychotic drugs in PE facilities, which is associated with higher mortality in elderly people. Gupta et al., “Does private equity investment in healthcare benefit patients? Evidence from nursing homes,” National Bureau of Economic Research Working Paper 28474, February 2021

Top executives at the companies fighting hardest against Medicare for All earned more in compensation in 2020 than any other year. Despite the pandemic, the CEOs of commercial insurance, pharma, and investor-owned hospitals made record income, largely due to the value of their stocks. For example, David Cordani of Cigna made $79 million (six times as much as 2019), and $73 million of that came from stock. Dave Ricks of Eli Lilly made $68 million (twice as much as 2019), $58 million from stock. Sam Hazen of the HCA Healthcare hospital chain made $84 million (four times as much as 2019), with $66 million from stock. In 2019, the CEOs of 179 leading health care companies collectively took home almost $2.5 billion, an amount that is four times what the Centers for Disease Control and Prevention were allocated to study and prepare for all “emerging and zoonotic infectious diseases” in the year before the global pandemic. Herman, “Health giants disclose hefty pandemic year paydays for top executives,” Axios, 3/23/2021; and “Health care CEO pay outstrips infectious disease research,” Axios, 6/1/2020

Commercial Health Insurance: A Dangerous and Defective Product

Commercial insurers did little to relax prior authorization (PA) policies during the pandemic, causing delays in care and poor treatment outcomes for patients. In a new survey of providers, nearly all doctors (94%) reported care delays while waiting for PA, and 79% had patients abandon treatment due to PA struggles with insurers. One-third of physicians had a patient suffer a serious medical event as a result of delayed treatment, almost 20% said the delay caused a life-threatening event or hospitalization, and 9% said that PA led to a patient’s disability/permanent bodily damage, birth defect, or death. Physicians said they processed 40 PAs per week, which require 16 hours of additional work time. “2020 AMA prior authorization (PA) physician survey,” American Medical Association, 4/7/2021

Administrative “sludge” caused by health insurers costs the economy billions of dollars in employee stress, absenteeism, and reduced productivity. Researchers estimated that the direct cost of the time spent by employees dealing with health insurance representatives was $21.6 billion, with 53% of that time (worth $11.4 billion) spent at work. People who spent more time on the phone with their insurer were less satisfied with their workplace, less engaged, more likely to report significant stress and burnout, and more likely to have missed a day or more of work. The additional absences caused by insurance hassles are estimated to cost employers $26.4 billion; the productivity cost of reduced satisfaction was approximately $95.6 billion. Pfeffer et al., “Magnitude and effects of ‘sludge’ in benefits administration: How health insurance hassles burden workers and cost employers,” Academy of Management Discoveries, October 2020

One out of every six workers whose primary health insurance comes from an employer are staying in jobs they might otherwise leave out of fear of losing their health benefits. Black workers (21%) are more likely to say they would stay in an unwanted job for purposes of keeping their health benefits than white workers (14%). The fear of losing coverage is also pronounced among workers making less than $48,000 a year. Witters, “One in six U.S. workers stay in unwanted job for health benefits,” Gallup, 5/6/2021

Commercial insurers reported record profits in 2020 because enrollees utilized hospitals and doctors at much lower levels during the pandemic. UnitedHealth Group, the nation’s largest insurer, reported 2020 profits of $15.4 billion. Humana reported a profit of $4.6 billion, a 40% increase over its 2019 profits of $3.5 billion. Cigna took in $8.5 billion in profits, a 66% increase from its 2019 profits of $5.1 billion. Burns, “The pandemic one year in: Despite large profits in 2020, health insurers see volatility ahead,” Managed Healthcare Executive, 3/11/2021

And despite the pandemic, commercial insurance executives still had record paydays. Centene CEO Michael Neidorff made almost $59 million in 2020, roughly 1.5 times more than what he made in 2019. Centene collected $1.8 billion in profit, up 37% from 2019. Note that Centene gets almost all of its revenue from taxpayer-funded health programs, including Medicare Advantage, Medicaid managed care, military and federal employee plans, and health staffing in prisons and jails. Centene Corporation, Schedule 14A Preliminary Proxy Statement, U.S. Securities and Exchange Commission, 3/12/2021

Medicare Advantage & Medicaid Managed Care

Medicare Advantage (MA) increases national health spending. In 2019, the U.S. spent $3.8 trillion on health care, an increase of nearly 5% from 2018. While costs increased in nearly all sectors of health care, an outsized spending bump was seen in the MA program run by commercial insurers. MA costs increased 14.5% in 2019, up from an already high 12.6% growth in 2018. Per-capita enrollee spending in MA plans grew 6.3% in 2019, almost three times the 2.4% per capita growth rate of traditional (fee-for-service) Medicare. Martin et al., “National health care spending in 2019: Steady growth for the fourth consecutive year,” Health Affairs, 12/16/2020

2020 was an extremely profitable year for commercial insurers in Medicaid and Medicare. Last year, commercial insurers pocketed $200 in average gross margins per enrollee per month in their Medicare Advantage (MA) plans, up from $139 per month in 2018. By the end of 2020, 26.4 million people were enrolled in MA plans, up 41.4% from 2017. For Medicaid managed care plans, commercial insurers kept $71 per enrollee per month in gross margins, up from $36 in 2018. Last year, 53.9 million people were enrolled in Medicaid managed care plans, which accounts for 69% of all Medicaid enrollees. Tepper, “Insurers set sights on growth in Medicare Advantage, Medicaid managed care,” Modern Healthcare, 3/6/2021

More than one out of every 10 rural seniors (10.5%) in a Medicare Advantage (MA) plan switched to traditional Medicare between 2010 and 2016. By contrast, only 1.7% of rural enrollees in traditional Medicare moved to MA during this period. Switching from MA to traditional Medicare was driven primarily by low satisfaction with care access, and was most common among MA enrollees who experienced higher costs, such as hospitalization or long-term facility stay. Among those requiring more expensive services, rural enrollees were twice as likely to switch from MA to traditional Medicare as nonrural enrollees (16.8% versus 8.3%), suggesting that limited provider options in rural areas were a major factor for the change. Park et al., “Rural enrollees In Medicare Advantage have substantial rates of switching to traditional Medicare,” Health Affairs, March 2021

Medicare Advantage (MA) plans use “chart reviews” to extract more profits from taxpayers. MA plans receive capitated payments based on an enrollee’s number and severity of clinical conditions, but plans are allowed to review charts to add conditions not present in claims data (also known as “upcoding”), which increases their risk-adjusted payments. Examining encounter data from 2015, researchers found that MA plans’ “chart reviews” were associated with a $2.3 billion increase in payments, a 3.7% increase in Medicare spending going to MA plans. Just 10% of plans accounted for 42% of the additional spending attributed to chart review; among these plans, the relative increase in risk score from chart review was 17.2%. Meyers and Trivedi, “Medicare Advantage chart reviews are associated with billions in additional payments for some plans,” Medical Care, February 2021

A Humana Medicare Advantage plan in Florida improperly collected nearly $200 million by overstating how sick patients were. Certain conditions such as some cancers or uncontrolled diabetes net the plans more money from Medicare because they are costlier to treat, but auditors found that many of these conditions did not match patients’ medical records. For example, Medicare paid $4,380 too much in 2015 for treatment of a patient whose throat cancer had previously been resolved but was still claimed as active by the insurer. Auditors estimated that Humana received at least $197.7 million in net overpayments for 2015. Schulte, “Humana Health plan overcharged Medicare by nearly $200 million, federal audit finds,” Kaiser Health News, 4/20/2021

Dark Money in Health Care

New financial disclosures by the commercial insurance front group “Partnership for America’s Health Care Future” shed light on just how much the industry spends to block health care reform. In 2019, the group raised more than $55 million and spent roughly $20 million, ending the year with $36 million in assets, according to its tax return. During the 2020 Democratic presidential primary campaign, the Partnership spent $4.5 million on television ads attacking Medicare for All, and continues to spend millions to block a public option plan in Colorado. Sirota and Perez, “The establishment is gearing up against even a public option,” Jacobin, 12/ 9/2020

Insurers spent record amounts lobbying Congress as Democrats crafted new Covid relief bills in early 2021. America’s Health Insurance Plans spent $3.9 million on lobbying in the first quarter of 2021, a 7% increase over the same time period last year and the most AHIP has ever spent in a first quarter. Kaiser Foundation Health Plan (which is nonprofit) spent $2 million on lobbying in the first quarter of 2021, a 200% increase from the same time last year. Centene, which runs multiple Medicaid managed care, ACA, and Medicare Advantage plans, spent $1.4 million lobbying in the first quarter of 2021, an 80% increase from 2020. Hellmann, “Insurers spent more on lobbying as Congress debated ACA and COBRA subsidies,” Modern Healthcare, 4/20/2021

Pharma increased its lobbying spending by 6.3% in the first quarter of 2021. Drug and health product manufacturers, along with their national association, spent a combined $92 million to lobby the federal government from January through March; the industry’s first-quarter spending was more than double what was spent by the second-highest-spending industry, electronics companies. There are currently 1,270 registered lobbyists for pharmaceuticals and health products — more than two lobbyists for every member of Congress. “Industry Profile: Pharmaceuticals/Health Products,” Center for Responsive Politics, April 2021

The pharmaceutical industry funneled millions to prominent dark money groups that pushed pharma-friendly messages in the last election. In 2019, the Pharmaceutical Research and Manufacturers of America, or “PhRMA,” raised nearly $527 million — a $68 million increase from 2018 — and spent $506 million. The group’s largest political donation ($4.5 million) went to the American Action Network, a dark-money group that launched several multi-million dollar ad campaigns opposing both Pres. Trump’s proposal to let Medicare negotiate drug prices and House Democrats’ bill to lower drug prices. In 2019, PhRMA also gave nearly $1.6 million to Center Forward, a dark-money group aligned with moderate “Blue Dog” Democrats. Evers-Hillstrom, “Pharma lobby poured millions into ‘dark money’ groups influencing 2020 election,” Center for Responsive Politics, 12/8/2020

Public Support for Reform

Voters want bold action on health care reform. Covid-19 has made health care reform a priority for voters regardless of political affiliation, race, location, or background. Three in four voters say health care should be a high priority for Pres. Biden and Congress this year, including a strong majority of Democrats (91%), independents (75%), and Republicans (58%). More than eight in ten voters believe that the health care system today “works more for the benefit of the insurance and drug industries than the average person.” Roughly nine in ten voters say it is important for Congress and the president to take action to lower drug prices and health care costs this year. Rather than being worried about Congress “going too far,” 67% of voters (including majorities of Democrats, independents, and Republicans) are concerned that Congress will not go far enough to bring down drug costs. “Finishing the Job: Americans want action on the cost of health care this year, new poll shows,” Families USA and Hart Research Associates, March 2021

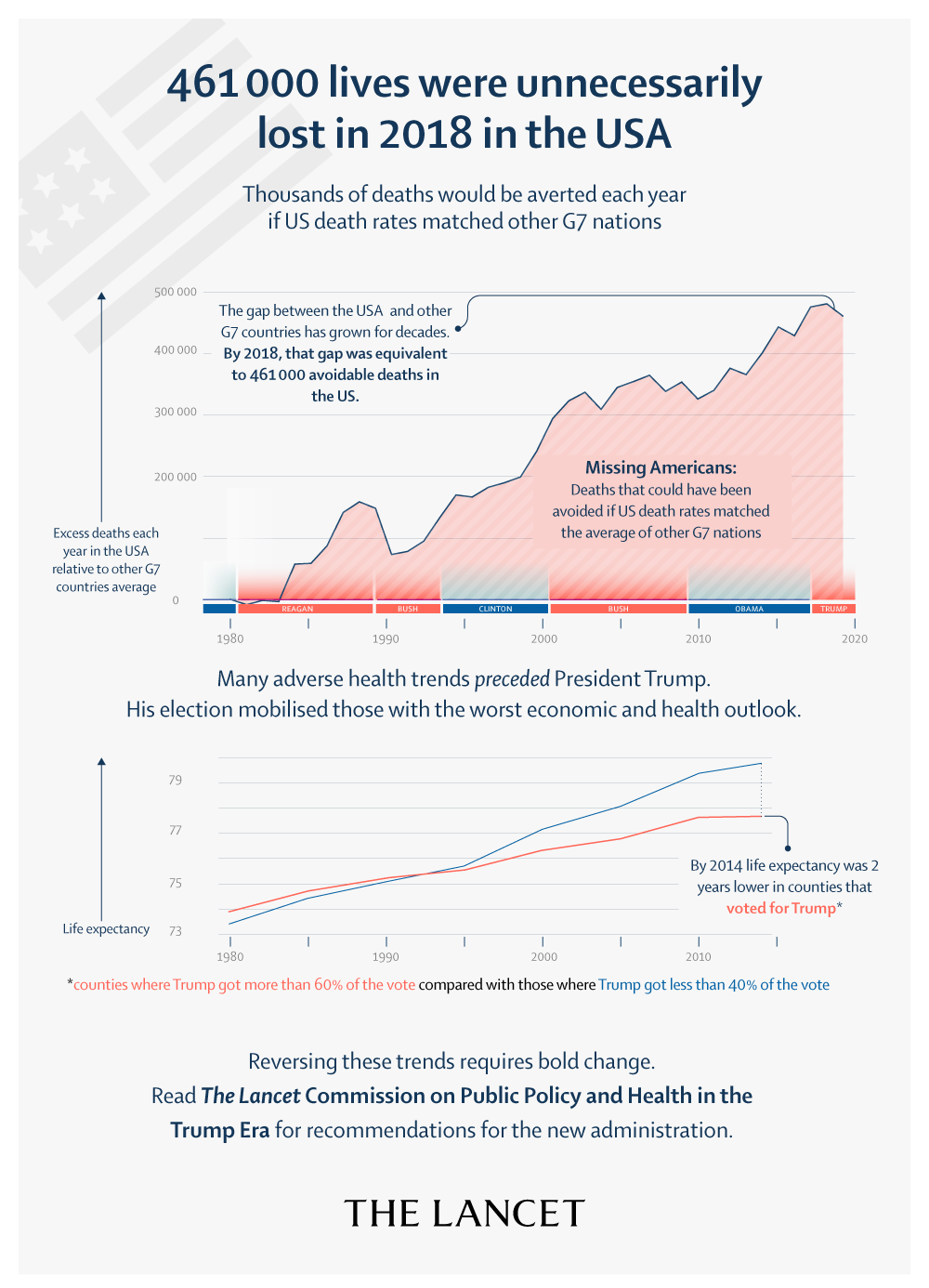

Featured report: The Lancet Commission on public policy and health in the Trump era

This February 10, 2021 report from the Commission offers the first comprehensive assessment of the detrimental legislation and executive actions during Trump’s presidency, while also tracing the preceding decades of policy failures that left the U.S. lagging behind other high-income nations on life expectancy. The report warns that a return to pre-Trump era policies is not enough to protect health. Instead, sweeping reforms are needed to redress long-standing racism, weakened social and health safety nets that have deepened inequality. The Commission includes PNHP members Drs. Adam Gaffney, Steffie Woolhandler, David U. Himmelstein, Mary Bassett, Olveen Carrasquillo, Danny McCormick, Linda Prine, Altaf Saadi, David Bor, Samuel Dickman, Kevin Grumbach, Martin Shapiro, Lello Tesema, and Micheal Lighty, MA and Richard Gottfried, JD.

Among the report’s topline findings:

- 461,000 fewer Americans would have died in 2018, and 40% of U.S. deaths during 2020 from COVID-19 would have been averted if the U.S. had death rates equivalent to those of the other G7 nations;

- The U.S. was uniquely unprepared for the pandemic due to its degraded public health infrastructure. Between 2002 and 2019, public health spending fell from 3.21% to 2.45% – approximately half the share of spending in Canada and the UK; 50,000 state and local health department jobs were cut, effectively reducing the front-line workforce by 20%;

- Prior to the pandemic, midlife mortality for Indigenous and Black Americans was 59% and 42% higher, respectively, than for white people. The pandemic has widened the Black-white mortality gap by 50%, and has cut Latinx life expectancy by more than 3.5 years;

- Between 2016 and 2019, the number of annual deaths from environmental and occupational factors increased by more than 22,000 after years of steady decline;

- Even before the pandemic, the number of uninsured Americans grew by 2.3 million during Trump’s presidency, including 726,000 children.

For additional materials, including video of the introductory panel discussion and media coverage of the Lancet Commission report, visit pnhp.org/LancetCommission.

Studies and analysis of interest to single-payer advocates

“Pricing universal health care: How much would the use of medical care rise?” by Adam Gaffney, M.D., M.P.H., David U. Himmelstein, M.D., Steffie Woolhandler, M.D., M.P.H., and James G. Kahn, M.D., M.P.H. Health Affairs, Jan. 5, 2021. This new study concludes that predictions of large cost increases under a single-payer system are likely wrong, and that universal coverage increases the overall use of care only modestly or not at all. The finite supply of providers’ time and hospital beds has constrained cost and utilization increases in essentially all past coverage expansions; new services would likely be offset by reductions in useless or low-value care currently over-provided to the well-off.

“Congressional Budget Office scores Medicare for All: Universal coverage for less spending,” by Adam Gaffney, M.D., M.P.H., David Himmelstein, M.D., and Steffie Woolhandler, M.D., M.P.H., Health Affairs Blog, Feb. 16, 2021. For the first time in a quarter century, the CBO issued an economic analysis of single-payer reform, projecting that it would achieve universal coverage, bolster provider revenues, and eliminate almost all copayments and deductibles, even as it reduced overall health spending. The authors discuss the CBO’s estimates of national health spending, the implications for providers, and concerns about “provider congestion” under a single-payer system.

“The health costs of cost-sharing,” by Amitabh Chandra, Evan Flack, and Ziad Obermeyer, National Bureau of Economic Research Working Paper 28439, Feb. 2021. Even a modest increase in out-of-pocket costs has shown to significantly lower medication adherence and increase mortality among senior patients. Raising patients’ out-of-pocket costs by just $10 per prescription led to a 23% drop in overall drug consumption, and to a 33% increase in mortality. When faced with higher costs, seniors did not drop “low-value” drugs, but instead cut back life-saving, high-value medications.

“Medicare Advantage for all? Not so fast,” by Ken Terry and David Muhlestein, Health Affairs, March 11, 2021. Some health policy experts have suggested that the best route to universal coverage might be to expand Medicare Advantage (MA) rather than enact Medicare for All. However, MA plans have not saved Medicare any money relative to traditional Medicare. To the extent that they lower costs, the lion’s share of those savings flow to insurance companies, partly in the form of profits: Between 2016 and 2018, annual gross margins in the MA market averaged $1,608 per covered person.

“Income-related inequality in affordability and access to primary care in eleven high-income countries,” by Michelle M. Doty, Roosa S. Tikkanen, Molly FitzGerald, Katharine Fields, and Reginald D. Williams, Health Affairs, Dec. 9, 2020. Compared to peers in ten other high-income countries, low-income adults in the U.S. fared worse on affordability of care, including skipping needed doctor or dentist visits, tests, treatments, follow-up, and prescription medicines because of cost, and having serious problems paying medical bills. Low-income Americans had worse access to primary care, with relatively few having a regular provider and more having avoidable emergency department visits.

“Unprepared for COVID-19: How the pandemic makes the case for Medicare for All,” by Eagan Kemp and Kate Thomas, Public Citizen, March 2021. Despite having less than 5% of the world’s population, the U.S. has had 25% of the world’s confirmed Covid-19 cases and 20% of the deaths. This white paper lays out how the for-profit health care system left the U.S. vulnerable and unprepared for the pandemic, and how a single-payer system would have helped the U.S. response to the crisis and prevented thousands of deaths.

“We are all in this together: Covid-19 and the case for Medicare for All,” by Hebah Kassem, Congressional Progressive Caucus Center, March 2021. Produced in collaboration with PNHP and other Medicare for All coalition partners, this report explains why the U.S. health care system was so dreadfully unprepared for a pandemic and how Medicare for All would address the deficiencies in our current system to ensure that everyone has guaranteed comprehensive health care.

“Draining the pool: Our collective responsibility to end racism in medicine,” by Vanessa E. Van Doren, M.D., and Tracey L. Henry, M.D., M.P.H., M.S., Society of General Internal Medicine Forum, October 2020. In this opinion piece, two young physicians urge their colleagues to first acknowledge that the institution of medicine is steeped in a tradition of racism, and then do the uncomfortable work of evaluating whether their own institutions are living up to their moral promise.

“Health care roulette: What is likely to kill me first?” by Vanessa E. Van Doren, M.D., and Tracey L. Henry, M.D., M.P.H., M.S., Annals of Internal Medicine (Fresh Look), Oct. 28, 2020. A doctor-in-training describes the frustration and heartbreak she feels when patients can’t afford the interventions needed to stay alive, forcing her to play a form of health care “roulette” to decide which treatment is most urgent and which to defer because of cost. With Medicare for All, “rather than betting—with their lives—about which medical conditions to address, we could simply provide the standard of care.”

PNHP Chapter Reports

California

PNHP California endorsed A.B. 1400, the single-payer California Guaranteed Health Care for All bill, as well as H.R. 1976 in the U.S. House. The Santa Barbara chapter held several events to pressure elected officials to support these bills, including a caravan of 40 cars carrying Medicare-for-All signs in February, and a march to the offices of state legislators Monique Limón and Steve Bennett in April. Members also helped circulate a statewide petition demanding that Gov. Newsom apply for federal waivers allowing the state to implement single payer. At the local level, chapters in Chico, Sonoma, and Santa Barbara successfully passed Medicare-for-All resolutions in their city councils. PNHP-CA just welcomed a chapter of Students for a National Health Program (SNaHP) at the new Kaiser Permanente Bernard J. Tyson School of Medicine in Pasadena. To get involved in California, contact Dr. Kathleen Healey at khealey.ent@gmail.com.

Colorado

In January, PNHP-CO collaborated with SNaHP leaders at the University of Colorado to host a forum called, “Medicare for All 101.” PNHP-CO co-directors Drs. Rick Bieser and Cecile Rose were the keynote speakers at the “Beyond the ACA” forum sponsored by Health Care for All Colorado. PNHP members are also active in the statewide “Push to Pass” coalition which is pushing the state’s Congressional delegation to support emergency Medicare coverage for the unemployed and a permanent Medicare-for-All program. The coalition recently met with staff members for Rep. Diana DeGette, and Sens. John Hickenlooper and Michael Bennet. To get involved in Colorado, contact Dr. Bieser at rgbieser@gmail.com.

Illinois

PNHP and SNaHP members are part of a coalition that won over two new co-sponsors for H.R. 1976, the Medicare for All Act of 2021. Rep. Mike Quigley signed on for the first time after years of pressure from local activists, and newly elected Rep. Marie Newman signed on after defeating a Democratic incumbent who refused to support single payer. SNaHP students

Paul Ehrlich and Alankrita Siddula met with Rep. Newman in April to encourage her to provide more leadership for Medicare for All among her colleagues. PNHP Illinois also supports “Save Our VA,” a campaign that works to improve benefits and oppose privatization, union busting, and facility closures at Veterans’ Health facilities. To get involved in Illinois, contact Dr. Anne Scheetz at annescheetz@gmail.com.

Kentucky

Kentuckians for Single Payer Health Care is working to protect seniors from being charged more or denied a “Medigap” policy because of pre-existing conditions. The group found that many seniors who first enrolled in Medicare Advantage (MA) plans run by commercial insurers later switched to traditional Medicare because of MA’s narrow networks and hidden costs. But when seniors switched to Medicare they were often denied coverage for supplemental “Medigap” policies due to pre-existing health conditions. KSPHC is helping to pass a state bill that would forbid commercial insurers from denying coverage based on factors such as age, health status, claims experience, or medical condition. In addition to their work on Medigap plans, chapter leaders have spoken at several events, including a hearing at a church in Louisville and a meeting of residents in internal medicine. To get involved in Kentucky, contact Kay Tillow at nursenpo@aol.com.

Maine

Maine AllCare has recently formed a new nonprofit called Maine Health Care Action. In January, MHCA launched a ballot initiative that would direct the state legislature to “create a bill that ensures comprehensive, publicly funded, privately delivered health care for every Maine citizen.” The resolve language has already been accepted by the Secretary of State and needs 63,067 signatures to appear on the ballot in November of 2022. In 2021, chapter members passed Medicare-for-All resolutions in the towns of Brooklin, Surry, Tremont, Brooksville, and Bar Harbor, in addition to the five municipal resolutions passed in 2020. To get involved in Maine, contact info@maineallcare.org.

Minnesota

In honor of Black History Month, PNHP-MN partnered with Health Care for All Minnesota and the Minnesota Nurses Association to host a February screening and discussion of “The Power to Heal.” In April, the chapter hosted a presentation on the economics of single payer by health economist Dr. John Nyman, who explained that six leading studies all conclude that Medicare for All can save money while expanding coverage. Dr. Nyman was also a key advisor to PNHP-MN interns Conor Nath and Preethiya Seka, who analyzed numerous single-payer financing studies during the summer of 2020, and whose conclusions can be read at pnhp.org/PayingForIt. To get involved in Minnesota, contact pnhpminnesota@gmail.com.

Missouri

PNHP-MO is working with other consumer groups in the state to develop an educational and advocacy campaign about the hazards of the Medicare Advantage program run by commercial insurers. The campaign will focus on the lack of consumer protections, guaranteed issue, and community rating for Medigap plans, which create a trap for seniors who join Medicare Advantage. The coalition is pursuing a grant that could fund an actuarial analysis, professional message development, and the launch of a community educational campaign. To get involved in Missouri, contact Dr. Ed Weisbart at pnhpMO@gmail.com.

New Hampshire

The Granite State PNHP chapter worked with local activists to introduce Medicare-for-All resolutions in two towns, one of which passed successfully. Chapter leaders have also given online presentations about single payer to a number of Rotary groups in the state. This summer, the chapter is collaborating with colleagues in Vermont to once again sponsor an internship for medical students. To get involved in New Hampshire, contact Dr. Donald Kollisch at Donald.O.Kollisch@dartmouth.edu.

New York

PNHP members in New York are working to pass the single-payer New York Health Act, which was introduced this year with majority support in both the House and the Senate. On March 23, the NY Metro chapter held a Health Worker, Student, and Resident Virtual Lobby Day, where activists attended workshops and met with state legislators and their staff. The chapter continues to hold online forums on health care justice topics. January’s forum on systemic racism in medicine, called “Unequal Treatment: The Unjust Death of Dr. Susan Moore,” included prominent speakers Drs. Mary Bassett, Mary Charlson, and Camara Phyllis Jones, who discussed the importance of demanding institutional accountability for change. The forum in March explored how a state single-payer program would spur an equitable economic recovery from the pandemic. To get involved in New York, contact NY Metro Executive Director Bob Lederer at info@pnhpnymetro.org.

North Carolina

Members of Health Care Justice NC in Charlotte met with Rep. Alma Adams ahead of the introduction of the 2021 Medicare for All Act in the House. They encouraged her to be an original co-sponsor of the bill and to broaden her advocacy for single payer. Chapter leaders also met with a member of the Mecklenburg County Commission to discuss a proposal for restorative justice in Charlotte as well as a county resolution for Medicare for All. The area’s SNaHP members continue to produce short videos that can be viewed at newimprovedmedicareforall.org. To get involved in Health Care Justice NC, contact Dr. Jessica Schorr Saxe at jessica.schorr.saxe@gmail.com.

Members of Health Care for All NC held an emergency Human Rights Day press conference on December 10. Speakers from PNHP, the National Domestic Workers Alliance, Charlotte City Workers Union, the NC Council of Churches, and the NC Medicare for All Coalition discussed the pandemic’s toll on the health of Americans and demanded single-payer Medicare for All.

As a follow-up action, the NC Medicare for All Coalition held a series of “Medical Bill Burns” in Charlotte, Asheville, and Durham where participants burned their medical bills and shared their health care horror stories; the burn events were covered by several local news outlets. To get involved in Health Care for All NC, contact Jonathan Michels at jonscottmichels@gmail.com.

Healthcare For All – Western North Carolina (HCFA-WNC) launched a YouTube channel to share health care stories from community members, as well as a special page on their website with resources to fight racism and white supremacy. The chapter is working on passing a Medicare-for-All resolution in the Asheville city council, and forming a broader coalition with other groups in the area such the Sunrise Movement, the Poor People’s Campaign, and National Nurses United. To get involved in HCFA-WNC, contact Terry Hash at theresamhash@gmail.com.

Oregon

PNHP members are active on the Oregon Universal Care Task Force. Dr. Samuel Metz serves on the Finance and Revenue subcommittee and has developed a financing plan for a potential state single-payer system. In April, Dr. Metz debated Michael Cannon of the Cato Institute in a lively event hosted by the Oregon Health Forum, “Single Payer vs. Free Market: A Debate on the Future of Healthcare.” In Corvallis, members are organizing several events this spring and early summer, including a town hall on how to fund universal health care in Oregon, how to finance Medicare for All nationally, and on racial inequities in health care. To get involved in Oregon, contact Dr. Peter Mahr at peter.n.mahr@gmail.com.

Pennsylvania

Members of PNHP’s chapter in Western Pennsylvania, along with local medical students, organized a flu vaccine clinic for steelworkers in Farrell, Penn. who had lost their comprehensive health coverage during an ongoing strike. In April, the chapter sponsored PNHP’s webinar called “Addressing Racial Inequity in Healthcare: Strategies in the Fight for Achieving Health Justice.” To get involved in Western PA, contact Dr. Judy Albert at jalbertpgh@gmail.com.

In Philadelphia, Dr. Walter Tsou gave a presentation on health care as a public good to the Progressive Democrats of America’s national meeting in January. In March, PNHP members met with the chief of staff for Rep. Dwight Evans to discuss why he hasn’t co-sponsored H.R. 1976. Then in April, members of PNHP, Healthcare-NOW!, the Labor Campaign for Single Payer, and Philly DSA organized a social media and phone “zap,” a series of coordinated phone calls and social media posts directed at Reps. Evans, Mary Gay Scanlon, and Madeleine Dean, the Philadelphia-area members of Congress who have so far refused to sponsor H.R. 1976. To get involved in Philadelphia, contact Dr. Walter Tsou at walter.tsou@verizon.net.

Vermont

In November, the Vermont Medical Society (VMS) overwhelmingly endorsed a single-payer resolution that was introduced by Dr. Jane Katz Field, a pediatrician and vice president of Vermont PNHP. The VMS, which represents 2,400 physicians and physician assistants, is only the second state medical society in the U.S. after Hawaii to endorse a national single-payer program. Dr. Katz discussed the resolution campaign on the Medicare for All Explained podcast. Chapter members also worked to pass Vermont’s first Medicare-for-All municipal resolution in the town of Putney; it was approved by a ratio of five to one. PNHP and SNaHP leaders recently met with the legislative assistant to Sen. Bernie Sanders to discuss the differences between the Medicare-for-All bills in the Senate and House, and to urge Sen. Sanders to update his bill to more closely align with the House version, especially regarding global budgeting of hospitals. The chapter is expanding its summer internship to accommodate up to 19 medical students and is seeking outside speakers and trainers from June 14 to July 16. To get involved in Vermont, contact Dr. Betty Keller at bjkellermd@gmail.com.

Washington State

PNHP Western Washington changed its name to “PNHP Washington” to better reflect the chapter’s goals and to encourage participation across the state. Throughout the pandemic, the chapter has held monthly meetings via Zoom on various topics related to single-payer advocacy. Chapter leaders are also involved in efforts to achieve universal coverage in the state. PNHP-WA president Dr. Sherry Weinberg serves on the Work Group for Universal Health Care, appointed by the state legislature to develop universal health care legislation; PNHP-WA coordinator Dr. David McLanahan is a member of the Health Care is a Human Right coalition steering and coordinating committees, which promote both state and national Medicare-for-All programs. To get involved in Washington, contact Dr. McLanahan at mcltan@comcast.net.

PNHP in the News

News Articles Quoting PNHP Members

National Outlets:

- “Roughly 40% of the USA’s coronavirus deaths could have been prevented, new study says,” USA Today, Feb. 11, 2021 [Drs. Steffie Woolhandler and David Himmelstein]

- “40% of U.S. COVID deaths could have been averted if it weren’t for Trump: Report,” Newsweek, Feb. 12, 2021 [Drs. Steffie Woolhandler and Mary Bassett]

- “The essential pandemic relief bill is Medicare for All,” The Nation, March 17, 2021 [Dr. Susan Rogers]

- “Jayapal, Dingell introduce Medicare for All Act with 112 co-sponsors,” Common Dreams, March 17, 2021 [Dr. Susan Rogers]

- “New Medicare for All bill gets support of some docs, nurses,” Medscape, March 22, 2021 [PNHP]

- “About 7 in 10 voters favor a public health insurance option. Medicare for All remains polarizing,” Morning Consult, March 24, 2021 [Dr. Susan Rogers]

- “The UK’s vaccine rollout is the latest reminder we need universal health care,” In These Times, March 30, 2021 [Drs. James Kahn, Steffie Woolhander, and Margaret Flowers]

- “Why don’t more companies support single-payer health care?” WhoWhatWhy, April 15, 2021 [Dr. Susan Rogers]

Local Outlets:

- “The car caravan: a Covid-era demonstration for healthcare,” Sonoma Valley Sun, Feb. 3, 2021 [Dr. Mary McDevitt]

- “Under the Sun: Mary McDevitt, M.D.” Sonoma Valley Sun, Feb. 14, 2021 [interview with local PNHP leader Dr. Mary McDevitt]

- “Board of Alders considers endorsing Medicare for All,” Yale Daily News, April 4, 2021 [Tanvee Varma, SNaHP leader at Yale School of Medicine]

- “Single-Payer Action Network Ohio to walk for healthcare justice May 22 in Lakewood,” Cleveland Plain Dealer, May 18, 2021 [Dr. Matt Noordsij-Jones]

TV and Video

“40% of U.S. COVID deaths were preventable. The country needs universal healthcare now,” Democracy Now, Feb. 15, 2021 [Dr. Mary Bassett]

“The Inside Scoop,” Fairfax, Virginia, March 13, 2021 [Dr. Jay Brock]

“House reintroduces Medicare-for-All Bill,” Rising Up with Sonali, March 18, 2021 [Dr. Paul Song]

“The Mehdi Hasan Show,” March 24, 2021 [Dr. Adam Gaffney]

Radio and Podcasts

- “Discussing a single-payer health system and the Campaign for New York Health,” Rochester Public Radio, Feb. 25, 2021 [Mahima Iyengar, medical student at University of Rochester School of Medicine]

- “With latest California single-payer health care bill shelved, advocates push Newsom for support,” Capital Public Radio, April 30, 2021 [Dr. James Kahn]

- “The pandemic exposed how vulnerable U.S. health care is. What will it take to expand universal coverage & Medicare for All?” San Francisco Public Radio, May 12, 2021 [Dr. Micah Johnson]

Opinion: Op-eds and Guest Columns

National Outlets:

- “What is the “Public Option?” Can it compete with private health insurers?” by Dr. John Geyman, Counterpunch, Jan. 8, 2021

- “It’s time to end abhorrent medical debt that consumes families,” by Rohit Anand, medical student at Case Western Reserve University School of Medicine, Common Dreams, Jan. 18, 2021

- “Medicare for All would have ensured the US had a better pandemic response,” by Drs. Abdul El-Sayed and Micah Johnson, CNN, Feb. 11, 2021

- “Our failing healthcare system costs us countless lives. It’s time to adopt Medicare for All,” by Dr. Adam Gaffney, Salon, Feb. 11, 2021

- “Trump’s policy failures have exacted a heavy toll on public health,” by Drs. David U. Himmelstein and Steffie Woolhandler, and Jacob Bor, ScD, SM; Scientific American, March 5, 2021

- “The private health insurance industry: Should it be eliminated?” by Dr. John Geyman, Counterpunch, March 8, 2021

- “The American Rescue Plan does not fix our fundamentally flawed healthcare system. We need Medicare for All,” by Dr. Ed Weisbart, Common Dreams, March 17, 2021

- “Winning Medicare for All would have massive implications beyond health care,” by Jonathan Michels, Jacobin, March 31, 2021

- “Covid-19 vaccinations: A shot in the arm for universal health care?” by Dr. Philip Caper and Peter Arno, PhD., Common Dreams, May 5, 2021

Local Outlets:

- “Why should Oregon work so hard to bring single-payer health care?” by Dr. Samuel Metz, The Bulletin, Jan. 8, 2021

- “America’s health care system no match for pandemic,” by Dr. James Fieseher, Seacoast Journal (Maine), Jan. 21, 2021

- “Single-payer, publicly administered, health care system is the best solution,” by Dr. Daniel Schaffer, Lynnette Vehrs, RN, Cris M. Currie, RN, and Dennis Dellwo, JD; The Spokesman Review (Spokane, Wash.), Jan. 26, 2021

- “The Haven debacle shows the need to adopt Medicare for All,” by Dr. Donald Frey, Omaha World Herald, Jan. 26, 2021

- “Diagnosing health care in America: The case for Medicare for All,” by Drs. Abdul El-Sayed and Micah Johnson, Detroit Metro Times, Feb. 3, 2021

- “Why America is overpaying for health care,” by Dr. Robert Funke, The Times News (Tennessee), Feb. 3, 2021

- “Single payer is the solution, but can we afford it?” by Patty Harvey, Eureka Times Standard (California), Feb. 9, 2021

- “Why Medicare-for-All is good for our towns,” by Dr. Jane Katz Field, Brattleboro Reformer (Vermont), Feb. 18, 2021

- “It’s time to uncouple insurance from employment,” by Dr. Robert Funke, The Times News (Tennessee), Feb. 21, 2021

- “COVID shows flaws in health care system; Medicare for All would solve problems,” by Patty Christensen, RN, The Free Press (Minnesota), Feb. 24, 2021

- “Putney voters, send a message about universal health care,” by Dr. Jane Katz Field, The Commons (Vermont), Feb. 24, 2021

- “Tax-payer subsidized private health insurance can’t make coverage affordable,” Dr. J. Mark Ryan, Uprise Rhode Island, Feb. 24, 2021

- “Want more NM health care providers? Improve the system,” by Drs. John Mezoff, Kathy Mezoff, Doris Page, and Davena Norris; Albuquerque Journal, March 10, 2021

- “Health care is too expensive. Medicare for all is the solution,” by Dr. William Babson, Jr., Bangor Daily News (Maine), March 17, 2021

- “Health Insurance 101: Why health insurance cannot work like other insurance and Medicare for All is required,” by Dr. Jim Cowan, Uprise Rhode Island, March 29, 2021

- “COVID highlights need for meaningful health care reform,” by Dr. Marc H. Lavietes, Staten Island Advance, April 21, 2021

- “COVID-19 vaccine rollout in the face of racial inequities in health care system,” by Arika Shaikh and Kalyani Ballur (both M1 at the Medical College of Georgia), Augusta Chronicle, April 29, 2021

- “Why the “Public Option” cannot work (and single payer can),” by Dr Anita Kestin, Uprise Rhode Island, May 5, 2021

- “Medicare for All makes economic sense for Western North Carolina,” by Dr. Ellen Kaczmarek and Theresa Hash, Mountain Express (Asheville, NC), May 5, 2021

Opinion: Letters to the Editor

National Outlets:

- “Stop tinkering with health care and start fixing it,” by Dr. Jay Brock, Washington Post, Jan. 15, 2021

- “Our medical system was demoralizing health care workers long before the pandemic,” (two letters) by Dr. Robert S. Vinetz and Dr. Nancy Greep, Los Angeles Times, March 10, 2021

- “Too much choice is ruining us,” by Dr. Elizabeth Rosenthal, The New York Times, March 14, 2021

- “Health insurance does not equal universal health care,” by Joseph Sparks, Washington Post, March 22, 2021

- “High bills for Covid tests at a hospital E.R.,” by Dr. Eric Manheimer, New York Times, April 7, 2021

Local Outlets:

- “Fixes shouldn’t hurt Americans,” by William Bianchi, Chicago Tribune, Jan. 10, 2021