In U.S., Healthcare Insecurity at Record Low

By Jeffrey M. Jones and Nader Nekvasil

Gallup, June 20, 2016

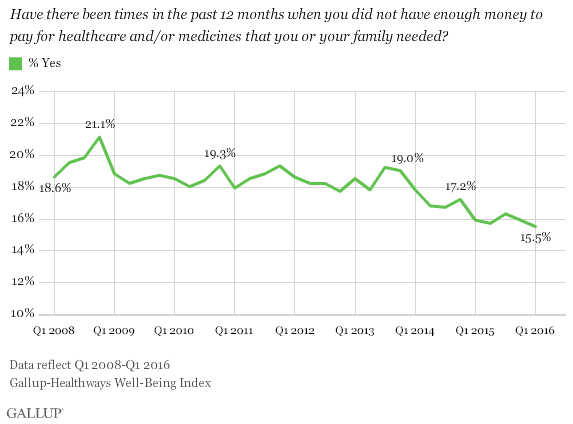

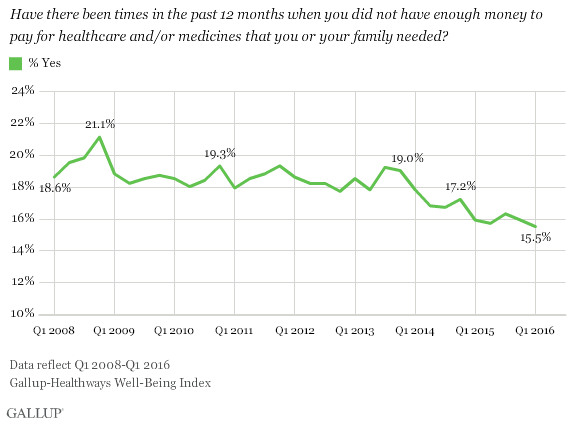

Fewer Americans reported not having enough money in the past 12 months to pay for necessary healthcare and/or medicines for themselves or their families than at any point since Gallup and Healthways began tracking this metric in 2008. From 2008 through 2013, the percentage of Americans who experienced difficulty in the past 12 months affording healthcare and medicine was fairly steady, hovering near the average of 18.7%. Since then, the average has been 16.4%, including the new quarterly low of 15.5% in the most recent quarter.

The increase in the percentage of Americans having health insurance is likely a key reason why fewer Americans are struggling to pay for healthcare. Generally, those without health insurance are at least three times more likely to report not having enough money for healthcare/medicine than their counterparts with health insurance. In the most recent quarter, 41.8% of the uninsured said they had struggled to pay for healthcare costs, compared with 12.3% of those with insurance.

Bottom Line

Although roughly one in six Americans report having times in the past year when they were unable to afford the healthcare or medicine they needed, this is down significantly from just three years ago. The expansion of health insurance coverage to millions more Americans under the Affordable Care Act is likely a major factor in the decline of healthcare insecurity, demonstrating a concrete benefit of the law.

At the same time, there are growing concerns that health insurance costs are set to rise in many parts of the country, as insurers and states adjust to the new healthcare market. These increases would mostly affect Americans who do not qualify for a health insurance subsidy under the Affordable Care Act.

http://www.gallup.com/poll/192914/healthcare-insecurity-record-low.aspx

***

Comment:

By Don McCanne, M.D.

The headlines reporting the results of this Gallup survey are celebrating the decline in health care insecurity (e.g., “Fewer Americans Are Having Trouble Paying Health Care Bills, Gallup Finds” – Kaiser Health News). Although any improvement is always good news, a 17 percent decline in health care insecurity is not much to celebrate (declining from 18.7% to 15.5%). Filling the glass less than one-fifth full is disappointing when we could have had a full glass.

The graph in the article shows a very modest decline, but even it is deceptive since it is truncated. The bottom of the graph is cut off at 10% and the top at 24%, but imagine showing the range at 0% to 100%. The curve would look quite flat, demonstrating visually how unimpressive the gain is.

Although it is shameful that 41.8% of the uninsured are struggling with medical bills, 12.3% of those who are insured still face health care insecurity, and many of the insured who are not have simply been fortunate enough to not require a significant amount of health care. So having insurance is not working well for many of those who do need health care.

The health care insecurity described refers only to medical bills; it does not refer to other costs of illness such as lost income. But a well designed single payer system with first dollar coverage for all essential health care services could virtually eliminate medical bills (though a person might still be responsible for charges for services and products that might not be appropriate for a taxpayer financed system). Removing financial barriers is a crucial step toward improving health care access.

Let’s enact single payer. Then we can celebrate.