Health Care Cost Institute, January 2018

The Health Care Cost Institute’s (HCCI) 2016 annual report on U.S. health care cost and utilization trends finds that Americans under the age of 65 who were insured through their employer spent more than ever on health care, and spending grew faster in 2016 than in recent years.

The report covers the period 2012 through 2016 and includes claims data from four national insurance companies: Aetna, Humana, Kaiser Permanente, and UnitedHealthcare.

Health Care Spending Trends

Health care spending per person for the commercially insured reached a new high of $5,407 in 2016. Total spending per person in 2016 was 4.6% higher than 2015. This was the highest annual total spending growth observed during the 2012-2016 study period; much greater than the 2.8% growth from 2012 to 2013.

Increasing Prices Drive Health Care Spending Growth

Health care spending is the product of two components: price and utilization. From 2012 to 2016, increases in spending were almost entirely attributable to increases in price. In 2016, high growth in prices was partially offset by a net decrease in utilization.

From 2012 to 2016, we observed increases in prices each year and across nearly all service categories. The greatest cumulative price increase was seen in prescription drugs, with 24.9% price growth. Inpatient services also experienced very high price growth, with prices increasing 24.3% between 2012 and 2016.

In contrast, utilization of most services declined over the 2012-2016 period, with the exception of prescription drugs, which increased 1.8%. The utilization of inpatient services had the largest decline, with admissions rates decreasing 12.9% between 2012 and 2016. This decline in use resulted in relatively low inpatient spending growth despite the high price growth. Conversely, the small increase in use of prescription drugs, coupled with high price growth, led to very high spending growth.

Inpatient Spending Trends

Between 2012 and 2016, spending on inpatient admissions grew 8%.

The biggest driver of the higher inpatient spending in 2016 was surgical admissions.

Inpatient Use Continued to Decline but Prices Rose Substantially

Within the inpatient category, declines in the use of both medical admissions and surgical admissions drove the overall decline in utilization. Every sub-category of inpatient admissions experienced double-digit price increases, with cumulative growth ranging from 18% to 30%. The increase in prices more than made up for the decline in use, causing inpatient spending to increase between 2012 and 2016.

Outpatient Spending Trends

In 2016, outpatient services had the highest annual spending growth of any service category, at 6%.

Within the outpatient services category, emergency room (ER) visits and outpatient surgeries accounted for the largest share of spending.

Outpatient Prices Drove Spending Growth

From 2012 to 2016, utilization of most outpatient services declined, but we did observe modestly higher utilization of ancillary services and emergency room visits towards the end of the study period.

Emergency room visits. Between 2012 and 2016, the price of an outpatient ER visit increased by 31%. The price increase, in combination with the slight increase in use, drove 40% of the increase in total outpatient spending between 2012 and 2016.

Outpatient surgery. Prices rose 19% from 2012 to 2016. Despite the decline in use, surgery continued to account for the largest share of outpatient spending and was responsible for 28% of the cumulative increase in spending on outpatient services.

Professional Services Spending Trends

Professional services—including visits to physicians, administered drugs, anesthesia, radiology, pathology, and related services–made up the largest share of health care spending in 2016, but had relatively low spending growth between 2012 and 2016, rising a cumulative 11%.

Utilization of PCP and Specialist Visits is Shifting

We rarely observe a decline in spending on health services. Within the professional services category, however, two types of services had net declines from 2012 and 2016. Spending on professional radiology services fell by 3%, but more striking was the 6% decrease in spending on office visits to PCPs.

The decline in spending on PCP office visits over the study period was driven by the 18% decline in use of these visits. In contrast, the increased utilization of specialist visits contributed to a 31% spending increase for those visits.

Prescription Drug Spending Trends

Prescription drugs had the highest cumulative spending growth (27%) of any service category during the study period.

Out-Of-Pocket Spending Trends

From 2012 to 2016, total OOP spending per person increased slightly each year. In dollars, the average increase was relatively small – a total of $88. It is important to note that our OOP data does not include consumer spending on premiums, which studies suggest are rising considerably and adding to the overall health care spending burden for consumers. In addition, our per person OOP metrics do not reflect the OOP costs of using a certain service, but consider OOP spending as an average across the population – including those who used no services at all.

The cumulative growth in OOP spending (12%) was outpaced by total spending (15%). However, like total spending, OOP spending growth appears to be on the rise after a few years of relatively low growth. In 2016, we observed a modest increase of 3.6% in OOP spending per person, up from a 2.9% increase in 2015.

http://www.healthcostinstitute.org…

***

Comment:

By Don McCanne, M.D.

This study is important because it shows what impact private commercial health plans offered by employers are having on prices and utilization.

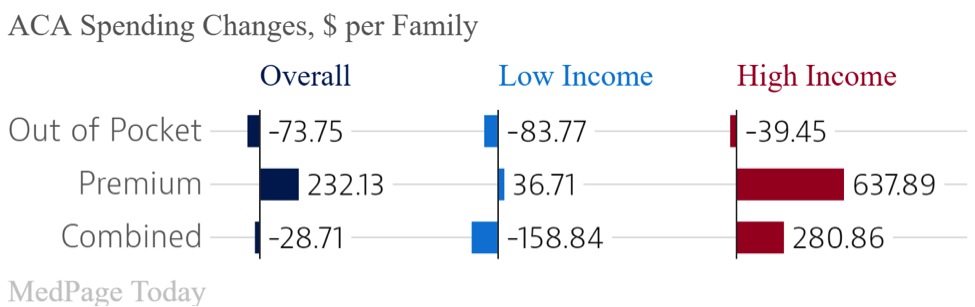

The Patient Protection and Affordable Care Act was supposed to protect health care benefits and control excessive price increases. Prices are way up, and utilization is down in spite of the need, indicating that current policies have not achieved either goal.

Another goal was to expand primary care to improve access, efficiency, and value, yet one of the more alarming findings in this report is that primary care office visits declined by 18%, whereas the increase in specialist visits resulted in 31% greater spending for those visits.

The architects of the Affordable Care Act wanted to protect employer-sponsored plans because, they said, these plans were the part of the health care financing system that was already working well. Yet these private commercial insurers have brought us even higher prices, reduced access but with higher net spending, and a shift from efficient primary care to more expensive specialized services.

These private commercial insurers are selling us an awful lot of very wasteful and intrusive administrative services, and yet they are not doing their job of improving efficiency and value in our health care system. They gotta go.

Stay informed! Visit www.pnhp.org/qotd to sign up for daily email updates.