By Jim Landers

Dallas Morning News, Sept. 16, 2014

WASHINGTON — Americans spend more than $9,000 apiece on health care every year. Ouch, you say. But how does it feel to know that more than $1,000 of that sum goes to administrative costs? Or that Americans spend more than $210 billion a year on the health insurance claims system?

Needless back-office spending is one of the biggest sources of waste in health care, according to health insurers, providers and academics alike.

In a recent Health Affairs article, the authors estimated that administrative expenditures account for 25.3 percent of the average American hospital’s annual spending. No other developed nation comes close. The next highest, the Netherlands, spends 19.8 percent on administration.

“It’s getting worse,” said Dr. David Himmelstein, an internist who teaches at Hunter College in New York and Harvard Medical School. Himmelstein was the lead author of the article.

“It’s because we’re running health care more and more like a business. What that means is, if you think you can make $101, it’s worth spending $100 to do it. Hospitals are saying, gee, if we hired another financial person here they might help us bring in just a little more than their salary. There’s a whole variety of games you can play.”

Any business with 25 percent of its spending going to administration should be trying to cut, not add, to that burden. Hospitals, physicians and insurers all say that’s what they’re doing.

“We’re continuously looking at administrative costs and looking for ways to reduce the costs,” Wendell Watson, director of public relations with Texas Health Resources, wrote in an email.

“Over the last 10 years, we’ve consolidated many administrative functions to gain efficiencies and economies of scale and improved our processes to reduce costs where we can.”

Texas Health Resources owns 25 hospitals in North Texas. In the 12 months ending May 31, 2013, Texas Health Presbyterian Hospital of Dallas spent $119.8 million on administrative costs, or 20.3 percent of its expenditures that year. The figures come from Medicare reports sifted by American Hospital Directory, which compiles statistics on more than 6,000 hospitals.

Much of the administrative expense in American health care is due to the complexity of billing. There are many insurance companies and hundreds of thousands more companies that self-insure their employees with their own nuanced health plans. A hospital or physician’s office has to find the policy that matches the patient and send in a bill.

Insurers, meanwhile, collect those bills and promptly slash them. Whether it is BlueCross BlueShield of Texas, Aetna, Cigna or government insurance plans like Medicare and Medicaid, the billed price usually isn’t even close to the reimbursement. There are formulas that work through negotiated discounts that determine reimbursements. Then there are the co-payments and deductibles that the patient pays.

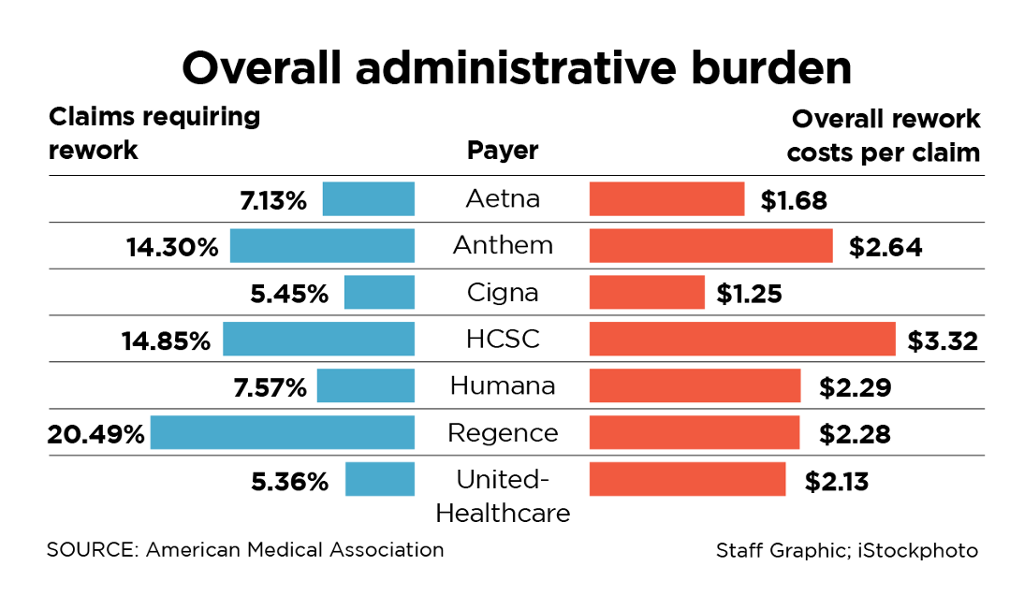

The American Medical Association says 10 percent of these reimbursements have errors. It put out a report card last year on various insurers, working out the average cost to handle each claim. Cigna did the best. Only 5.45 percent of their claims had to be reworked, and the average cost of a reworked Cigna claim for a physician’s office was pegged at $1.25.

Chicago-based Health Care Services Corp., whose divisions include BlueCross BlueShield of Texas, scored the worst. The AMA said 14.85 percent of its claims had to be reworked, and the average cost to process them through HCSC was $3.32.

Insurers say it would help if physicians and hospitals did a better job of filing claims. Some still come on paper. And even with electronic medical records, there are problems getting providers to send in the right information.

Taxpayers have paid $27 billion to help providers get with it. Physicians, meanwhile, are complaining that these electronic records have slowed care delivery. The average doctor now spends an extra 48 minutes a day struggling with electronic health records, says the American College of Physicians.

Himmelstein argues the current system would be vastly improved if the nation went to “single payer” health insurance — one national insurance company, with standard billing procedures.

Vermont has committed to implementing such a system, which is similar to the Canadian approach. It’s not a popular system in most other parts of the country. And so administrative costs continue adding to the cost of care.

Follow Jim Landers on Twitter at @landersjim.

http://www.dallasnews.com/business/columnists/jim-landers/20140915-health-care-overhead-is-costing-us-big-bucks.ece