By PNHP-Massachusetts and Mass-Care

- 272,000 Massachusetts residents lacked health insurance in 2012, 4.1% of the population. (Source: U.S. Census Bureau)

- About 300 adults die from lack of health insurance coverage annually in the state. (Ann Intern Med 2014;160:585 & AJPH 2009;99:2289).

- At least 530,000 Massachusetts residents under age 65 are under-insured, meaning they have coverage, but still devote a large share of income to cover costs including copayments and deductibles. Many more lack adequate coverage for long-term care or mental health services. For 618,000 with private coverage, their premiums are so high that they’re unaffordable, according to federal guidelines. (Commonwealth Fund 2014)

- Massachusetts’ per capita health costs are about 30% above the national average and continue to rise. Between 2009 and 2011 private insurance premiums in Massachusetts increased 9.7% despite a 5.1% fall in benefit levels – effectively a 14.8% cost increase. (CMS Office of the Actuary & Mass. Center for Health Info. and Analysis)

- Federal, state and local governments already pay about 64% of all health costs in Massachusetts, which totals about $8,500 per resident in 2014. This figure includes health benefits for public employees and tax subsidies for private insurance, as well as government programs such as Medicare and Medicaid. That’s more than total (public + private) health spending in any other nation. (Health Affairs, 2002;21(4):88 – updated by the authors)

- Surveys show strong support for single-payer. Nationally, 56% of adults favor a “universal program like Medicare” (ABC/USA Today/Kaiser survey, 2006) and one-third of those opposed to Obamacare say its “not liberal enough” (CNN/ORC survey, May, 2013). Among Massachusetts doctors, 60% favor single payer or public option, a policy that many conflate with single payer (Mass Medical Society Survey, October, 2012).

- Single-payer health insurance in Massachusetts could save about $12.3 billion annually on paperwork and administration (NEJM 2003;349:768-75 Updated by authors). Separate studies commissioned by the Massachusetts Medical Society and the state legislature found that the administrative savings under single payer would be large enough to cover all of the uninsured, eliminate all co-pays and deductibles, and upgrade coverage for Medicare enrollees – without any increase in health spending.

- Massachusetts’ three largest private insurers (Blue Cross, Harvard Pilgrim and Tufts) employ about 6,600 workers to administer coverage for 5 million people (Companies’ annual reports, Boston.com and Patriot Ledger). That’s more people than work for the Center for Medicare and Medicaid Services, which administers coverage for 49 million Medicare enrollees and 51 million Medicaid enrollees. Nationally, private insurance overhead averages 12% vs. traditional Medicare’s 2.1%.

- At present, Massachusetts hospitals devote on average 24.0% of total expenditures to administration, about double the percentage for hospitals in nations with single payer systems which greatly simplify billing and the documentation that private insurers require. (Himmelstein and Woolhandler analysis of 2012 Medicare cost reports, and NEJM 2003;349:768-75). Reducing hospital administration spending to the levels in Canada would save about $3.4 billion annually.

- The complexity of the current payment system forces doctors and clinics to spend less time on patient care and to waste money and time on billing-related documentation and paperwork.

- Whatever their other merits, the ACA and the 2006 Massachusetts reform have increased administrative costs.

- In Massachusetts, the costs of running the Connector have added an additional 2% overhead (on top of the private insurers’ overhead) to the policies it sells.

- Nationally, the cost of setting up exchanges exceeded $6 billion in 2013. That’s about $750 for each of the 8 million people who enrolled through exchanges by March 31, 2014.

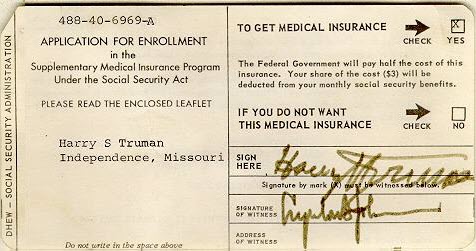

- In contrast, the cost of getting Medicare up and running in 1966 was $867 million (in current dollars). But that figure includes the cost of administering payment for the 18.9 million Medicare enrollees, and also doesn’t subtract the $376 million in overhead that was saved on the programs Medicare displaced. In other words, the net startup costs for Medicare were $491 million, or $26 per enrollee. The original Medicare sign-up form is reproduced in its entirety below.

If you would like more information, please email pnhp@bu.edu or director@masscare.org