Healthcare is the number-one cause of personal bankruptcy and is responsible for more collections than credit cards.

By Olga Khazan

The Atlantic, October 8, 2014

After his recent herniated-disk surgery, Peter Drier was ready for the $56,000 hospital charge, the $4,300 anesthesiologist bill, and the $133,000 fee for orthopedist. All were either in-network under his insurance or had been previously negotiated. But as Elisabeth Rosenthal recently explained in her greatNew York Times piece, he wasn’t quite prepared for a $117,000 bill from an “assistant surgeon”—an out-of-network doctor that the hospital tacked on at the last minute.

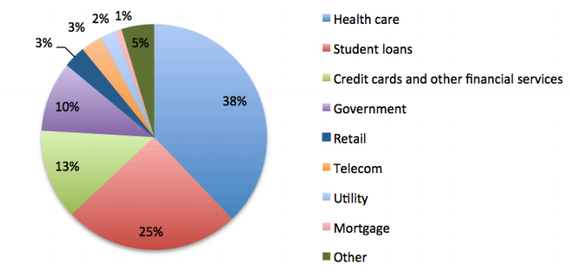

It’s practices like these that contribute to Americans’ widespread medical-debt woes. Roughly 40 percent of Americans owe collectors money for times they were sick. U.S. adults are likelier than those in other developed countries to struggle to pay their medical bills or to forgo care because of cost.

Earlier this year, the financial-advice company NerdWallet found that medical bankruptcy is the number-one cause of personal bankruptcy in the U.S. With a new report out today, the company dug into how, exactly, medical treatment leaves so many Americans broke.

Americans pay three times more for medical debt than they do for bank and credit-card debt combined, the report found. Nearly a fifth of us will hear from medical-debt collectors this year, and they’ll gather $21 billion from us, collectively.

The company also found that 63 percent of Americans have received a medical bill that was more than they expected to pay. Some of that is a result of hospital errors: Nearly half of the Medicare insurance claims NerdWallet examined contained billing mistakes.

Another contributing factor is that hospitals charge wildly different amounts for the same procedures. In the most extreme example NerdWallet analyzed, the highest charge for an inpatient stay for severe intestinal bleeding was 54 times higher than the lowest charge. At most, California patients paid more than $291,000 for the procedure, while those in Arkansas paid just $5,400.

It’s worth noting that the Affordable Care Act’s individual mandate and Medicaid expansion might alleviate some of this debt strain over the coming years. But otherwise, patients have few options beyond attempting to research hospital charges ahead of time—which is probably the furthest thing from a person’s mind when they are most in need of a hospital.

http://www.theatlantic.com/health/archive/2014/10/why-americans-are-drowning-in-medical-debt/381163/