Table of contents

Click the links below to jump to different sections of the newsletter. To view a PDF version of the shorter print edition of the newsletter, click HERE.

If you wish to support PNHP’s outreach and education efforts with a financial contribution, click HERE.

If you have feedback about the newsletter, email info@pnhp.org.

PNHP News and Tools for Advocates

- PNHP launches Medical Society Resolutions campaign

- New Kitchen Table Campaign highlights America’s maternal mortality crisis

- Meet PNHP’s newly elected board members

Research Roundup

- Data Update: Health care crisis by the numbers

- Studies and analysis of interest to single-payer advocates

- Commentary

PNHP Chapter Reports

- California

- Illinois

- Kentucky

- Maine

- Minnesota

- New Jersey

- New York

- North Carolina

- Oregon

- Pennsylvania

- Tennessee

- Vermont

- Washington

- West Virginia

PNHP in the News

PNHP News and Tools for Advocates

PNHP launches Medical Society Resolutions campaign

Moving organized medicine to Medicare for All should be a top priority

Polling shows that a majority of physicians support single-payer reform, with even stronger support among medical students and early-career physicians. Unfortunately, the vast majority of professional associations that claim to represent physicians do not support Medicare for All, and in some cases actively oppose it.

The lack of support by organized medicine is a huge problem for the Medicare-for-All movement. Medical societies have enormous influence over health care policy at the federal and state level. With the insurance, pharma, and investor-owned hospital industries spending millions each year lobbying against single-payer reform, the Medicare-for-All movement needs the full force of organized medicine fighting back.

As the only physician organization dedicated to single-payer reform, PNHP has a unique responsibility to move the medical profession to support Medicare for All. We’re meeting that challenge by launching the Medical Society Resolutions campaign.

“We can no longer ignore the elephant in the room — the powerful medical societies standing in the way of Medicare for All,” said PNHP president Dr. Susan Rogers. “As physicians, we are the only ones who can organize our colleagues for change.”

What is the Medical Society Resolutions (MSR) Campaign?

Virtually every physician is a member of a local, state, or specialty medical society, and is therefore in a position to propose resolutions that determine what policies their society will support (or oppose). The goal of the MSR campaign is to organize colleagues in the medical profession by passing Medicare-for-All resolutions in every medical society in the U.S.

The MSR campaign follows two years of unprecedented movement towards Medicare for All within organized medicine. In 2019, the American Medical Association only narrowly rejected a student-led pro-single payer resolution, opening the door for future support. Under pressure from activists, the AMA then resigned from the anti-single payer Partnership for America’s Health Care Future. In January 2020, the 159,000-member American College of Physicians — the largest medical specialty society and second-largest physician group after the AMA — announced its endorsement of Medicare for All, along with a “universal public choice” reform model. The 3,300-member Society of General Internal Medicine followed suit by formally endorsing the ACP’s position.

At the state level, the Vermont Medical Society overwhelmingly endorsed a single-payer resolution in November 2020, becoming the second state society to do so after Hawaii.

All the major associations representing medical students and new physicians have endorsed Medicare for All, including the American Medical Students Association; the AMA Medical Student Section; the Student National Medical Association (representing medical students of color); and the Committee of Interns and Residents.

How to participate in the MSR campaign

Every physician member of PNHP can participate in the MSR campaign by visiting medicalsocietyresolutions.org, where they can see if other PNHP members are actively organizing single-payer resolutions in their state, national, or specialty societies; download and edit a sample resolution; and watch recorded workshops on the nuts and bolts of passing resolutions. Interested members can contact organizer@pnhp.org to get started and connect with other PNHP members in their societies.

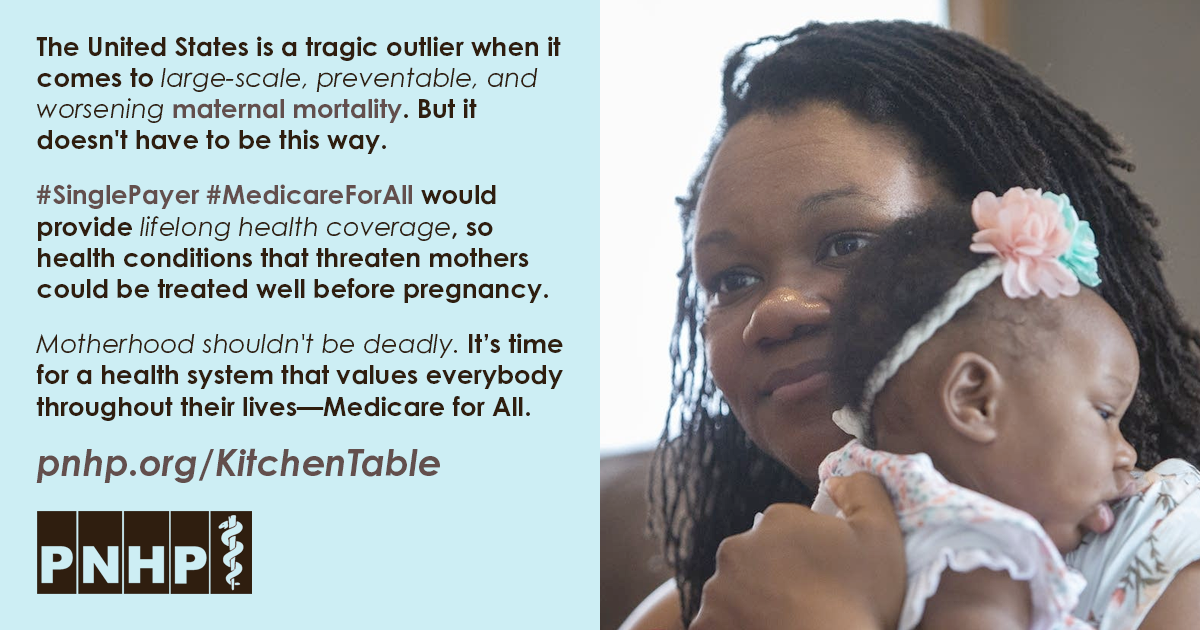

New Kitchen Table Campaign highlights America’s maternal mortality crisis

The U.S. is facing a crisis in maternal mortality. The rate of pregnancy-related deaths in the U.S. has nearly tripled in the past 30 years. Besides the U.S., the only other countries with rising maternal mortality rates are Afghanistan and Sudan. Our maternal mortality rate is more than double that of other high-income nations, and our infant mortality rate is 71% higher. Indigenous mothers are twice as likely — and Black mothers 2.5 times more likely — to die from pregnancy complications compared to white mothers.

The most frustrating aspect of this crisis is that these deaths are mostly preventable. Not with high-tech interventions, but with routine primary care. A majority of pregnancy-related complications and deaths are caused by health conditions that can be identified, managed, or even eliminated with regular preventive care, such as diabetes, heart disease, and hypertension. But addressing these conditions before pregnancy requires a lifetime of regular care, which is out of reach for many Americans — especially people of color — because of costs and insurance barriers.

We won’t solve this crisis with band-aid approaches. Even Medicaid — which now finances nearly half the births in the U.S. — only starts after a person discovers they are pregnant, and in many states ends soon after birth, limiting access to critically important prenatal and postpartum care.

By providing lifelong coverage for all medically necessary health services, including primary care; mental health; contraception and abortion; and pregnancy, childbirth, and postpartum care — Medicare for All is the only plan that would empower patients to prevent, identify, and treat the chronic health conditions that increase risk of pregnancy-related complications and death.

Visit pnhp.org/maternalmortality to explore the full toolkit on America’s maternal mortality crisis, which includes talking points and handouts, a slide set and webinar, videos and podcasts, and a new interactive quiz to test your knowledge of this crisis. Please use these materials in your own advocacy and share with your colleagues and communities. To learn more about PNHP’s Kitchen Table Campaign, contact clare@pnhp.org.

Meet PNHP’s newly elected board members

At Large Members

Sanjeev Sriram, M.D., M.P.H. has been a PNHP member since 2018. Dr. Sriram completed his medical degree and residency at UCLA, his masters in public health at Harvard, and now practices pediatrics in Maryland. He founded the “All Means All” campaign to center racial equity in single payer, and promotes Medicare for All and health equity in national publications and as “Dr. America” for act.TV. As a board member, Dr. Sriram will urge PNHP to collaborate with racial justice organizations on strategies to broaden single-payer activism, and expand mentorship and professional development opportunities for our student members.

Sanjeev Sriram, M.D., M.P.H. has been a PNHP member since 2018. Dr. Sriram completed his medical degree and residency at UCLA, his masters in public health at Harvard, and now practices pediatrics in Maryland. He founded the “All Means All” campaign to center racial equity in single payer, and promotes Medicare for All and health equity in national publications and as “Dr. America” for act.TV. As a board member, Dr. Sriram will urge PNHP to collaborate with racial justice organizations on strategies to broaden single-payer activism, and expand mentorship and professional development opportunities for our student members.

Philip Verhoef, M.D., Ph.D. has been a PNHP member since 2006. Dr. Verhoef received his medical degree and a Ph.D. in pharmacology from Case Western Reserve University, followed by med-peds residency at UCLA. He joined the faculty at the University of Chicago after a fellowship in adult and pediatric critical care, while serving as the president of the Illinois Single Payer Coalition and co-president of PNHP-Illinois. In 2019, Dr. Verhoef moved to Kaiser Permanente in Hawaii, where he serves as an adult/pediatric intensivist and hospitalist and as the associate program director for the internal medicine residency program. As a continuing board member, he plans to develop strategies for physician engagement, including messaging, programming, development, and recruitment, with a specific focus on diverse and underserved communities.

Philip Verhoef, M.D., Ph.D. has been a PNHP member since 2006. Dr. Verhoef received his medical degree and a Ph.D. in pharmacology from Case Western Reserve University, followed by med-peds residency at UCLA. He joined the faculty at the University of Chicago after a fellowship in adult and pediatric critical care, while serving as the president of the Illinois Single Payer Coalition and co-president of PNHP-Illinois. In 2019, Dr. Verhoef moved to Kaiser Permanente in Hawaii, where he serves as an adult/pediatric intensivist and hospitalist and as the associate program director for the internal medicine residency program. As a continuing board member, he plans to develop strategies for physician engagement, including messaging, programming, development, and recruitment, with a specific focus on diverse and underserved communities.

Continuing at-large member: Stephen Chao, M.D. (Texas)

North East Region

Scott Goldberg, M.D. has been a PNHP member since 2009. Dr. Goldberg earned his medical degree at University of Chicago Pritzker School of Medicine (where he launched a SNaHP chapter in 2012) and completed residency in 2019 in internal medicine-primary care at UCSF. He serves as an attending physician at Montefiore Medical Center in the Bronx where he supervises residents in the Primary Care/Social Internal Medicine program, and an assistant professor at the Albert Einstein College of Medicine. As a board member, Dr. Goldberg plans to expand PNHP’s fundraising and membership efforts, with the goal of building the power necessary to shape the culture of organized medicine around single payer.

Scott Goldberg, M.D. has been a PNHP member since 2009. Dr. Goldberg earned his medical degree at University of Chicago Pritzker School of Medicine (where he launched a SNaHP chapter in 2012) and completed residency in 2019 in internal medicine-primary care at UCSF. He serves as an attending physician at Montefiore Medical Center in the Bronx where he supervises residents in the Primary Care/Social Internal Medicine program, and an assistant professor at the Albert Einstein College of Medicine. As a board member, Dr. Goldberg plans to expand PNHP’s fundraising and membership efforts, with the goal of building the power necessary to shape the culture of organized medicine around single payer.

Continuing North East board members: Mary O’Brien, M.D. (New York) and Janine Petito, M.D. (Massachusetts)

South Region

Ed Weisbart, M.D. has been a PNHP member since 1996. He completed his medical degree at the University of Illinois and family medicine residency at Michigan State University. Dr. Weisbart practiced family medicine for 20 years, served as CMO of Express Scripts from 2003-2010, and retired clinically in 2021. He serves as the chair of the Missouri chapter of PNHP, where he has delivered more than 600 public presentations and published dozens of pieces on single payer. As a board member, Dr. Weisbart will help PNHP increase its influence within the health care policy debate, and strengthen its relationships with adjacent advocacy organizations.

Ed Weisbart, M.D. has been a PNHP member since 1996. He completed his medical degree at the University of Illinois and family medicine residency at Michigan State University. Dr. Weisbart practiced family medicine for 20 years, served as CMO of Express Scripts from 2003-2010, and retired clinically in 2021. He serves as the chair of the Missouri chapter of PNHP, where he has delivered more than 600 public presentations and published dozens of pieces on single payer. As a board member, Dr. Weisbart will help PNHP increase its influence within the health care policy debate, and strengthen its relationships with adjacent advocacy organizations.

Continuing South Region board member: Jessica Schorr Saxe, M.D. (North Carolina)

North Central Region

Judith Albert, M.D.> has been a PNHP member since 2017. She received her medical degree from the University of Cincinnati, completed residency in obstetrics and gynecology at the University of Pittsburgh and fellowship in reproductive endocrinology at the University of Pennsylvania. Dr. Albert recently retired from having practiced in academic and private practice settings for over 30 years in Pittsburgh. She co-founded a PNHP chapter in western Pennsylvania where she has been involved in anti-racist organizing for several years. As a board member, Dr. Albert hopes to grow the single-payer movement by strengthening PNHP chapters in the region, and building coalitions with anti-racist, fair housing and anti-poverty organizations, as well as labor unions.

Judith Albert, M.D.> has been a PNHP member since 2017. She received her medical degree from the University of Cincinnati, completed residency in obstetrics and gynecology at the University of Pittsburgh and fellowship in reproductive endocrinology at the University of Pennsylvania. Dr. Albert recently retired from having practiced in academic and private practice settings for over 30 years in Pittsburgh. She co-founded a PNHP chapter in western Pennsylvania where she has been involved in anti-racist organizing for several years. As a board member, Dr. Albert hopes to grow the single-payer movement by strengthening PNHP chapters in the region, and building coalitions with anti-racist, fair housing and anti-poverty organizations, as well as labor unions.

Continuing North Central Region board member: Joshua J. Faucher, M.D., J.D. (Illinois)

West Region

Kathleen Healey, M.D. has been a PNHP member since 2018. Dr. Healey completed her medical degree at University of Colorado School of Medicine and her residency at the Naval Medical Center in Oakland. She is an otolaryngologist whose career ranged from military service as a flight surgeon, to solo and group practices. Now retired, Dr. Healey serves as co-chair of PNHP-Napa County and PNHP-California. As a board member, Dr. Healey will work to bring more physicians into our movement, and increase PNHP’s involvement in organized medicine at all levels.

Kathleen Healey, M.D. has been a PNHP member since 2018. Dr. Healey completed her medical degree at University of Colorado School of Medicine and her residency at the Naval Medical Center in Oakland. She is an otolaryngologist whose career ranged from military service as a flight surgeon, to solo and group practices. Now retired, Dr. Healey serves as co-chair of PNHP-Napa County and PNHP-California. As a board member, Dr. Healey will work to bring more physicians into our movement, and increase PNHP’s involvement in organized medicine at all levels.

Stephen Kemble, M.D. has been a PNHP member since 1989. Dr. Kemble attended medical school at University of Hawaii and Harvard, and completed residencies in both internal medicine (Queen’s Medical Center) and psychiatry (Cambridge Health Alliance). He is now semi-retired, working part-time in a primary care clinic. Dr. Kemble is past president of both the Hawaii Psychiatric Medical Association and the Hawaii Medical Association, and also served on the Hawaii Health Authority board. As a board member, Dr. Kemble will continue to chair the newly formed PNHP Policy Committee, and help PNHP fight the power of the insurance industry with ongoing public education and community organizing.

Stephen Kemble, M.D. has been a PNHP member since 1989. Dr. Kemble attended medical school at University of Hawaii and Harvard, and completed residencies in both internal medicine (Queen’s Medical Center) and psychiatry (Cambridge Health Alliance). He is now semi-retired, working part-time in a primary care clinic. Dr. Kemble is past president of both the Hawaii Psychiatric Medical Association and the Hawaii Medical Association, and also served on the Hawaii Health Authority board. As a board member, Dr. Kemble will continue to chair the newly formed PNHP Policy Committee, and help PNHP fight the power of the insurance industry with ongoing public education and community organizing.

Continuing West Region board member: Eve Shapiro, M.D., M.P.H. (Arizona)

Research Roundup

Data Update Fall 2021

Health Costs

Both the insured and uninsured struggle with medical costs. Nearly one in four (38%) adults had medical bill or debt problems in the last year, including 46% of those on individual/marketplace plans, 34% of those on employer plans, 55% of Black people, and 47% of low-income people; a third of those with debt said they were paying off $4,000 or more. Among those with medical debt problems, 35% used up all or most of their savings, 35% took on credit card debt, 27% had been unable to pay for basic necessities like food or rent, 23% delayed education or career plans, and 43% received a lowered credit score. Although uninsured people reported medical bill problems at the highest rates, 64% of those with a medical bill or debt problem said they had been insured at the time. Collins et al., “As the pandemic eases, what is the state of health care coverage and affordability in the U.S.? Findings from the Commonwealth Fund health care coverage and Covid-19 survey, March–June 2021,” Commonwealth Fund, 7/16/2021

Even high-income Americans have trouble paying for care. In the past year, nearly one in four Americans (38%) said they had trouble accessing health care because of cost, including 27% of high-income earners; 36% skipped health or dental care because of cost, including 21% of high-income earners; 34% said their insurance denied payment for medical care; 22% had serious problems paying or were unable to pay medical bills; and 44% had out-of-pocket medical expenses exceeding $1,000. Schneider et al., “Mirror, Mirror 2021 — Reflecting poorly: Health care in the U.S. compared to other high-income countries,” Commonwealth Fund, 8/4/2021

Americans’ medical debt reaches record levels. An estimated 17.8% of individuals in the U.S. had medical debt in collections in June 2020, for care provided prior to the pandemic. Collection agencies held $140 billion in unpaid medical bills, up from an estimated $81 billion in 2016. Between 2009 and 2020, unpaid medical bills became the largest source of debt that Americans owed to collection agencies. Residents of states that did not expand Medicaid owed an average of $375 more compared to those in expansion states, roughly a 30% increase from the year before Medicaid expansion. People living in the lowest-income ZIP codes owed an average of $677, compared to $126 in the highest-income ZIP codes. Kluender et al., “Medical debt in the U.S., 2009-2020,” JAMA, 7/20/2021

Providing medications for free leads to greater adherence and cost savings. In a study of patients in Ontario who reported cost-related non-adherence to medications, providing those medications for free increased patient adherence by 35% and reduced total health spending, including hospitalization, by an average of $1,222 per patient per year. Persaud et al., “Adherence at two years with distribution of essential medicines at no charge: The CLEAN Meds randomized clinical trial,” PLOS Medicine, 5/21/2021

Health Inequities

U.S. life expectancy drops most for people of color. Life expectancy in the U.S. decreased by nearly two years between 2018 and 2020, down to 76.9 at the end of 2020 from 78.7 in 2018. However, the declines were more pronounced among Black people, whose life expectancy decreased by 3.3 years, and Latinx/Hispanic people, whose life expectancy decreased by 3.9 years. By comparison, among a group of 16 peer countries, the average decline in life expectancy was 0.22 years (about two-and-a-half months). Woolf et al., “Effect of the Covid-19 pandemic in 2020 on life expectancy across populations in the USA and other high-income countries: Simulations of provisional mortality data,” BMJ, 5/24/2021

Life expectancy gap widens between urban and rural communities. In 2019, the mortality rate in urban areas of the U.S. was nearly 665 deaths per 100,000 people, but in rural areas was 834 deaths per 100,000 people. Over the past 20 years, the life expectancy gap between rural and urban areas grew by 172%. Cross et al., “Rural-urban disparity in mortality in the U.S. from 1999 to 2019,” JAMA Network, 6/8/2021

Latinx/Hispanic children in the U.S. are twice as likely to be uninsured. The uninsured rate for Latinx/Hispanic children in the U.S. reached 9.3% in 2019, compared to an uninsured rate of 4.4% for non-Latinx/Hispanic youth. There is considerable variation in the uninsured rate based on state, ranging from 1.8% uninsured in Massachusetts to 19.2% in Mississippi. The uninsured rate for Latinx/Hispanic children in states that had not expanded Medicaid by 2019 was more than 2.5 times higher than expansion states (14.9% vs. 5.8%). Whitener and Corcoran, “Getting back on track: A detailed look at health coverage trends for Latino children,” Georgetown University Center for Children and Families, 6/8/2021

U.S. health spending goes disproportionately to white patients. The U.S. spends about 15% more on health services for white people than for people of color. Per-person spending for white people averaged $8,141, compared to $7,361 for Black people, $6,025 for Latinx/Hispanic people, and $4,692 for Asian, Native Hawaiian, and Pacific Islander people. Spending also differed by types of care. For example, compared to the national average, Black people accounted for 26% less spending on outpatient services, but 12% more on emergency or inpatient care, suggesting they are treated for illnesses at more advanced stages. Dieleman et al., “U.S. health care spending by race and ethnicity, 2002-2016,” JAMA Network, 8/17/2021

Coverage Matters

Low-cost care improves colon cancer survival rates, especially for Black patients. Between 1987 and 2013, colon cancer patients in the U.S. Military Health System (MHS) — where care is provided with few or no financial barriers — had an 18% lower risk of death, and were 10% less likely to be diagnosed in a later phase of the disease, compared to similar patients in the general population. The better survival rates were also more evident among Black patients in the MHS, who were 26% less likely to die of colon cancer than those in the general population. Lin et al., “Comparison of survival among colon cancer patients in the U.S. Military Health System and patients in the Surveillance, Epidemiology, and End Results (SEER) Program,” Cancer Epidemiology, Biomarkers & Prevention, 6/23/2021

Medicare coverage reduces racial disparities in coverage and care. Eligibility for Medicare coverage was associated with reductions in racial and ethnic disparities in insurance coverage, access to care, and self-reported health, benefiting Black and Latinx/Hispanic people the most. Medicare eligibility shrank disparities in insurance coverage by 53% between Black and white people, and 51% between Latinx/Hispanic and white people. Insurance coverage for Latinx/Hispanic people rose from 77.4% prior to the age of 65 to 91.3% after 65; for Black people, it rose from 86.3% to 95.8%. The proportion of Black and Latinx people who self-reported their health as poor also dropped significantly after they became eligible for Medicare. Wallace et al., “Changes in racial and ethnic disparities in access to care and health among U.S. adults at age 65 years,” JAMA Internal Medicine, 7/26/2021

Workplace “wellness” programs are no substitute for actual health care. A controlled study of workplace wellness programs — which included modules on nutrition, physical activity, and stress reduction — found that employees at the wellness program worksites had better self-reported health behaviors (such as attempting to manage their weight), but found no significant differences in self-reported health, clinical markers of health, health care spending or use, absenteeism, tenure, or job performance. A three-year follow up did not yield detectable improvements in clinical, economic, or employment outcomes. Song and Baicker, “Health and economic outcomes up to three years after a workplace wellness program: A randomized controlled trial,” Health Affairs, June 2021

Commercial Insurance: A Hazardous Product

High-deductible health plans (HDHP) now the norm. The majority (51%) of private-sector employees are now enrolled in HDHPs, defined as having a deductible of $1,350 for an individual and $2,700 for a family in 2018. HDHP enrollment has grown by 43% over the past five years. “State health compare,” State Health Access Data Assistance Center, Health Policy and Management Division of the School of Public Health at the University of Minnesota, accessed August 2021

High cost-sharing has potentially deadly consequences for lower-income patients. Among patients who had been forced to switch from a low-deductible to a high-deductible health plan (HDHP), researchers found that patients from low-income neighborhoods had fewer emergency department visits or hospitalizations for nonspecific chest pain, but had more hospitalizations for myocardial infarction (heart attack) after ED diagnosis of nonspecific chest pain. Researchers conclude that HDHPs’ higher out-of-pocket costs lead to potentially negative health implications for lower-income populations. Chou et al., “Impact of high-deductible health plans on emergency department patients with nonspecific chest pain and their subsequent care,” Circulation, June 2021

Patients again saddled with Covid care cost-sharing burden. Despite record profits and a recent surge in Covid cases, insurers are dropping their Covid-19 cost-sharing waivers. Across the two largest health plans in each state, 72% are no longer waiving out-of-pocket costs for Covid-19 treatment, with another 10% phasing out their waiver policies by the end of October. Almost half these plans ended cost-sharing waivers in April 2021, citing vaccine availability. Ortaliza et al., “Most private insurers are no longer waiving cost-sharing for Covid-19 treatment,” Kaiser Family Foundation, 8/19/2021

Those with commercial insurance face worse access, higher costs than those in public plans. Compared to people on Medicare, those with employer-sponsored or “marketplace” plans were less satisfied with their care, less likely to have a personal physician, and more likely to report instability in insurance coverage and difficulty receiving medical care or prescriptions due to cost. Reports of medical debt were more common among people who had employer-sponsored coverage (23.4%) and those with individual commercial plans (22.3%) than individuals covered by Medicare (15.6%) or Medicaid (18.3%). Wray et al., “Access to care, cost of care, and satisfaction with care among adults with private and public health insurance in the U.S.,” JAMA, 6/1/2021

Commercial plans save money by denying patient claims. Insurers offering individual ACA “marketplace” plans denied about 17% of in-network claims (40.4 million) in 2019. Patients almost never appeal claim denials: 0.2% of patients appealed their denials, vs. 99.8% that did not appeal. When patients did appeal, insurers upheld 60% of those denials. Even though patients have the right to request an external review after a claims appeal is denied by the insurer, fewer than one in 20,000 denied claims made it to external review. Pollitz and McDermott, “Claims denials and appeals in ACA Marketplace plans,” Kaiser Family Foundation, 1/20/2021

Insurers’ “utilization management” schemes cost the health care system $93 billion per year, with patients paying most of the cost. Insurers are restricting drug formularies, requiring more stringent prior authorizations, and raising patient cost-sharing requirements for prescriptions. These so-called “utilization management” schemes cost the U.S. health system approximately $93.3 billion each year for implementing, contesting, and navigation. Insurers spend approximately $6.0 billion administering utilization management, and drug companies spend approximately $24.8 billion subsidizing patient copays. However, the biggest costs are borne by patients and doctors: Physicians waste $26.7 billion on time spent navigating utilization management, and patients spend $35.8 billion in drug cost sharing, even after copay coupons from manufacturers and charities. The study did not measure the health effects of these schemes, but notes that approximately 20% of prescriptions in the U.S. are never filled. Howell et al., “Quantifying the economic burden of drug utilization management on payers, manufacturers, physicians, and patients,” Health Affairs, August 2021

Insurers gobble up provider practices and keep more of patients’ premiums. Some commercial insurers are expanding aggressively into care delivery, and get to keep more of the premiums they collect when they also own the providers. Federal law limits insurers’ profits to 15-20% of collected premiums, but puts no limits to how much profit a provider can keep. So if an insurer directs enrollees to insurer-owned providers, the company is able to keep more premium dollars. UnitedHealth, for example, owns commercial insurance plans but also operates Optum-branded surgery centers, physician practices, and specialty pharmacies. In 2021, UnitedHealth expects to earn $91 billion in “eliminations,” an accounting term for revenues that stay within the company, a fourfold increase from 10 years ago. Herman, “Profits swell when insurers are also your doctors,” Axios, 7/16/2021

Not all surprise medical bills come from the hospital. Among large employer health plans in 2018, about half (51%) of emergency and 39% of non-emergency ground ambulance rides included an out-of-network charge for ambulance services, sticking patients with surprise bills. Ambulances bring 3 million privately insured people to an emergency room each year. Amin et al., “Ground ambulance rides and potential for surprise billing,” Peterson-Kaiser Family Foundation Health System Tracker, 6/24/2021

Commercial insurers continue pandemic profit streak. At the mid-point of 2021 — as the U.S. entered another wave of Covid hospitalizations and death — commercial insurers posted massive profits. UnitedHealth led the way with second quarter net profits of $4.3 billion; CVS Health (Aetna), $2.8 billion; Anthem, $1.8 billion; Cigna, $1.5 billion; and Humana, $588 million. Herman, “The vaccine wave kept health care as profitable as ever,” Axios, 8/30/2021

Privatizing Medicare

Medicare Advantage drives up Medicare spending. Medicare spending for enrollees on privatized Medicare Advantage (MA) plans was $321 higher per person in 2019 than it would have been if enrollees had been covered by traditional Medicare, raising overall Medicare spending by $7 billion. Between 2021 and 2029, federal spending on payments to MA plans is projected to increase by $316 billion, from $348 billion to $664 billion. Biniek et al., “Higher and faster growing spending per Medicare Advantage enrollee adds to Medicare’s solvency and affordability challenges,” Kaiser Family Foundation, 8/17/2021

Medicare Advantage plans find ways to dump dying patients. Commercial Medicare Advantage (MA) plans are finding ways to avoid paying the high costs of end-of-life care. As a result, MA beneficiaries in the last year of life disenrolled to join traditional Medicare at more than twice the rate (5%) of all other MA beneficiaries (2%) in 2017. The U.S. Government Accountability Office found that beneficiaries in the last year of life disenroll because of limitations accessing specialized (and expensive) care under MA. Because Medicare pays MA a fixed fee per enrollee, MA enrollees who switched to traditional fee-for-service Medicare in their last year of life increased Medicare’s costs by $490 million in 2017. “Medicare Advantage: Beneficiary disenrollments to fee-for-service in last year of life increase Medicare spending,” U.S. Government Accountability Office, 6/28/2021

Medicare enrollees face cost problems, but fare better in traditional Medicare than Medicare Advantage. The rate of cost-related problems was lower among beneficiaries in traditional Medicare (TM) (15%) than among those enrolled in Medicare Advantage (MA) (19%) plans. Those with TM plus supplemental coverage (80% of those in TM) had the lowest cost-related problems (12%), but among the remaining 20% of TM enrollees without supplemental coverage, 30% reported cost-related problems. Among Black beneficiaries, those in TM had lower cost problems (24%) than those in MA (32%). Across all plans, the rate of cost-related problems was twice as high among Black beneficiaries compared to white beneficiaries (28% vs. 14%), three times higher among beneficiaries in fair or poor self-reported health than among those good health (34% vs. 11%), and 3.5 times higher among beneficiaries under age 65 with long-term disabilities than among those ages 65 and older (42% vs. 12%). Biniek et al., “Cost-related problems are less common among beneficiaries in traditional Medicare than in Medicare Advantage, mainly due to supplemental coverage,” Kaiser Family Foundation, 6/25/2021

Health Care for Profit

Despite the pandemic, health industry CEOs have big paydays. The CEOs of 178 health care companies collectively made $3.2 billion in 2020, 31% more than 2019. The CEOs of the six biggest commercial health insurers (Anthem, Centene, Cigna, CVS Health, Humana, UnitedHealth Group) made a combined $236 million in 2020, a 45% increase over 2019. Herman, “Health care executive pay soars during pandemic,” Axios, 6/14/2021

High-revenue hospitals more likely to sue their patients. More than a quarter of the 100 U.S. hospitals with the highest revenues sued patients over unpaid medical bills between 2018 and mid-2020, filing nearly 39,000 court actions (which is likely an undercount since many court records are inaccessible), including lawsuits, wage garnishments, and personal property liens. McGhee and Chase, “How America’s top hospitals hound patients with predatory billing,” Axios, 6/14/2021

Investor-owned hospitals more likely to inflate prices. Most hospitals charge more for a procedure than what it costs them, but for-profit facilities take this markup to extremes. The top 100 revenue-generating hospitals charged patients seven times the cost of service, and for-profit hospitals averaged a nearly 12-fold markup. Nine of the 10 top-markup hospitals were investor owned. While these charges are almost never the actual price paid by insurers, they are used to charge uninsured patients. McGhee and Chase, “How private hospitals make their money: Massive markups,” Axios, 6/14/2021

Investors are cashing in on trauma centers. Investor-owned hospital firms like HCA are rapidly opening “trauma centers,” which treat injuries from events like car crashes, falls, or gunshot wounds. Trauma centers were once operated mainly by established teaching hospitals, but investor-owned HCA has opened trauma centers in 90 of its hospitals and now operates one out of every 20 trauma centers in the country. Once a hospital has a trauma designation, it can charge patients special “trauma team activation” fees of as much as $50,000 per patient for the same care provided in a regular emergency department. Hancock, “In alleged health care ‘money grab,’ nation’s largest hospital chain cashes in on trauma centers,” Kaiser Health News, 6/14/2021

Independent physician practices are now the minority. By the end of 2020, hospitals and corporations owned half of America’s physician practices; nearly 70% of U.S. physicians are now employed by hospitals or corporations like private equity firms and health insurers. In 2019 and 2020, 48,000 physicians quit private practice; of those, more physicians moved to corporate entities than to hospitals. Corporate entities now employ an estimated 20% of all physicians, a 31% increase in the percentage of corporate-employed physicians over two years. “COVID-19’s impact on acquisitions of physician practices and physician employment 2019-2020,” Avalere Health, June 2021

Pharma

Drug prices are rising at twice the rate of inflation. While the 2020 rate of inflation was 1.3%, the price of a group of 260 widely used prescription drugs rose by nearly 3% overall since 2019. Over the past 15 years, the price of 65 regularly used brand name drugs rose by nearly 280%, while inflation only rose by 32%. Purvis and Schondelmeyer, “Rx price watch report: Trends in retail prices of brand name prescription drugs widely used by older Americans, 2006 to 2020,” AARP Public Policy Institute, June 2021

Medicare drug spending spikes due to prices, not volume. The amount Medicare spent on drugs dispensed at pharmacies increased 26% from 2013 through 2018. The Medicare Payment Advisory Commission attributed nearly all of the growth in spending to higher prices charged by pharmaceutical firms rather than an increase in the number of prescriptions filled by beneficiaries. “Report to the Congress: Medicare and the health care delivery system,” The Medicare Payment Advisory Commission, June 2021

Direct advertising leads to increases in Medicare spending on expensive drugs. Pharma manufacturers spend about $6 billion each year on consumer advertising. The highest ad spenders were AbbVie’s rheumatoid arthritis drug Humira at $1.4 billion; Pfizer’s neuropathic pain drug Lyrica at $913 million; and Eli Lilly’s Type 2 diabetes drug Trulicity at $655 million. Between 2016 and 2018, nearly 60% of Medicare Parts B and D beneficiary spending ($324 billion) went to drugs the industry advertised directly to consumers. Advertised drugs accounted for 8% of total Medicare Part D drugs used but 57% of drug spending. Among the top 10 drugs with the highest Medicare expenditures, four were also among the top 10 drugs in advertising spending in 2018. “Prescription drugs: Medicare spending on drugs with direct-to-consumer advertising,” Government Accountability Office Report to U.S. Senate Committee on the Judiciary, May 2021

Pharma payments to doctors are associated with increased prescribing of more expensive insulin. An analysis of Medicare claims found that more than 51,800 physicians received industry payments worth $22.3 million in 2016. The following year, those physicians wrote, on average, 135 prescriptions for more expensive long-acting insulin, compared with 77 prescriptions written by doctors who did not receive industry payments. The larger number of prescriptions resulted in an average Medicare Part D claim of $300, which was $71 more than claims generated by doctors who did not receive payments. Inoue et al., “Association between industry payments and prescriptions of long-acting insulin: An observational study with propensity score matching,” PLOS Medicine, 6/1/2021

Pharma spends more on dividends and stock buybacks than research and development. The 14 largest drugmakers spent $577 billion on stock buybacks and dividends from 2016 through 2020, which was $56 billion more than was spent on R&D during the same time. In fact, some of the spending categorized as “research and development” was spent “researching” ways to suppress competition — especially from generics — such as filing hundreds of new but very minor patents on older drugs. “Drug pricing investigation: Industry spending on buybacks, dividends, and executive compensation,” U.S. House of Representatives Committee on Oversight and Reform, July 2021

Some of the biggest patient advocacy groups take millions from drug companies, but hide those relationships. All but one of the 15 most prominent patient advocacy organizations — including the American Cancer Society, American Diabetes Association, American Heart Association, and American Lung Association — fail to fully disclose the amount of drug industry funding they receive, and 12 of the 15 leading groups also have representation from the pharmaceutical industry on their boards. One of the groups, the International Myeloma Foundation, received 57% of its funding ($11.5 million) from just two pharmaceutical companies. Researchers found that many of these same groups “appear unable or unwilling to take positions on consumer issues such as lowering prescription drug prices that might anger their drug corporation funders.” “The hidden hand: Big pharma’s influence on patient advocacy groups,” Patients for Affordable Drugs, 6/30/2021

Pharma keeps prices high by buying off lawmakers. Nearly every attempt to lower drug prices at the state level has failed. Not surprisingly, more than one-third of state legislators in the U.S. (at least 2,467) took pharmaceutical industry campaign contributions in the last two years. In Louisiana 84% of lawmakers took cash from pharma during the 2020 election cycle; in California it was 82%; in Illinois, 76%; and in Oregon, 66%. The industry spent slightly more on Democrats ($4.5 million) than on Republicans ($4.4 million). Facher, “Pharma funded more than 2,400 state lawmaker campaigns in 2020, new STAT analysis finds,” STAT, 6/9/2021

Pharma throws cash at Dems who fight Medicare drug negotiations. In early May, Rep. Scott Peters (D-Calif.) led a group of nine centrist Democrats attempting to block Rep. Nancy Pelosi’s bill allowing Medicare to negotiate drug prices. Over the next two days, Rep. Peters received $19,600 from the pharmaceutical industry, including $5,800 from Pfizer CEO Albert Bourla, $5,000 from Eli Lilly CEO David Ricks, $2,900 from Bristol Myers Squibb CEO Giovanni Caforio, $2,900 from Merck CEO Ken Frazier, and three $1,000 checks from three separate PhRMA lobbyists. In total, Rep. Peters took in $66,400 from the pharmaceutical industry between May 4 and June 30. Cohrs, “Pharma CEOs, lobbyists showered Democrat with cash after his attempt to torpedo Pelosi’s drug pricing bill,” STAT, 7/20/2021

Studies and analysis of interest to single-payer advocates

“Racial Justice Report Card, 2020-2021,” White Coats for Black Lives, September 1, 2021. The goal of the Racial Justice Report Card is to document the racism that continues to permeate our nation’s leading medical institutions, highlight best practices, and encourage academic medical centers to direct their considerable power and resources toward addressing the needs of patients and colleagues of color. The Report Card consists of metrics that evaluate medical institutions’ curriculum and climate, student and faculty diversity, policing, racial integration of clinical care sites, treatment of workers, and research protocols. All of the schools received mostly failing grades.

“Medical debt in the U.S., 2009-2020,” Raymond Kluender, Ph.D.; Neale Mahoney, Ph.D.; Francis Wong, Ph.D.; Wesley Yin, Ph.D.; JAMA Network, July 20, 2021. Between 2009 and 2020, unpaid medical bills became the largest source of debt that Americans owe collections agencies; by 2020, these agencies held $140 billion in unpaid medical bills. That amount only measures debts that have been sold to collectors and does not count all medical bills owed to health care providers. An estimated 17.8% of individuals in the U.S. had medical debt in collections in June 2020, reflecting care provided prior to the Covid-19 pandemic. Medical debt was highest among individuals who lived in the South and in ZIP codes in the lowest income deciles, and was most concentrated in lower-income communities in states that did not expand Medicaid.

“Medical uninsurance and underinsurance among U.S. Children: Findings from the National Survey of Children’s Health, 2016-2019,” Adam Gaffney, M.D., M.P.H.; Samuel Dickman, M.D.; Christopher Cai, M.D.; Danny McCormick, M.D., M.P.H.; David U. Himmelstein, M.D.; Steffie Woolhandler, M.D., M.P.H.; JAMA Pediatrics, August 23, 2021. Researchers found that between 2016-19, the number of uninsured children rose from 5.9 million to 6.3 million, and the number of children with inadequate coverage increased from 16.2 million to 18.1 million. The proportion of children with inadequate insurance (either uninsured or underinsured) was lower in Medicaid expansion states (30.9%) than in non-expansion states (35.3%). Underinsurance was more common among privately-insured (34.8%) than publicly-insured (17.5%) children, likely reflecting the high copayments and deductibles in many private plans. The researchers also found that nearly one in three children with serious chronic illnesses or impairments were inadequately insured.

“Association between high-deductible health plans and cost-related non-adherence to medications among Americans with diabetes: An observational study,” Charlotte Rastas, M.D., M.Sc.; Drew Bunker, M.D.; Vikas Gampa, M.D.; John Gaudet, M.D.; Shirin Karimi, M.D.; Ariel Majidi, M.P.; Gaurab Basu, M.D., M.P.H.; Adam Gaffney, M.D., M.P.H.; and Danny McCormick, M.D., M.P.H.; Journal of General Internal Medicine, July 29, 2021. For Americans with diabetes, being enrolled in a high-deductible health plan (HDHP) substantially increases the risk of not taking prescribed medications due to cost. The study found that among all patients with diabetes, 20% of those enrolled in a HDHP reported forgoing medications due to cost, compared with 16% of those in a traditional commercial plan — a 28% higher rate of missing medication for those with a high deductible. Among patients specifically taking insulin for diabetes, 25% of HDHP enrollees were unable to afford their medication, compared with 19% of those in a traditional plan — a 31% higher rate of missing medications. Researchers also found that among the diabetic patients they studied, those who could not take their medication as prescribed because they could not afford it were more likely to have one or more emergency department visits, and potentially more hospitalizations per year, than patients who were not forced to skip their medications.

“Socioeconomic inequality in respiratory health in the U.S. from 1959 to 2018,” by Adam Gaffney, M.D., M.P.H.; David U. Himmelstein, M.D.; David C. Christiani, M.D., M.S., M.P.H.; Steffie Woolhandler, M.D., M.P.H.; JAMA Internal Medicine, May 28, 2021. This new study suggests that poor lung health and higher rates of respiratory problems may have left lower-income Americans susceptible to the pneumonia often caused by the coronavirus. From 1959 to 2018, socioeconomic disparities in respiratory symptoms, lung disease prevalence, and pulmonary function mostly persisted — and in some instances appeared to widen — despite improvements in air quality and tobacco use, suggesting that the benefits of these improvements have not been equitably enjoyed. Researchers conclude that social class may function as an independent determinant of lung health.

“Racial and ethnic disparities in outpatient visit rates across 29 specialties,” Christopher Cai, M.D.; Adam Gaffney, M.D., M.P.H.; Alecia McGregor, Ph.D.; Steffie Woolhandler, M.D., M.P.H.; David U. Himmelstein, M.D.; Danny McCormick, M.D., M.P.H.; Samuel Dickman, M.D. JAMA Internal Medicine, July 19, 2021. Researchers found that people of color are underrepresented in the outpatient practices of most specialist physicians, including surgical specialists such as orthopedists and medical subspecialists such as pulmonary (lung) specialists. Disparities persisted even after accounting for patients’ insurance, income, education, and health status. For example, Black patients’ visit rates to orthopedic surgeons, urologists, pulmonologists, and cardiologists were 59%, 62%, 63%, and 81% those of white individuals, respectively. Notably, nephrologists — who care for patients with end-stage kidney disease, almost all of whom are covered by Medicare, and many of whom are people of color — provided significantly more care to minority groups than to whites. In contrast, primary care physicians saw patients of color and white patients at roughly equal rates.

“States’ performance in reducing uninsurance among Black, Hispanic, and low-income Americans following implementation of the Affordable Care Act,” Gregory Lines, Kira Mengistu, Megan Rose, Carr LaPorte, Deborah Lee, Lynn Anderson, Daniel Novinson, Erica Dwyer, Sonja Grigg, Hugo Torres, Gaurab Basu, and Danny McCormick, Health Equity, July 21, 2021. Gains in health insurance coverage under the Affordable Care Act (ACA) were small for Black, Hispanic and low-income Americans in many states. This study found dramatic variation in states’ performance in expanding insurance coverage to these populations that have historically had low coverage rates. While the best performing states were able to reduce rates of uninsurance among Black, Hispanic and low-income adults by approximately 60%, the worst performing states reduced uninsurance by less than 10%, a six-fold difference. The study also found that, two years after ACA implementation, in six states one quarter of Black adults remained without insurance coverage; in 20 states, one quarter of low-income adults continued to lack coverage; in 13 states, over 40% of Hispanic adults lacked coverage.

“Changes in racial and ethnic disparities in access to care and health among U.S. adults at age 65 years,” Jacob Wallace, Ph.D.; Karen Jiang, B.A.; Paul Goldsmith-Pinkham, Ph.D.; Zirui Song, M.D., Ph.D.; JAMA Internal Medicine, July 26, 2021. Immediately after age 65 years — the age at which all adults are eligible for Medicare coverage — disparities between white and Black adults and between white and Hispanic adults sharply decrease. After age 65, there were marked reductions in the share of the population that was uninsured, without a usual source of care, unable to see a physician in the past year owing to cost, and in poor self-reported health.

“Promise vs. Practice: The actual financial performance of Accountable Care Organizations,” James G. Khan, M.D., M.P.H. and Kip Sullivan, J.D., Journal of General Internal Medicine, August 13, 2021. The authors collect and compare financial performance data from all four CMS Accountable Care Organization (ACO) programs from 2005 to 2018, examining net CMS cost (gross savings in medical billings minus “bonus” payments to ACOs). They found that overall, ACO programs roughly broke even — from the CMS perspective. That is, when bonuses CMS paid to ACOs are subtracted from gross savings, the programs lost money or saved no more than a few tenths of a percent.

Commentary

“We can heal from hate crimes by practicing solidarity,” by Christopher Cai, M.D., JAMA Network, June 21, 2021. Former SNaHP leader Dr. Chris Cai reflects on the experience of being a young Asian-American physician. He suggests that Asian- American physicians can heal from recent hate crimes by advocating for policies that dismantle structural racism in medicine and broader society.

“How would Medicare for All affect physician revenue?” by Christopher Cai, M.D., Journal of General Internal Medicine, July 8, 2021. Dr. Cai explains that the available evidence suggests physicians would prosper under single-payer reform. By supporting Medicare for All, physicians — and organized medicine — can both advocate for physicians’ self-interest while advancing legislation that would be enormously beneficial to patients.

“Financial profit in medicine: A position paper from the American College of Physicians,” Ryan Crowley, B.S.J.; Omar Atiq, M.D.; David Hilden, M.D.; Annal of Internal Medicine, September 7, 2021. In this position paper following the group’s endorsement of single-payer reforms, the ACP explains that profit motive in medicine may contribute to a bloated, complex, and fragmented health care system. “In recent years, we have seen health care become increasingly business-oriented with more for-profit entities and private equity investments,” said Thomas G. Cooney, M.D., chair of ACP’s Board of Regents. “We need to be sure that profits never become more important than patient care in the practice of medicine.”

PNHP Chapter Reports

California

In California, four physician members met with state Senator Monique Limon in July, sharing stories about patients who could have been helped by a single-payer plan. Sen. Limon is a member of the senate health committee. PNHP-CA members participated in several actions this summer, including a rally at the state capitol in support of the Healthy California Now bill, a rally demanding Gov. Newsom lead the way on single payer, a delegation to the national March for Medicare for All in Los Angeles, and an event celebrating Medicare’s birthday and demanding Medicare for All. To get involved in California, contact Dr. Kathleen Healey at khealey.ent@gmail.com.

Illinois

Many Illinois members have been giving interviews and speeches about Medicare for All. Shannon Rotolo, PharmD, a leader in the Illinois Single-Payer Coalition and founder of Pharmacists for Single Payer, discussed pharmacy issues on a Healthcare-NOW! podcast, and was quoted in the Journal of the American Pharmacists Association. Co-president Dr. Pam Gronemeyer spoke about Medicare for all on a podcast with Chicago journalist Ben Joravsky, and at the Chicago March for Medicare for All. Dr. Anne Scheetz spoke to the LaSalle Democratic Central Committee and on a panel sponsored by Chicago Jobs with Justice and Illinois Single Payer Coalition. The chapter also participated in several other events this summer, including a Chicago vigil for global vaccine access; a rally for Medicare for All at the office of Rep. Raja Krishnamoorthi; and a campaign by the Chicago-based Jesse Brown VA Medical Center’s Clinical Committee for Black Lives, urging the VA to discontinue the use of race-based algorithms in kidney function calculations. To get involved in Illinois, contact Dr. Anne Scheetz at annescheetz@gmail.com.

Kentucky

In Kentucky, Kentuckians for Single Payer Health Care found that many seniors who switch back to Traditional Medicare from a commercial Medicare Advantage plan are not protected from being denied a Medigap plan, or charged more, because of pre-existing conditions such as age, health status, claims experience, or medical condition. Dr. Eugene Shively proposed and successfully passed a resolution at the August meeting of the Kentucky Medical Association calling on the state legislature to end Medigap discrimination. In addition to their work on Medigap plans, chapter members helped to organize the Louisville March for Medicare for All in July, earning local media coverage. To get involved in Kentucky, contact Kay Tillow at nursenpo@aol.com.

Maine

Maine’s legislature passed the Maine Health Care Act, authorizing the state to request waivers from the federal government to implement a state universal health program, and requiring that 60 days after the implementation of such waivers, the governor appoint a board to design the state plan. The bill is a result of hundreds of volunteer hours, including testimony, meetings, and the production of educational materials for legislators. PNHP members also participated in the March for Medicare for All in Portland, earning media coverage from one TV station and two of Maine’s largest newspapers. PNHP’ers in Maine are also gathering signatures for a ballot initiative directing the state legislature to establish a universal health care system in the state. To get involved in Maine, contact Dr. Henk Goorhuis at henk@maineallcare.org.

Minnesota

PNHP-Minnesota hosted a workshop in July on passing local government resolutions in support of Medicare for All. Participants heard from health care activists around the state working on active resolution campaigns, as well as those looking to start new campaigns. To get involved in Minnesota, contact pnhpminnesota@gmail.com.

New Jersey

PNHP’s New Jersey chapter hosted a planning session in June to discuss organizing strategies to win national Medicare for All. Speakers included U.S. Rep. Bonnie Watson Coleman, who is vice-chair of the Congressional Progressive Caucus. To get involved in New Jersey, contact Dr. William Thar at wethar@gmail.com.

New York

In New York, PNHP’s NY-Metro chapter is continuing to focus on organizing around the New York Health Act, which was introduced this year with majority support in both the Assembly and the Senate. Organizing tactics included social media campaigns, as well as a series of in-person rallies outside of the offices of targeted legislators, along with a large rally and “die-in” civil disobedience outside of the state capitol building. This spring and summer, the chapter also focused on fighting a move by New York City to shift its public union retirees over to a Medicare Advantage plan. PNHP-NY Metro and the NY Statewide Senior Action Council worked with concerned union members, providing them with tools to coordinate the larger group of retirees interested in the fight, and by hosting two informational forums about the proposed change and how it would affect retirees. To get involved in New York, contact NY Metro Executive Director Bob Lederer at info@pnhpnymetro.org.

North Carolina

In North Carolina, board members of Health Care Justice NC — PNHP’s chapter in Charlotte — led several presentations on the topic of the pandemic, health inequities, and Medicare for All to the Atrium Health System pediatric residents, the staff of the Charlotte Center for Legal Advocacy, and to Duke University’s African-American Covid Taskforce Meeting on July 20. After a vote by the board, chapter members have been contacting their elected representatives to advocate for improvements to traditional Medicare, including lowering eligibility age to 60, coverage for dental, vision, and hearing care, a cap on out-of-pocket expenses, and allowing Medicare to negotiate drug prices. To get involved in Health Care Justice NC, contact Dr. Jessica Schorr Saxe at jessica.schorr.saxe@gmail.com.

Members of Health Care for All Western North Carolina (HCFA-WNC) in Asheville presented a Medicare for All resolution to the Asheville City Council and the Buncombe County Commission. Members also picketed in solidarity with NNU nurses Mission Hospital, who were organizing for a new contract. HCFA-WNC joined with six other organizations to plan and sponsor a March for Medicare for All which attracted more than 100 marchers. To get involved in HCFA-WNC, contact Terry Hash at theresamhash@gmail.com.

Health Care for All-NC co-hosted a teach-in with the Freelance Solidarity Project, a division of the National Writers Union, about why Medicare for All matters to all freelance workers, and how they can support it. Panelists included Rhiannon Duryea, the national coordinator for the Labor Campaign for Single Payer; Natalie Shure, a writer for The New Republic; and Dominic Harris, president of UE Local 150 in Charlotte and chair of UE 150’s Medicare for All campaign. PNHP is working with the writers’ union leadership to draft a resolution in support of Medicare for All. To get involved in Health Care for All NC, contact Jonathan Michels at jonscottmichels@gmail.com.

Oregon

Members of PNHP Oregon helped to organize a March for Medicare for All rally in July. The chapter has also joined PNHP’s Medical Society Resolutions Campaign, with the goal of passing resolutions in local chapters of internal medicine and pediatrics specialty societies. Dr. Paul Gormann is helping to organize a new chapter of Students for a National Health Program at Oregon Health and Science University. To get involved in Oregon, contact Dr. Peter Mahr at peter.n.mahr@gmail.com.

Pennsylvania

In Pennsylvania, members of PNHP’s Philadelphia chapter met with the chief of staff of Rep. Dwight Evans to learn why he is hesitant to support H.R. 1976, even though he endorsed previous single-payer bills. The chapter will use his response to strategize next steps in their campaign to win support from all members of the area’s Congressional delegation. To get involved in Philadelphia, contact Dr. Walter Tsou at walter.tsou@verizon.net.

PNHP’s Western Pennsylvania chapter continues to ally with the local labor movement, and recently visited striking members of the United Steelworkers to build solidarity. The chapter also sponsored the Pittsburgh March for Medicare for All in July, which attracted about 100 single-payer activists. To get involved in Western PA, contact Dr. Judy Albert at jalbertpgh@gmail.com.

Tennessee

In Tennessee, PNHP’s State of Franklin chapter (which includes easternmost Tennessee and southwest Virginia) holds monthly Zoom meetings focused on developing single-payer messaging that will appeal to more conservative friends, family and neighbors. In the past year, guest speakers included PNHP past president Dr. Carol Paris and former insurance executive Wendell Potter. Members have also published multiple op-eds and letters to editors in local media, and joined in coalition with other non-physician groups fighting for Medicare for All. To get involved in Tennessee, contact Dr. Bob Funke at r_funke@charter.net or Dr. Robin Feierabend at robin@firerobin.net.

Vermont

PNHP chapters in Vermont and New Hampshire completed their sixth annual summer internship program in July, with 14 rising second-year medical students. Because this year’s internship was online, students could hear from speakers across the country and globe. Topics included the market failures of health policy, the history of the U.S. health care system, the business model of the private insurance industry, and the history and potential of the Medicare, Medicaid and other public programs. The internship also included sessions on advocacy, such as organizing physicians and chapters, educating medical students, utilizing traditional and social media, and messages for legislators and the general public. To get involved in Vermont, contact Dr. Betty Keller at bjkellermd@gmail.com.

Washington

In Washington state, PNHP members held a session on the pros and cons of incremental change in the struggle for single payer. The chapter helped organize the March for Medicare for All in Seattle, and facilitated an opening greeting from Medicare for All lead sponsor Rep. Pramila Jayapal. Members hung Medicare for All banners over Seattle freeways on several occasions. To get involved in Washington, contact Dr. McLanahan at mcltan@comcast.net.

West Virginia

PNHP welcomes its first chapter in West Virginia, which formed in January 2021. The new chapter has been busy crafting by-laws, creating a 12-member board, and launching the first SNaHP chapter in the state. The chapter’s first project is a “55 strong” organizing campaign to recruit a PNHP member in each of the 55 counties of the mainly rural state. They are also actively recruiting in the West Virginia State Medical Association and working on Medicare for All municipal resolutions. To get involved in West Virginia, contact Dr. Daniel Doyle at doyledan348@gmail.com.

PNHP in the News

News Articles Quoting PNHP Members

Chapters in Action:

“Demonstrators push for ‘Medicare for All’ at west Toledo rally,” WTOL Ch. 11 News, May 22, 2021 [Ohio Chapter]

“Demonstrators in Louisville join nationwide Medicare for All March,” Spectrum News 1 (Louisville), July 24, 2021 [Kay Tillow and Dr. Garrett Adams]

“Thousands march to demand Medicare for All,” Free Speech TV/Rising up with Sonali, July 28, 2021 [Dr. Paul Song]

- “Dozens turn out for Lakewood SPAN Ohio Healthcare Justice Walk,” Cleveland Plain Dealer, May 24, 2021 [Ohio Chapter]

- “In New York City, retirees brace for switch to privatized health care,” The Intercept, August 23, 2021 [Len Rodberg, Ph.D and PNHP NY-Metro Chapter]

- “Pharmacy Benefit Managers: The mystery bureaucrats managing your prescription drugs,” Rhode Island Uprise, August 25, 2021 [Linda L Ujifusa, J.D. and Dr. J. Mark Ryan]

- “Unions should support health care reform, but many aren’t,” Riverdale Press (NYC), July 18, 2021 [Dr. Len Rodberg]

Health Policy and Research:

“Un-vaxxed tax: Should the unvaccinated have to pay more for health insurance?” MSNBC: All in with Chris Hayes, August 12, 2021 [Dr. Adam Gaffney]

- “Pragmatic Advocacy: Advancing racial equity in physician associations,” Health Affairs, July 16, 2021 [PNHP]

- “Many hit hard by pandemic now swamped by medical debt,” U.S. News and World Report/Healthday, July 19, 2021 [Dr. Susan Rogers]

- “Physicians supporting single payer urge medical societies to join effort,” Inside Health Policy, July 19, 2021 [Dr. Susan Rogers]

- “Texas’ Abortion Law Could Worsen the State’s Maternal Mortality Rate,” TIME, September 22, 2021 [Dr. David Eisenberg]

- “Poor Americans more likely to have respiratory problems, study finds,” New York Times, May 28, 2021 [Drs. Adam Gaffney and Steffie Woolhandler]

- “Rural Tennessee is losing more hospitals than anywhere in the country, but Covid-19 isn’t fully to blame,” The Daily Yonder, July 28, 2021 [Dr. Raymond Feierabend]

- “You want me to be blind and toothless?” The Indypendent, July 31, 2021 [Dr. Susan Rogers]

- “When deductibles rise, more diabetes patients skip their meds,” U.S. News and World Report/Healthday, July 30, 2021 [Dr. Danny McCormick]

- “Minorities less likely to receive specialist care,” Reuters/Medscape, July 21, 2021 [Dr. Chris Cai]

- “Why Nevada’s modest public option bill is getting heavy attention,” Nevada Current, May 24, 2021 [Dr. Adam Gaffney]

- “Prescription for health care,” WFHB News, September 9, 2021 [Dr. Ed Weisbart]

- “Concerns mount over looming surge in bankruptcy as COVID medical debt soars,” Newsweek, June 14, 2021 [Dr. David Himmelstein]

- “Patients of color less likely to get specialist care than white patients,” Health Day, July 26, 2021 [Dr. Steffie Woolhandler]

Opinion: Op-eds and Guest Columns

- “Texas’ uninsured situation is at a crisis point,” by Jack Bernard, The Caller Times (Corpus Christi, TX), May 28, 2021

- “Memorialize those we lost to COVID. Pass the NY Health Act Now,” by Dr. Duncan Maru, The Queens Daily Eagle, June 3, 2021

- “Health care for all works,” by Prof. Ellen Oxfeld, Rutland Herald (Vermont), June 16, 2021

- “Single Payer: A sane, accessible, and affordable health care system,” by Dr. Wayne Strouse, The Chronicle Express (New York), June 21, 2021

- “The COVID-19 case for Medicare for All,” by Drs. Jeanne Corwin, Jim Binder, and Donald Rucknagel (PNHP members among many co-signers), Cincinnati Enquirer, June 23, 2021

- “Improved Medicare for All: simple, universal, affordable,” by Bill Semple, LCSW, Boulder Weekly (Colorado), July 1, 2021

- “Henry Kaiser was right, single-payer health care better for the nation,” by Dr. Samuel Metz, Sandy Post (Oregon), July 6, 2021

- “Doctor: Voting rights are health care rights,” by Dr. Susan Rogers, Common Dreams, July 7, 2021

- “When will U.S. healthcare finally be fixed?” by Jack Bernard, Caller Times (Texas), July 16, 2021

- “Happy birthday, Medicare: You showed that public, universal health insurance is superior,” by F. Douglas Stephenson, LCSW, Common Dreams, July 25, 2021

- “North Carolina, U.S. health care are not the worst but certainly not the best,” by Jack Bernard, Fayetteville Observer, July 30, 2021

- “For its 56th birthday, let’s improve Medicare,” by Dr. George Bohmfalk, Aspen Daily News, July 31, 2021

- “The other pandemic is underinsurance,” by Dr. Marvin Malek, Vermot Digger, August 15, 2021

- “An Oregon physician on why single payer health care honors key conservative tenets,” by Dr. Samuel Metz, Portland Business Journal, August 18, 2021

- “Accountable care organizations don’t cut costs. It’s time to stop the managed care experiment,” by Dr. Jim Kahn and Kip Sullivan, STAT, August 23, 2021

- “Single-payer health care system will improve U.S. health,” by Mary Rossillo (NYU medical student), Albany Times Union, September 8, 2021

Opinion: Letters to the Editor

- “Stop hesitating on Health Act,” by Helen Meltzer-Krim, Riverdale Press (New York), May 18, 2021

- “In support of Medicare for All,” by Dr. George Bohmfalk, The Aspen Times, June 2, 2021

- “California can have single-payer healthcare right now,” by Dr. Jerome Helman, Los Angeles Times, June 16, 2021

- “Demand Medicare for All,” by Dr. George Bohmfalk, The Aspen Times, June 21, 2021

- “Tell legislators to support amendment,” by Dr. Michael Huntington, Corvallis Gazette Times (Oregon), June 25, 2021

- “We cannot rely on charities; U.S. must overhaul system of health care and how we pay for it,” by Dr. Raymond Feierabend, The Herald Courier (Tennessee), June 27, 2021

- “New rules are nice, but a new program would be better,” by Ken Lefkowitz, The Washington Post, July 8, 2021

- “ACRA, ICHRA and CEOs,” by Dr. George Bohmfalk, The Aspen Times, July 21, 2021

- “Local fight shows need for health care reform,” by Dr. Jay Brock, Fredericksburg Free-Lance Star, July 29, 2021

- “Vote in support of Medicare for All,” by Tanvee Varma (Yale medical student), New Haven Register, July 30, 2021

- “Medicare for All saves lives and $$,” by Dr. Justin Paglino, New Haven Independent, July 30, 2021

- “Health care is a human right,” by Dr. Judy Albert, Pittsburgh Post-Gazette, August 4, 2021

- “Happy birthday, Medicaid! Expand other health care to cover us all,” by Bob Krasen, Columbus Dispatch, August 8, 2021

- “Single-payer is much better system,” by Dr. Kathleen Healey, Napa Valley Register, August 26, 2021

- “Universal health care is solution,” by Dr. Rick Staggenborg, Corvallis Gazette Times (Oregon), August 27, 2021

- “Health care focus,” by Dr. G. Richard Dundas, Rutland Herald (Vermont), September 2, 2021

- “Improved Medicare for All is the answer,” by Dr. G. Richard Dundas, Vermont Digger, September 10, 2021

- “Medicare for All Is the ticket to good health care,” by Dr. Jay Brock, New York Times, September 17, 2021