Title: An Analysis of Senator Sanders Single Payer Plan

Year: 2019

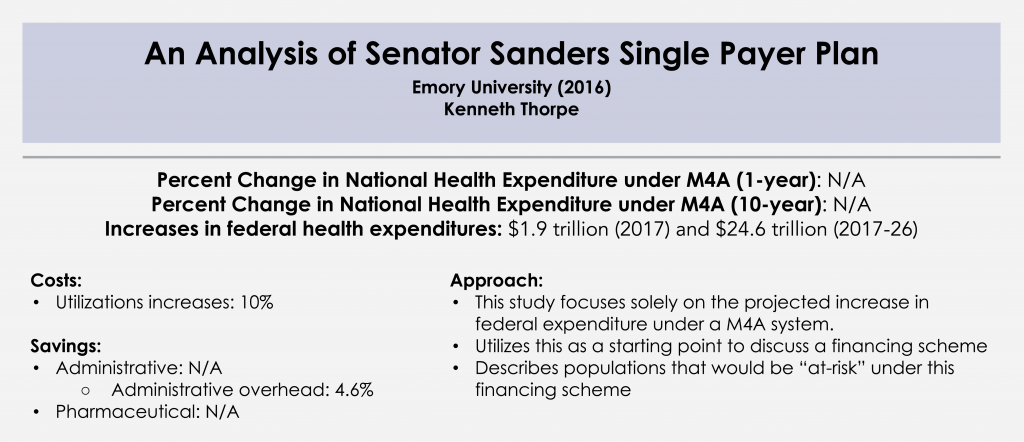

Author: Kenneth Thorpe

Institution: Emory University

Plan Analyzed: S. 1129

Increases in federal health expenditures: $1.9 trillion (2017) and $24.6 trillion (2017-26)

Read Study:

An Analysis of Senator Sanders’s Single Payer Plan

Abstract:

Senator Sanders has proposed eliminating private health insurance and the exchanges created through the Affordable Care Act and replacing it with a universal Medicare program with no cost sharing. The plan would shift virtually all health care spending from private and public sources today onto the federal budget. The campaign estimates his plan would cost an average of $1.38 trillion per year over the next decade. They outline a variety of payroll and income tax increases, higher taxes for capital gains and dividends, taxes on estates of high income households and eliminate tax breaks that subsidize health insurance. Collectively he claims these taxes fully pay for the costs of the single payer plan. The analysis presented below however estimates that the average annual cost of the plan would be approximately $2.5 trillion per year creating an average of over a $1 trillion per year financing shortfall. To fund the program, payroll and income taxes would have to increase from a combined 8.4 percent in the Sanders plan to 20 percent while also retaining all remaining tax increases on capital gains, increased marginal tax rates, the estate tax and eliminating tax expenditures. The plan would create enormous winners and losers even with the more generous benefits with respect to what households and businesses pay today compared to what they would pay under a single payer plan. Overall, over 70 percent of working privately insured households would pay more under a fully funded single payer plan than they do for health insurance today.

Overview:

This study is unique because it primarily focuses on the increase in federal health care spending and how this increase might be financed.

This study considers:

- The impact of increased payment rates for current Medicare/Medicaid beneficiaries.

- Financing mechanisms for increased federal spending.

- Populations that would be “at-risk” based on proposed financing mechanisms.

Further Reading:

Gordon Mosser Critical Review and comment by Dr. Don McCanne