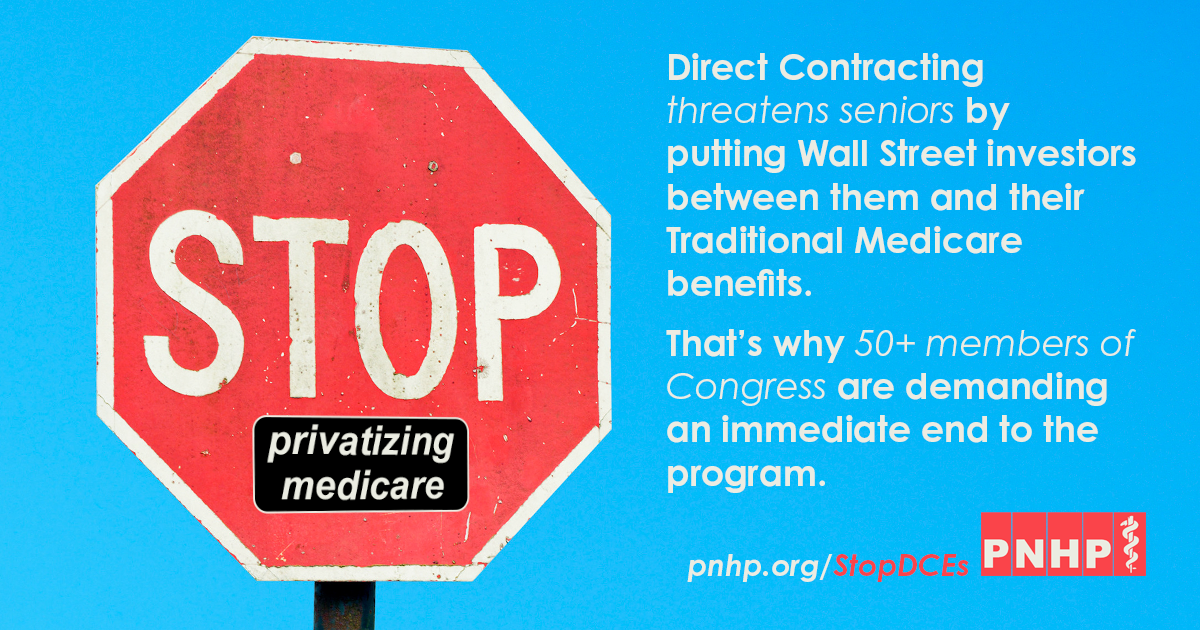

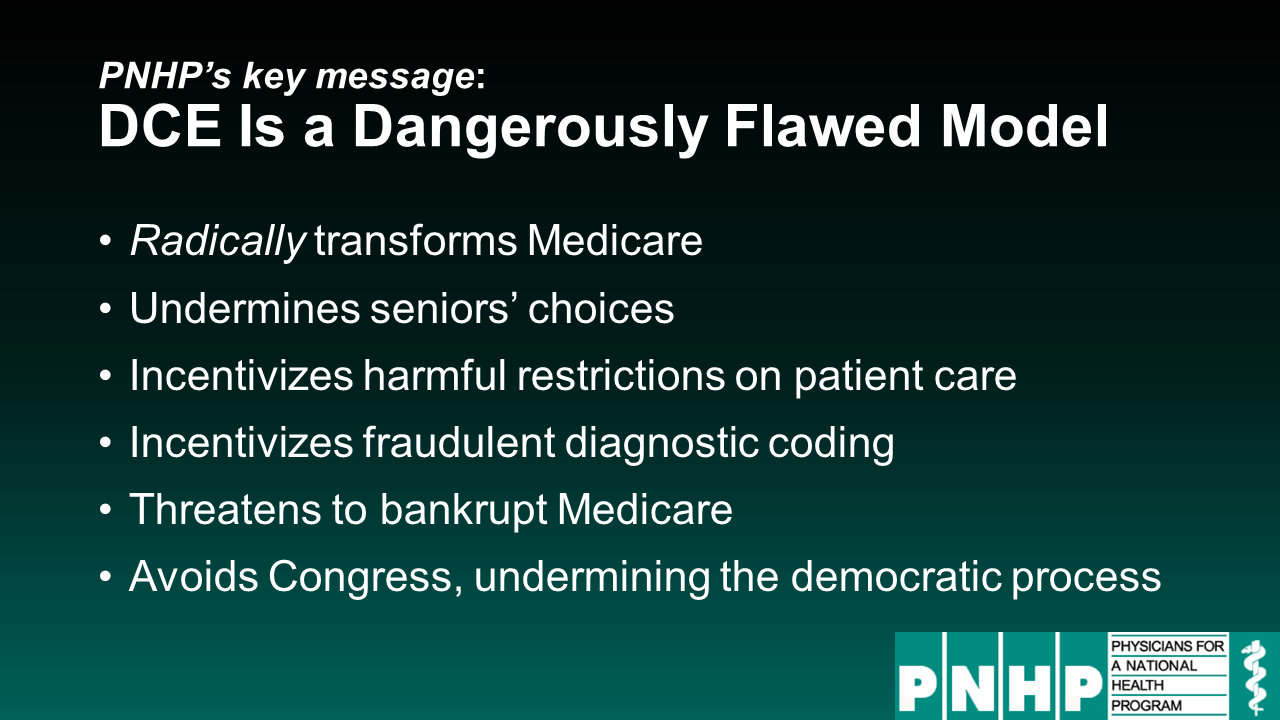

One of the most outrageous features of Medicare Direct Contracting (and there are many) is the fact that it would make radical changes to Traditional Medicare, without so much as a vote in Congress. That’s because DCEs originated in the typically under-the-radar, and unaccountable, Center for Medicare and Medicaid Innovation.

Thankfully, elected officials are putting pressure on Health and Human Services Sec. Xavier Becerra to end Direct Contracting, which he has the power to do. This Trump-era program poses a grave threat to seniors and to Medicare as a whole, and it must be stopped immediately.

Rep. Pramila Jayapal organizes against DCEs

H.R. 1976 (Medicare for All) lead sponsor Rep. Pramila Jayapal and her staff have worked closely with PNHP and other health justice organizations to push back against DCEs, both publicly and within the halls of Congress.

- Letter to Sec. Becerra calling for an end to Direct Contracting, led by Rep. Jayapal and signed by 54 members of the U.S. House

- Press release on the Congressional effort to end Medicare Direct Contracting

- “The biggest threat to Medicare you’ve never even heard of,” op-ed co-authored by Rep. Jayapal and PNHP president Dr. Susan Rogers, The Hill, December 9, 2021

Medicare Protectors stand up against privatization

PNHP thanks the following 54 members of the U.S. House of Representatives for signing on to Rep. Jayapal’s letter demanding an end to Direct Contracting:

- Alma Adams (NC-12)

- Karen Bass (CA-37)

- Donald S. Beyer Jr. (VA-08)

- Earl Blumenauer (OR-03)

- Suzanne Bonamici (OR-01)

- Jamaal Bowman, Ed.D. (NY-16)

- Cori Bush (MO-01)

- Salud Carbajal (CA-24)

- Andre Carson (IN-07)

- David Cicilline (RI-01)

- Yvette D. Clarke (NY-09)

- Steve Cohen (TN-09)

- Gerald E. Connolly (VA-11)

- Jim Cooper (TN-05)

- Jason Crow (CO-06)

- Danny K. Davis (IL-07)

- Peter A. DeFazio (OR-04)

- Rosa L. DeLauro (CT-03)

- Mark DeSaulnier (CA-11)

- Debbie Dingell (MI-12)

- Mike Doyle (PA-18)

- Adriano Espaillat (NY-13)

- Sylvia R. Garcia (TX-29)

- Jesús G. “Chuy” García (IL-04)

- Raúl M. Grijalva (AZ-03)

- Jared Huffman (CA-02)

- Pramila Jayapal (WA-7)

- Mondaire Jones (NY-17)

- John B. Larson (CT-01)

- Barbara Lee (CA-13)

- Mike Levin (CA-49)

- James P. McGovern (MA-02)

- Joseph Morelle (NY-25)

- Jerrold Nadler (NY-10)

- Joe Neguse (CO-02)

- Marie Newman (IL-03)

- Eleanor Holmes Norton (DC-00)

- Alexandria Ocasio-Cortez (NY-14)

- Ilhan Omar (MN-05)

- Donald M. Payne, Jr. (NJ-10)

- Mark Pocan (WI-02)

- Katie Porter (CA-45)

- Ayanna Pressley (MA-07)

- Jamie Raskin (MD-08)

- Jan Schakowsky (IL-09)

- Robert C. “Bobby” Scott (VA-03)

- Mary Gay Scanlon (PA-05)

- Mark Takano (CA-41)

- Dina Titus (NV-01)

- Rashida Tlaib (MI-13)

- Bonnie Watson Coleman (NJ-12)

- Peter Welch (VT-At Large)

- Nikema Williams (GA-05)

- John B. Yarmuth (KY-03)

Rep. Katie Porter sounds the alarm on DCEs

Rep. Katie Porter has led on the issue of Direct Contracting from the beginning, having sent an earlier letter to Sec. Becerra (co-signed by Reps. Mark Pocan, Bill Pascrell, Jr., and Lloyd Doggett) expressing concern about the program and calling for an immediate freeze.

She joined a webinar that PNHP co-hosted with National Single Payer on Sept. 23, 2021, and warned viewers about the dangers of letting corporate interests infiltrate a cherished and effective public health program.

“This isn’t hypothetical,” she said. “We know exactly what happens when insurers dip their hands into Medicare, because we’ve already seen that play out in Medicare Advantage.”

CMS leaders speak out about Medicare privatization

Speaking of Medicare Advantage, former Centers for Medicare and Medicaid Services (CMS) Administrator Dr. Don Berwick and former Center for Medicare and Medicaid Innovation Director Dr. Rick Gilfillan authored a crucial two-part Health Affairs blog titled, “Medicare Advantage, Direct Contracting, and the Medicare ‘Money Machine.’”

“Given an Orwellian title, Direct Contracting, launched by CMMI, was anything but direct,” they wrote. “‘Indirect Contracting’ would have been a far more accurate name, since the cornerstone of the program was CMS’s opening the door to non-provider-controlled ‘Direct Contracting Entities (DCEs)’ to become the fiscal intermediaries between patients and providers.”