Online registration will open later this summer—click HERE to sign up for updates!

PNHP Annual Meeting

Saturday, Nov. 16

- Daytime program, 9:00 am – 5:00 pm

- Dinner program, 6:00 pm – 8:00 pm

The PNHP Annual Meeting will be held in Chicago at the Venue SIX10, located at 610 S. Michigan Ave.

Sleeping rooms will be available at the Hilton Chicago, 720 S. Michigan Ave., for $229/night + $25/night mandatory destination charge (includes internet and athletic club access, and $25/day food/beverage credit). Sleeping room reservations may be booked in two ways:

- Online HERE

- Call 877-865-5320 and reference “PNHP Annual Meeting”

Sleeping room reservations must be made by Friday, Oct. 25.

SNaHP Summit

Friday, Nov. 15, 12:00 pm – 6:00 pm

Location TBA (Chicago)

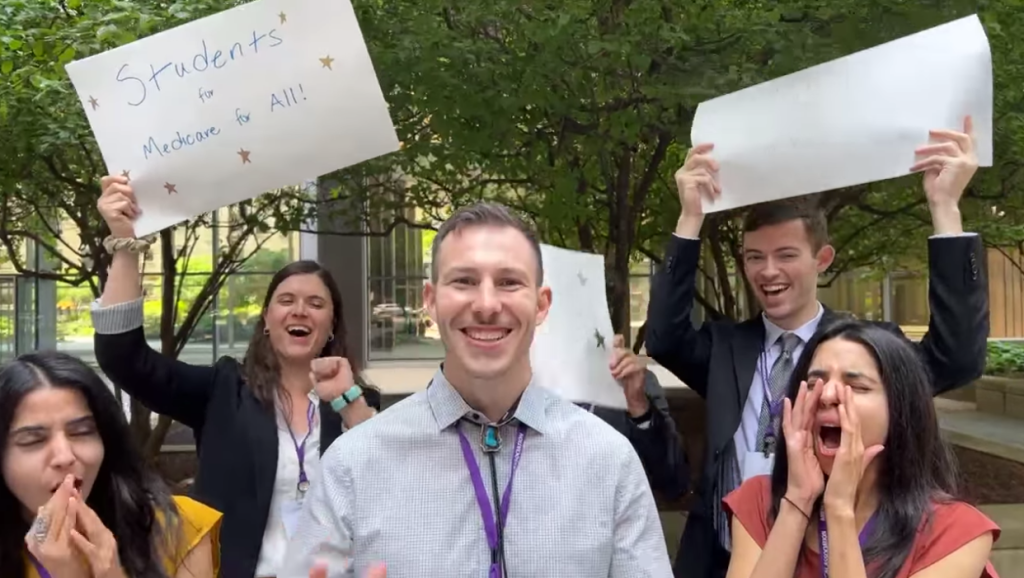

Scholarships are available to support student and resident attendance for both the SNaHP Summit and the PNHP Annual Meeting (information below). PNHP members and the public can support PNHP’s student outreach programs by making a GIFT to the Nicholas Skala Student Fund.

Speakers

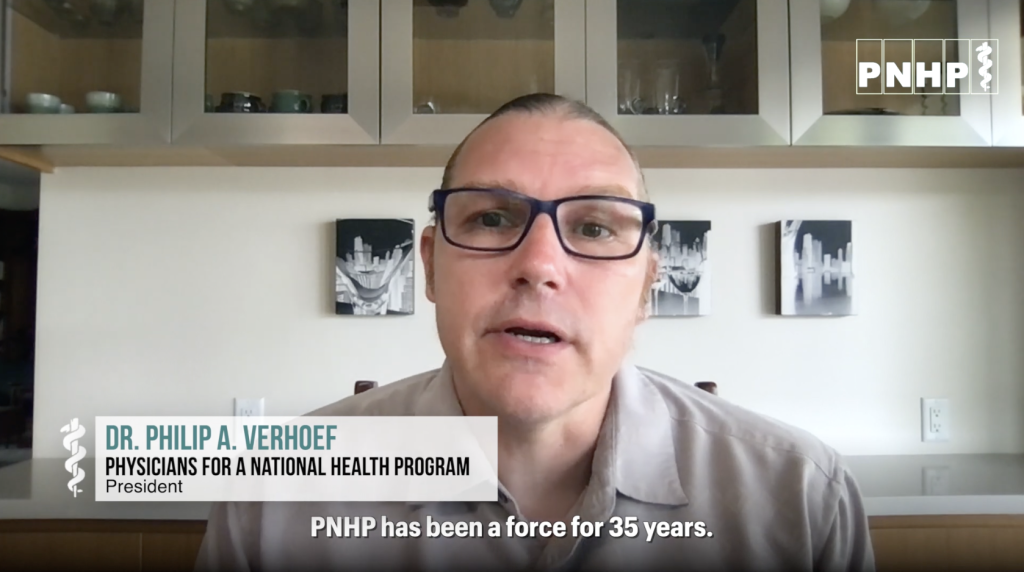

Meeting Chair: Philip Verhoef, M.D., Ph.D.

Dr. Phil Verhoef is the president of PNHP, an adult and pediatric intensivist, and a clinical associate professor of medicine at the John A. Burns School of Medicine at the University of Hawaii-Manoa.

Additional speakers will be announced in the future.

This conference will not be livestreamed in its entirety, but recordings of select sessions will be made available after the meeting.

Student and Resident Scholarships

Scholarships are available to students and residents to cover a portion of the cost of travel and lodging. More information will be available this summer. Applications will be due by Sept. 10.

PNHP members and the public can support PNHP’s student outreach programs by making a GIFT to the Nicholas Skala Student Fund.

Covid Safety Protocols

Covid safety protocols will be determined by PNHP’s Board of Directors and medical experts, and announced closer to the meeting date.

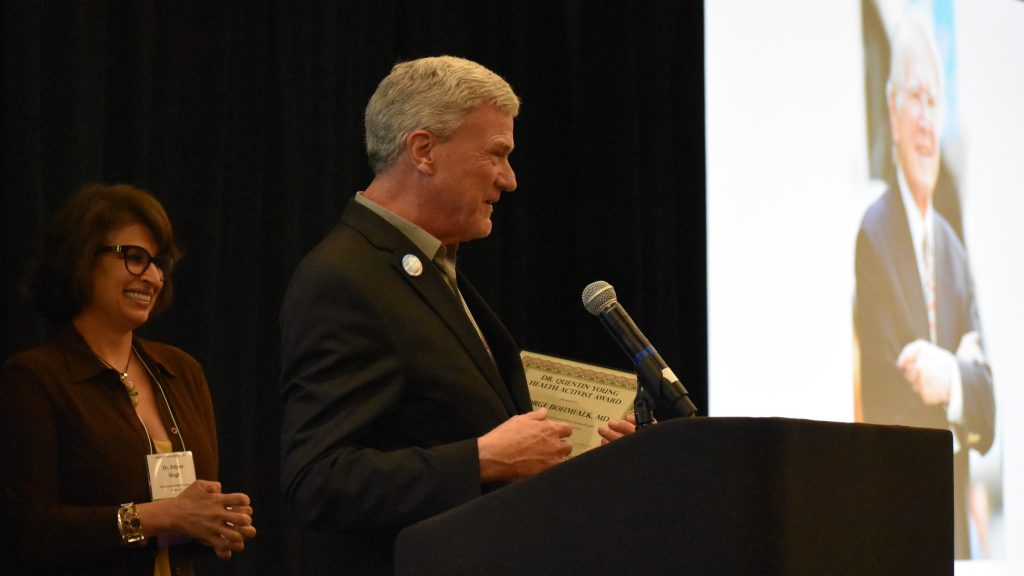

Previous Annual Meetings

Click HERE to access archival material from last year’s Annual Meeting in Atlanta. Click HERE to view photos from the conference.

Attending the 2024 PNHP Annual Meeting and SNaHP Summit is entirely voluntary and requires attendees to abide by any applicable rules of conduct, or local or state laws, that may be announced at any time. Attendees acknowledge the highly contagious and evolving nature of Covid-19 and voluntarily assume the risk of exposure to, or infection with, the virus by attending the Meeting, and understand that such exposure or infection may result in personal injury, illness, disability, and/or death. Attendees release and agree not to sue any persons or entities responsible for coordinating or organizing the PNHP Annual Meeting and SNaHP Summit in the event that they contract Covid-19. Attendees agree to comply with all Covid-related procedures that may be implemented at the Meeting, including mask-wearing.

Keynote Speaker

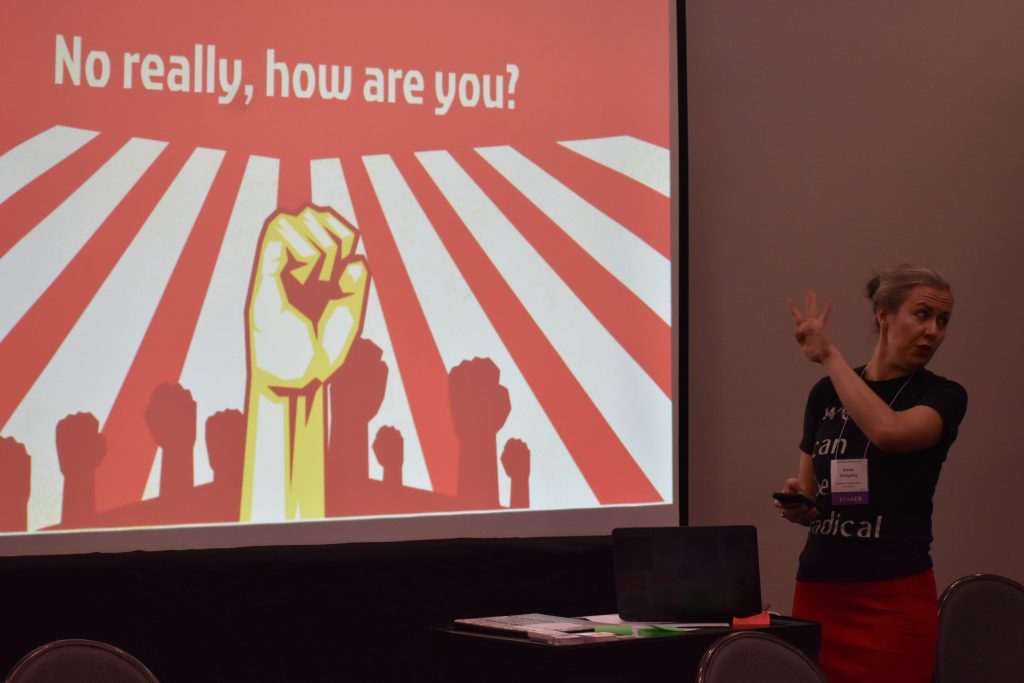

Keynote Speaker Health Policy Update

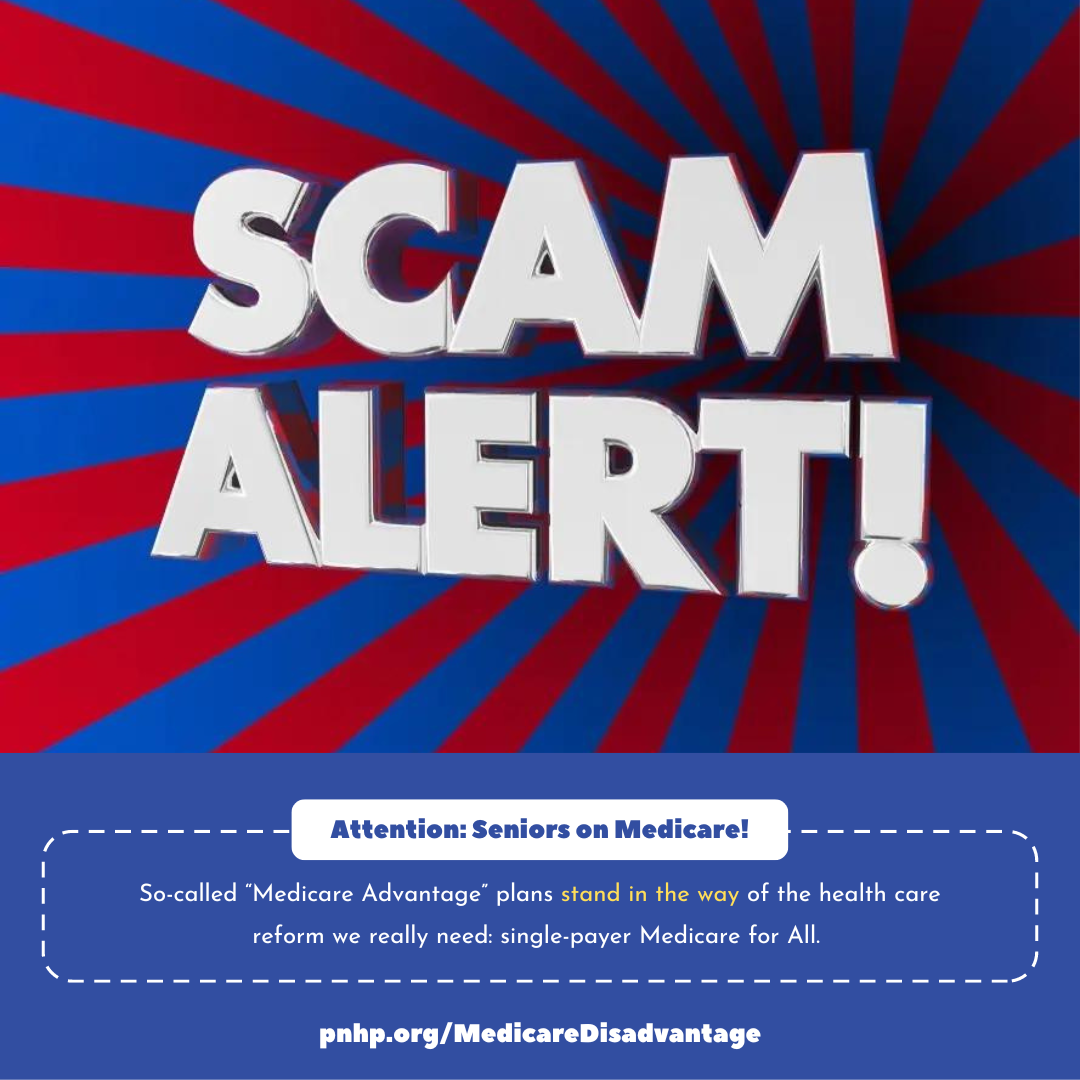

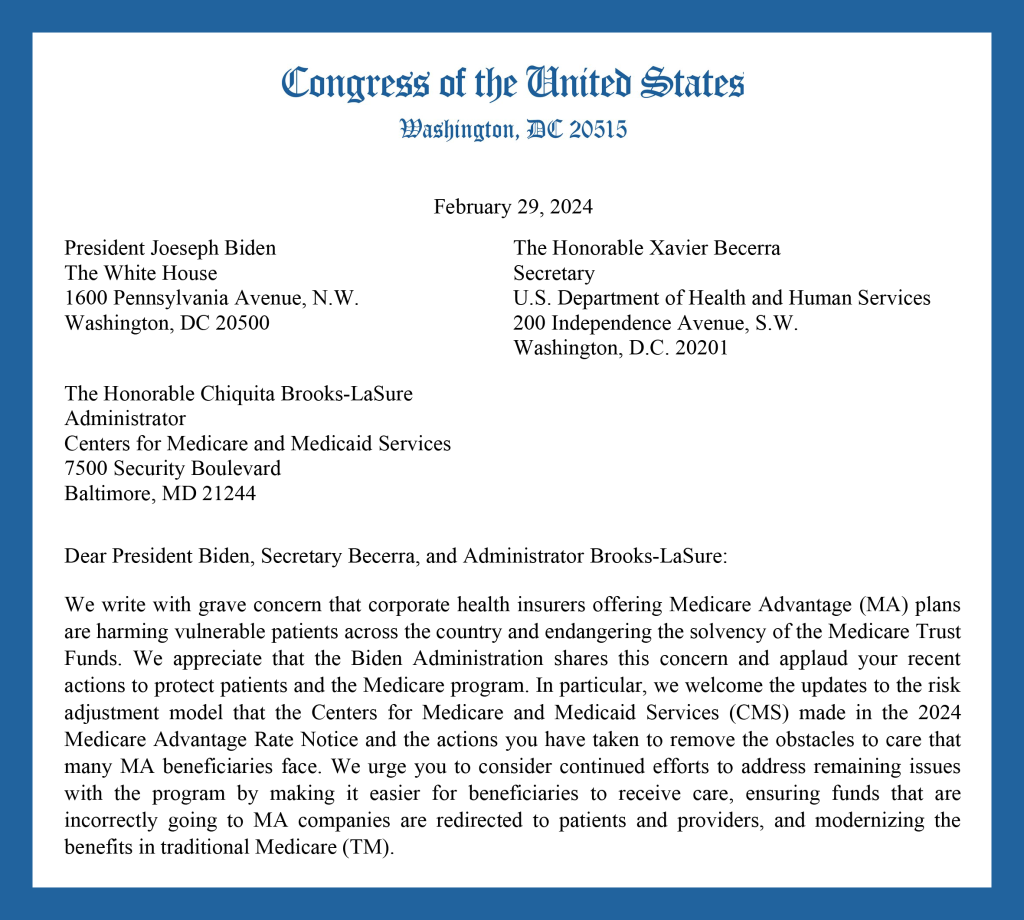

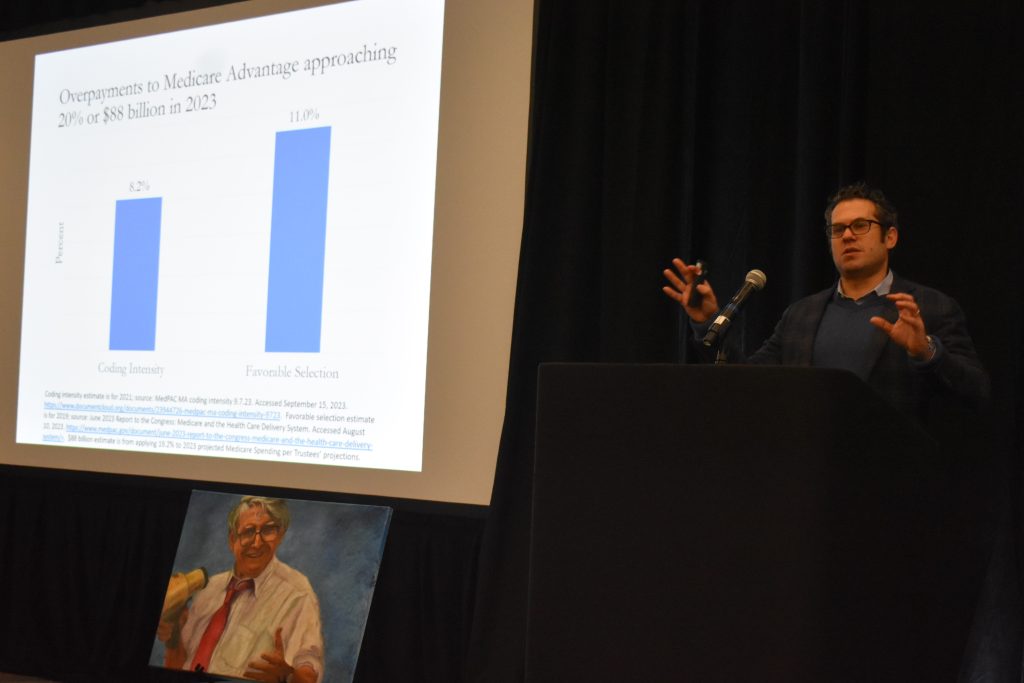

Health Policy Update Messaging Medicare Advantage

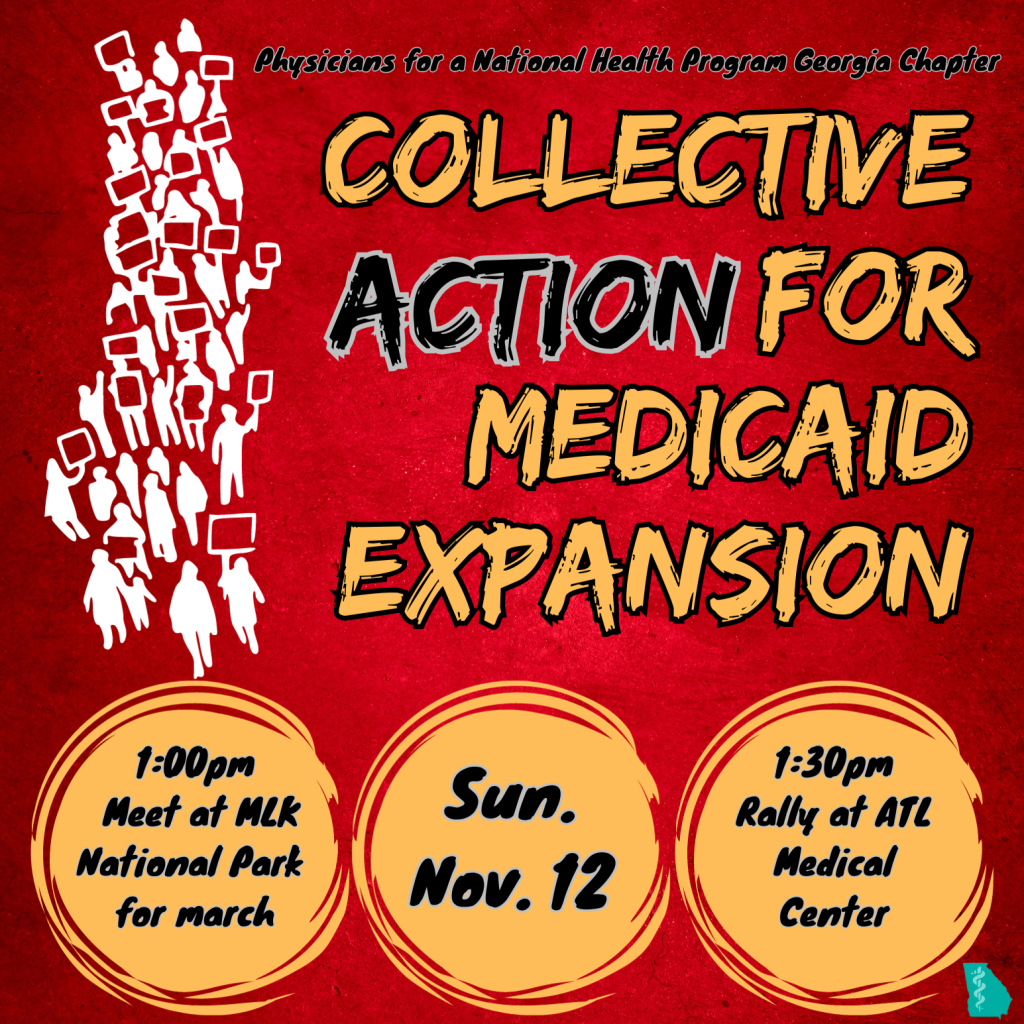

Messaging Medicare Advantage Building Progressive Power, Lessons from Georgia

Building Progressive Power, Lessons from Georgia